Investors often view Exchange Reserve data as one of the key metrics for assessing long-term holding demand. When Exchange Reserves drop, the available purchase supply becomes scarce and helps to increase prices.

Just as Altcoin’s market capitalization regains its upward momentum, in the first week of August, several Altcoins have shown a marked decline in exchange reserves.

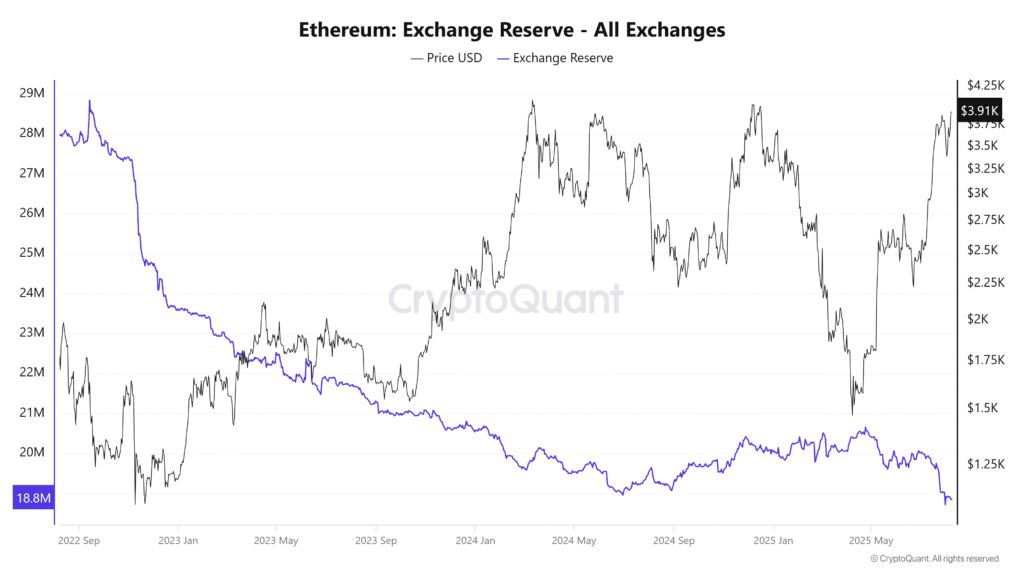

1. Ethereum (eth)

Encrypted data shows that Ethereum’s exchange reserve reached its new three-year low in the first three years in early August, falling below the 19 million ETH.

On August 8th, the price of the ETH approached $4,000. However, this price rise has not driven many investors to move ETH into exchange.

The current strongest drivers of ETH seem to be institutional demand. Strategic ETH reserve statistics show that by the end of July, the total strategic Ethereum reserves amounted to over $10 billion and there are 2.7 million ETH. In the first week of August, that figure jumped to $11.8 billion with ETH of over 3 million.

This demand helped ETH withstand potential pressures of sales pressure, such as large numbers of untold ETH and sales from the Ethereum Foundation.

“As ETH prices rise, the exchange reserves are falling. This indicates that more people are removing ETH, which is usually a sign of trust in long-term prices.”

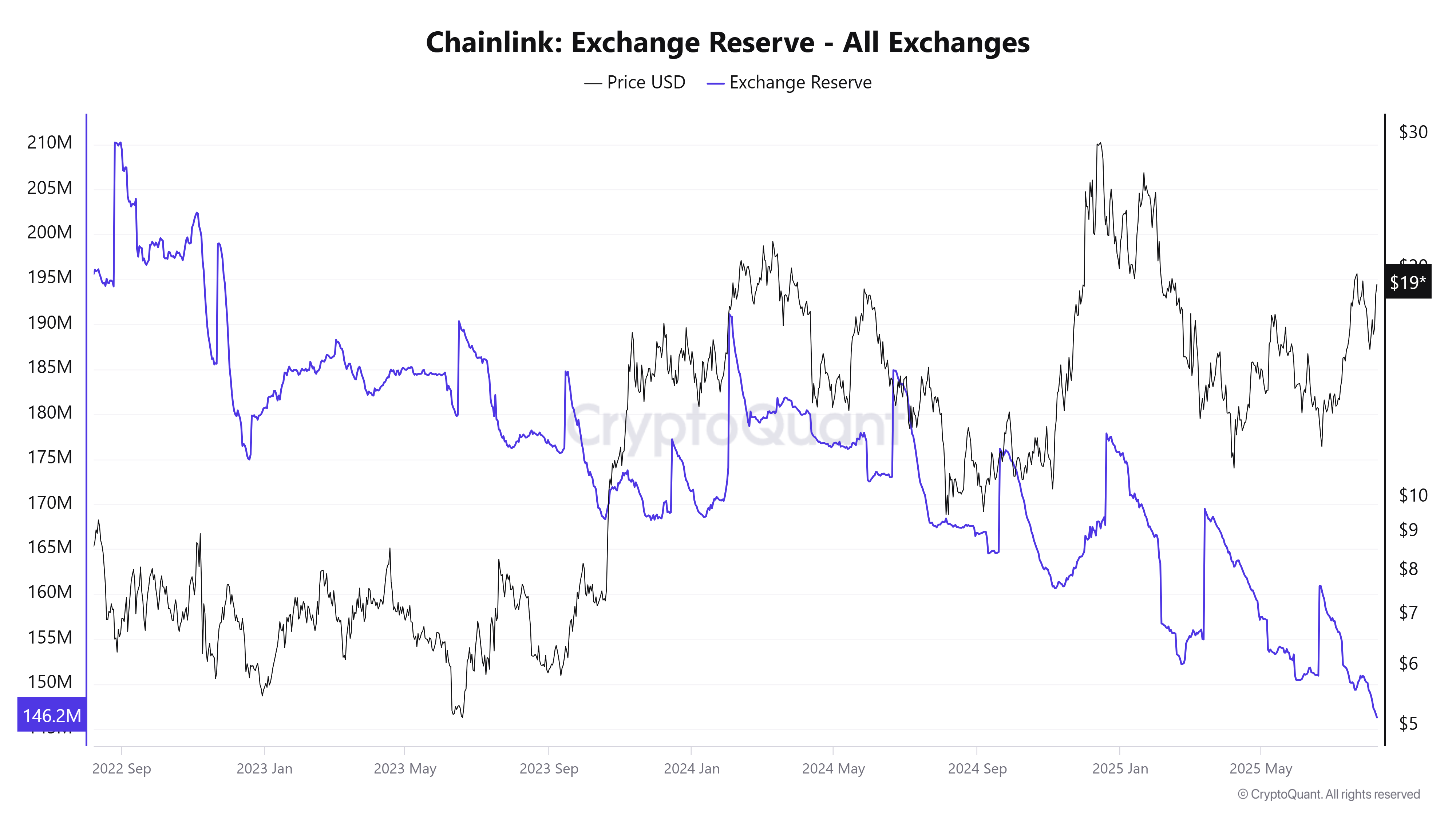

2. ChainLink

Cryptocurrency data also shows that the ChainLink exchange reserve reached a new low in the first week of August. Approximately 146.2 million links are available on the exchange, a 16% decrease since the start of the year.

The decline in link supply on this exchange occurred as prices recovered from 15%, up from $15.5 to 15%, over $19. This reflects the return of long-term accumulated feelings towards Altcoin.

“Now, think about chain link reserves. You’ll be hit with a huge link supply shock,” said investor Quinten.

Furthermore, recent Santiment data shows that when Link prices exceed $18.40, on-chain data recorded a 4.2% increase in wallets that hold links worth between $100,000 and $1 million. The accumulated supply rose 0.67% in August alone.

This coincided with the launch of data streams (real-time US stock/ETF data) on August 4th and the introduction of ChainLink Reserve on August 7th, where protocol revenues are converted to link purchases.

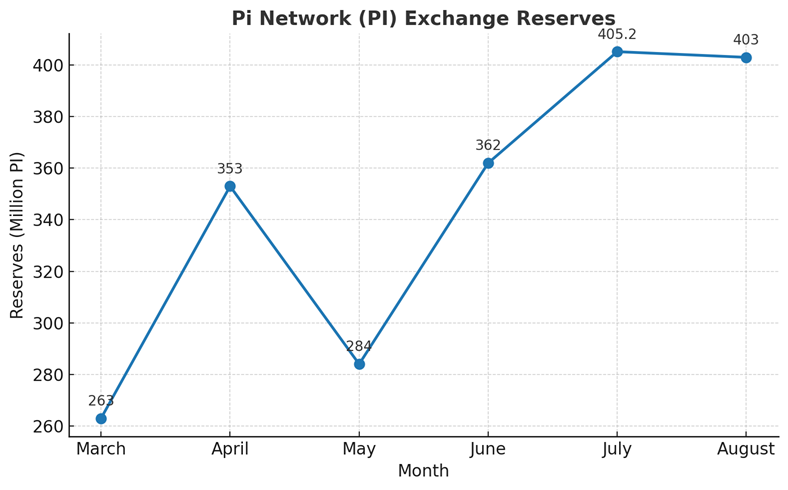

3. PI Network (PI)

A late July report from Beincrypto warned that the exchange’s PI network (PI) holdings have exceeded PI 405 million. However, according to Piscan data, the figures were only soaked at 403 million pi after the first week of August.

The decline is small, but it is still a positive sign after months of increasing exchange supply of PI.

In particular, the first week of August saw a decline in PI this August on the exchange, but prices rose 10% to $0.366. This suggests that accumulation of PI could return as investors begin to see opportunities to buy at a price significantly lower than the open network phase.

However, the decline is not strong enough to draw solid conclusions, so exchanged data must be closely monitored.

Post 3 Altcoins confirmed that the decline in exchange reserves first appeared in Beincrypto in the first week of August.