This week, there are multiple economic events with the effects of crypto, despite being shortened by another US holiday.

But instead of spreading them evenly over the already shortened weeks, these US economic indicators are pretty much stuck on Tuesdays and Thursdays, the latter being particularly busy days. Traders can take this week’s macroeconomic data to the forefront by monitoring the next event.

US economic indicators to look at this week

Crypto investors should watch the following US economic indicators this week, as they could cause volatility in the price of Bitcoin (BTC).

These macro data are especially important as the labor market gradually presents it as the next macro after Bitcoin.

impact

The U.S. Employment Opening Report begins this week with US economic indicators being affected by crypto. This macroeconomic data point, also known as the Job Openings and Labor Turnover Survey (JOLTS) report, is released by the U.S. Bureau of Labor Statistics (BLS).

The May Jolts report scheduled for Tuesday is projected to be lower than the 7.4 million recorded in April. Data on job openings, employment and separation in the US could be 7.3 million, according to economists surveyed by MarketWatch.

Despite the projected drops, the 7.3 million readings recorded in March are still above the low of 790 million. Nevertheless, it remains an important highlight of this week’s US economic indicators.

A decline in job openings could indicate a cooling labor market and could encourage the Federal Reserve to consider easing monetary policy. Such a shift could weaken the US dollar, making Bitcoin more attractive as an alternative asset.

Conversely, stabilizing or increasing recruitment could strengthen expectations for ongoing financial tightening and undermine Bitcoin’s appeal.

ADP Employment

Another highlight of the US economic indicators is the June 2025 ADP Employment Report, scheduled for Wednesday, July 2nd. Private employment increased 37,000 jobs in May, the lowest since March 2023.

However, the BLS report, which is widely regarded as a more comprehensive and official measure, shows that private sector employment increased 140,000 jobs in May 2025.

However, economists are looking at the median forecast of a 120,000 increase for private sector employment. Lower than expected employment growth could indicate economic cooling and encourage the Fed to consider easing monetary policy.

Such a shift could weaken the US dollar, making Bitcoin more attractive as a hedge against currency depreciation.

Conversely, a stronger than expected report could strengthen expectations of continuous financial tightening and attenuate the appeal of Bitcoin.

First unemployed claim

The first unemployment claims for the week ending June 21st reached 236,000, exceeding the previous week’s forecast of 245,000 to 229,000.

This reading brings the number of US citizens who first applied for unemployment insurance below the economist’s 248,000 forecast.

As part of the US economic indicators to watch this week, the market will see how many people filed for unemployment insurance in the week that ends June 28th.

With the median forecast of 240,000, an increase in unemployment claims could indicate economic weakness. This increases the likelihood that the Fed will adopt a better financial stance.

Such a shift can weaken the dollar and improve its appeal as an alternative asset for Bitcoin. However, if an increase in claims is considered temporary fluctuations, the impact on Bitcoin may be limited.

Meanwhile, analysts say, coupled with sticky inflation, the resilient labor market can continue to raise interest rates. However, signs from the cooling duties department can soften the Fed’s path.

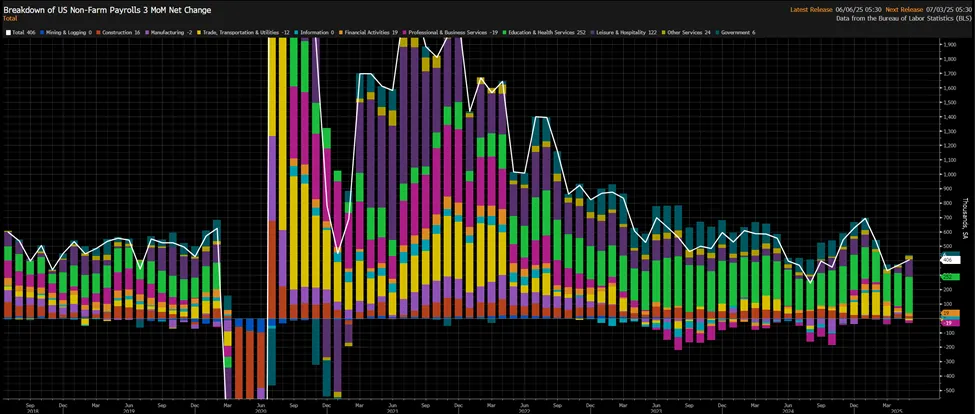

Non-farm salaries

The June 2025 US Employment Report, or the June 2025 Non-Agricultural Salary Report (NFP), is scheduled to be released on July 3rd. After adding 177,000 jobs in April, the economy added 139,000 jobs in May.

Meanwhile, the unemployment rate in April and May remained stable at 4.2%. NFP data will be held this time on Thursday, especially given that Friday is a US holiday.

MarketWatch data shows economists expect a 4.3% increase in US unemployment rate at 115,000 as jobs slow. This drop or slowdown reflects the potential economic impacts from President Trump’s tariffs.

Strong employment growth could lead the Fed to maintain its current monetary policy stance or even consider tightening, strengthening the US dollar and potentially curtailing Bitcoin. Analysts are paying attention to the NFP’s three-month positive trend.

However, despite the revisions, they are not sufficient to move the market and are not important enough to cause major changes to the labour market.

However, if underlying economic concerns encourage the Fed to adopt a more stubborn approach, Bitcoin can earn money as investors are looking for valued alternatives.

Analysts say the strict U.S. employment conditions will come as employers seeking clarity around the White House trade policy will gradually have to deal with frequent adjustments in timelines and schedules.

At the time of writing, Bitcoin was trading at $108,244, up just 0.87% in the last 24 hours.

Disclaimer

In compliance with Trust Project guidelines, Beincrypto is committed to reporting without bias and transparent. This news article is intended to provide accurate and timely information. However, we recommend that readers independently verify the facts and consult with experts before making decisions based on this content. Please note that our terms and conditions, privacy policy and disclaimer have been updated.