Solana (Sol) has faced a turbulent market in recent weeks, and its prices have struggled to recover despite several attempts to break through resistance levels.

Throughout June, Altcoin’s efforts to ensure upward momentum have been repeatedly thwarted by weak market conditions. Nevertheless, Solana owners refrain from selling and show strong investors’ trust.

Solana Investors are Stick to Accumulation

Solana’s market sentiment remains strong, with changes in exchange net positions indicating accumulation trends among investors. In almost three months, there was only one example in which sales sold accumulation.

This accumulation trend also highlights changes in investor behavior, with many choosing to retain their position rather than liquidate. Such a stance shows confidence in Solana’s long-term outlook, suggesting that Sol can see a recovery as market conditions improve.

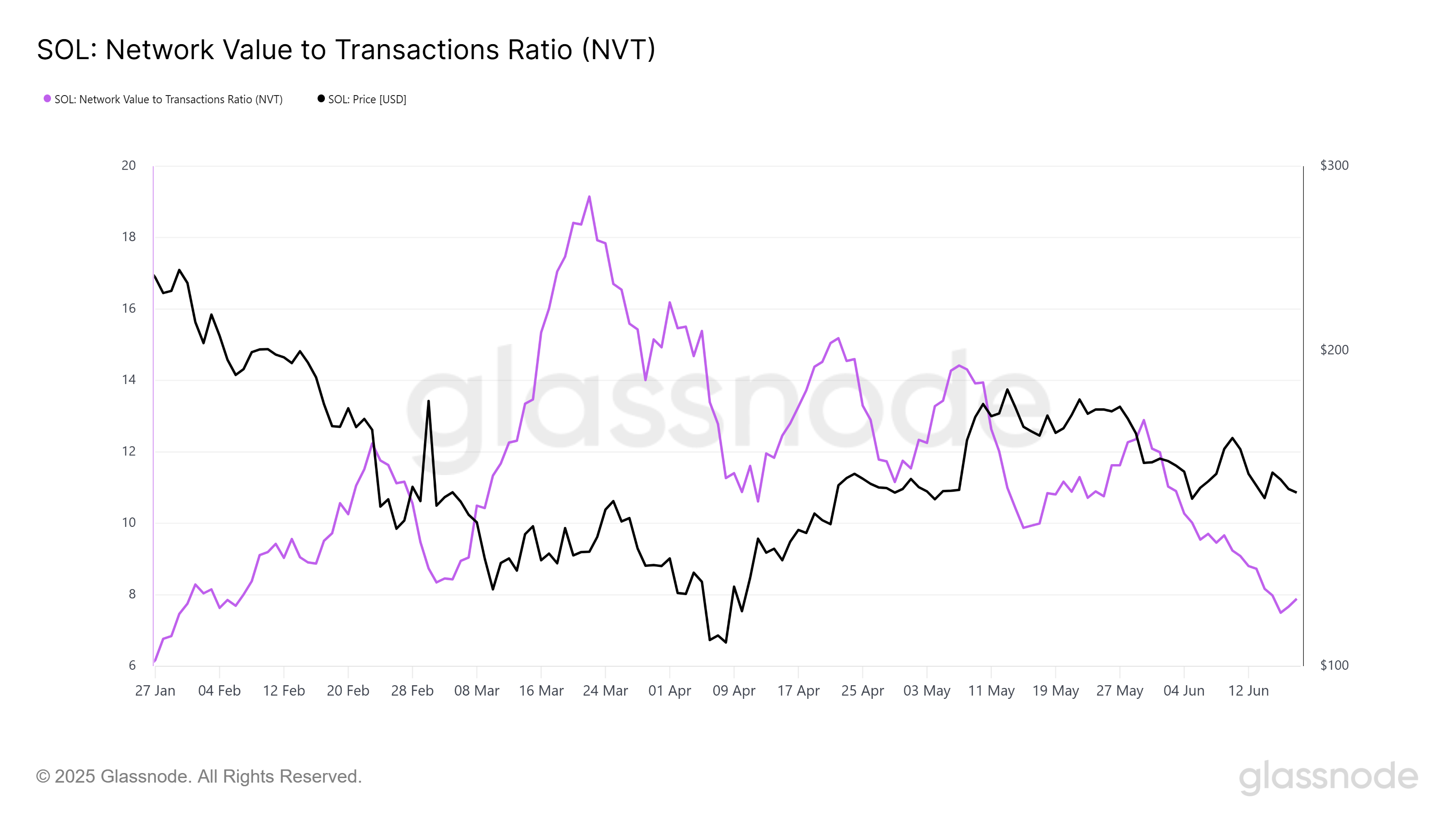

The overall macro momentum in Solana appears to be promising, indicating a downward trend in transaction (NVT) ratio from network values. A decrease in the NVT ratio indicates that the network values are consistent with transaction activity. In other words, the assets are not overheated.

A decline in Solana’s NVT ratio will help the assets recover from recent pricing challenges. A low NVT ratio usually indicates a potential price growth, as it suggests a balanced network value and user activity.

Waiting for Sol Price to bounce back

The Solana price is currently held at $146, exceeding the key support level of $144. This support was important to prevent a sharp drop this month. The ongoing ability to hold the $144+ signal that SOL has bullish momentum despite wider market challenges.

The bullish signal that emerged from Solana at this point suggests a possible price increase. Once Sol successfully bounces back $144’s support, he aims for a $152 resistance with a clear path to $161.

However, as bullish momentum fades and bear pressure increases, Solana can go below the $144 support level. In this case, the price could slide to $136, negating the current bullish outlook.

Disclaimer

In line with Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. Although Beincrypto is committed to accurate and unbiased reporting, market conditions are subject to change without notice. Always carry out your research and consult with an expert before making any financial decisions. Please note that our terms and conditions, privacy policy and disclaimer have been updated.