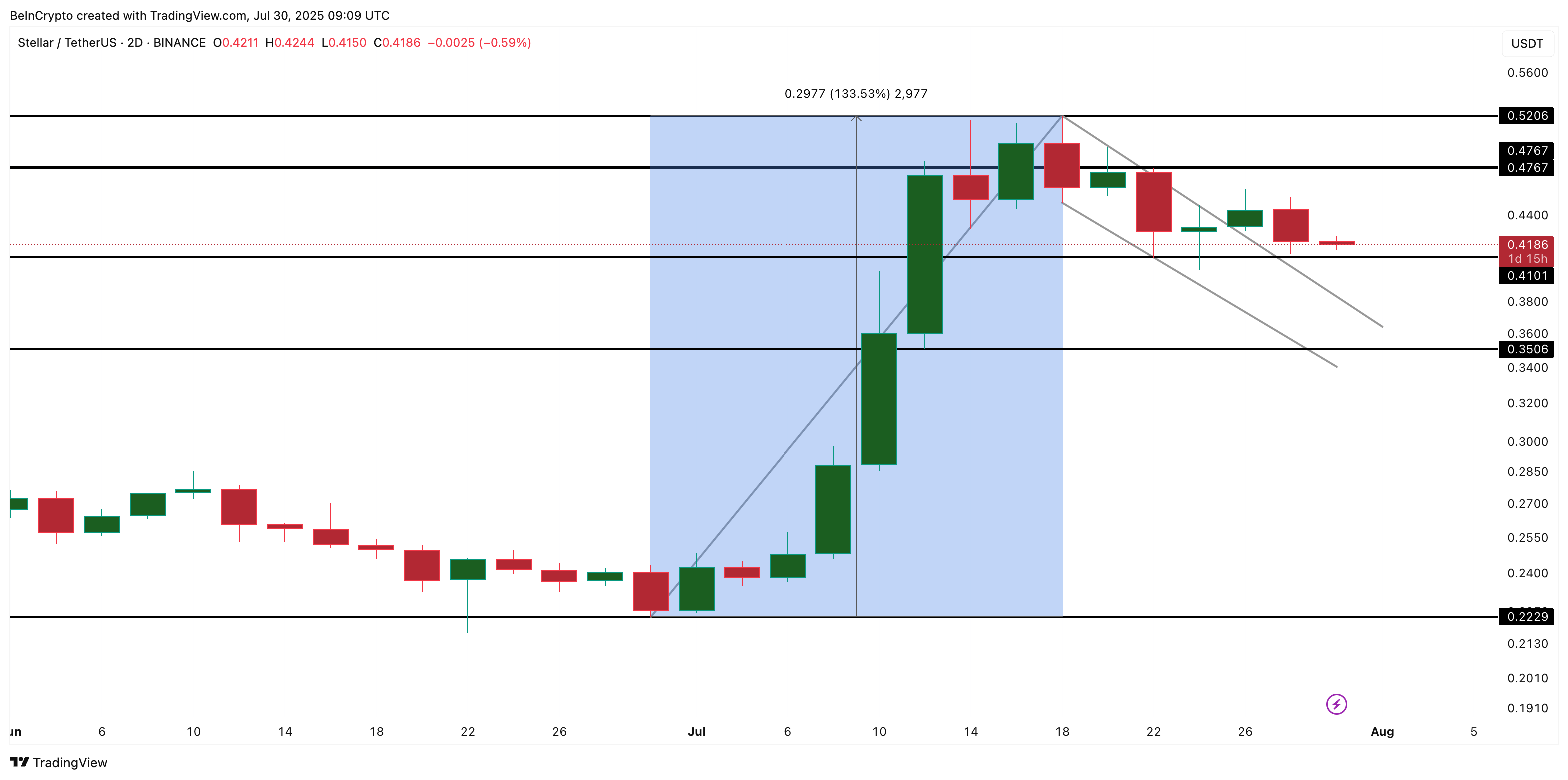

Stellar (XLM) was strong in July, attracting 77% this month. However, in the last seven days it has given up nearly 10% and the chart photos are less convincing.

On the two-day chart, XLM prices initially came from the bull flag. This is a continuation pattern that usually directs another upward leg, but the subsequent candles are almost red. Without new purchasing pressure, the breakout could already be upset.

Netflow: The only tailwind is losing power

Exchange netflow has played a major role in XLM’s recent gatherings. Earlier this month, more coins left the exchange than they entered, reducing the available supply and burning upward momentum.

Over the past week, the trend has been significantly weakened, with net spill approaching neutral levels. The lack of sustained withdrawal suggests that long-term holders are no longer adding new purchasing pressure, and the breakout leaves much support.

About Token TA and Market Updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s daily crypto newsletter.

Weak money flows add concern

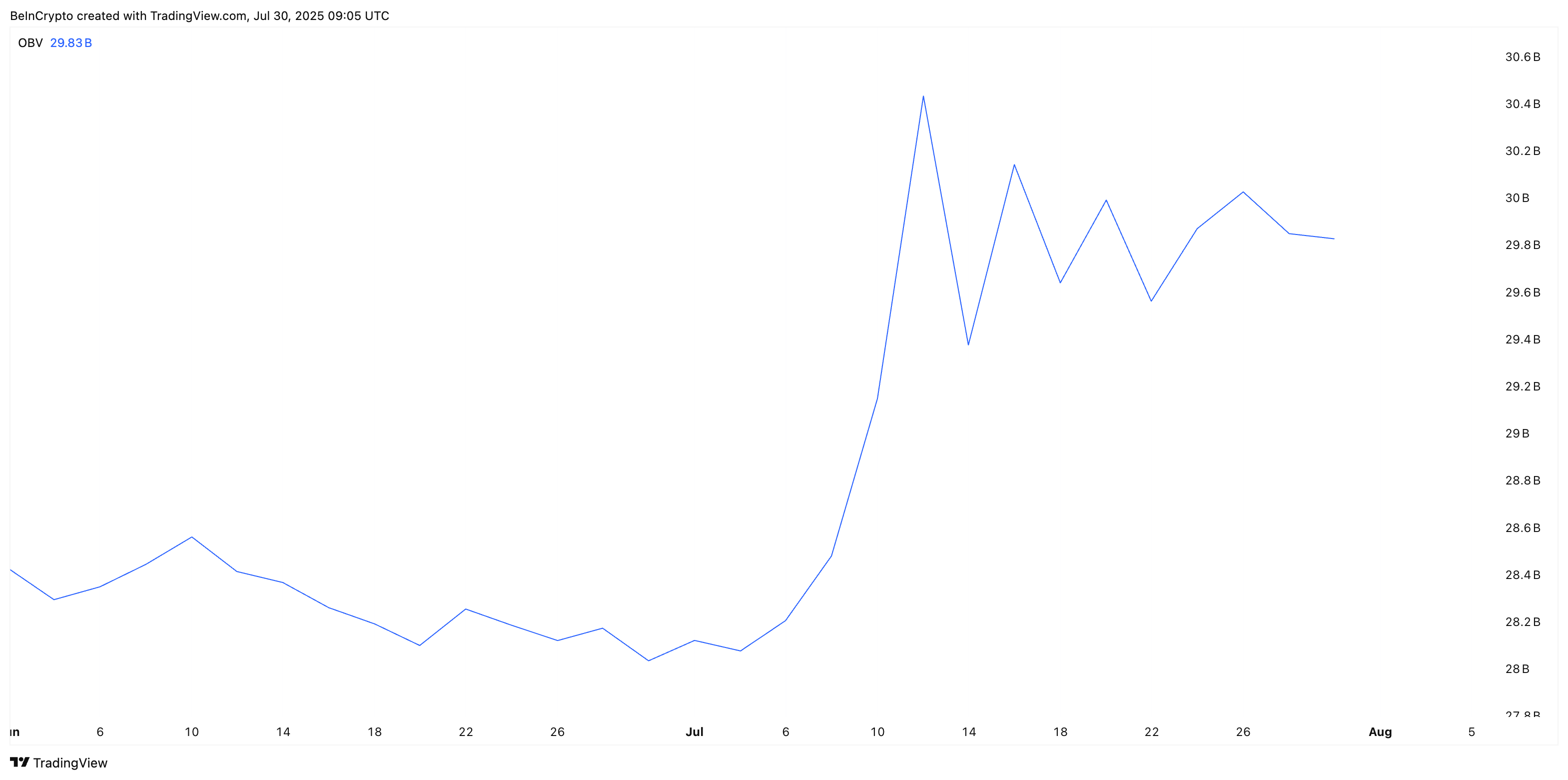

Volume data on two-day time frames augments this decline momentum. The Balance Volume (OBV) tracking cumulative buying and selling pressures indicates that despite XLM price breakouts, large buyers are not intervening with confidence.

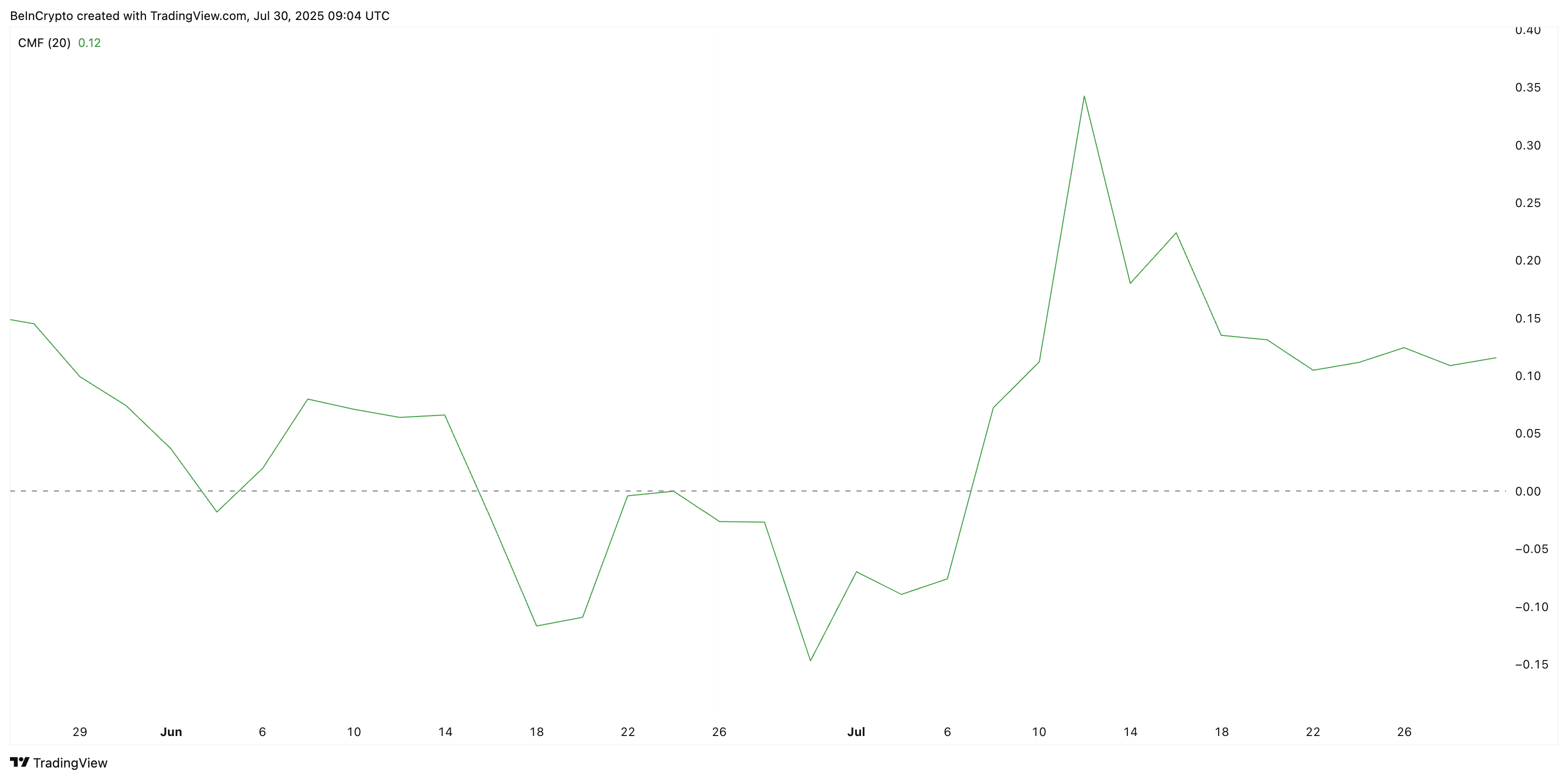

Similarly, Chaikin Money Flow (CMF) has fallen sharply, falling from around 0.35 in early July to around 0.12. The CMF measures whether actual money flows into assets, and such slides indicate weakening of demand.

Both metrics suggest that bullish breakouts may lack the capital support needed to scale higher.

Stellar (XLM) prices are still above the flag, but invalid levels are clear

The XLM price is currently held above the Bull Flag breakoutline and is trading nearly $0.41. However, the momentum is easily broken. A decline of less than $0.41 will bring the price of a star (XLM) back into the pattern, with a break under $0.35 going to erase almost half of the 133% gatherings that built the flagpole, effectively negating the breakout structure.

For the Bulls to regain control, the XLM price will need a critical move above $0.47, backed by a stronger influx and updated volume. Without it, the recent breakouts risk becoming another unsuccessful attempt to push towards a new high.

Momentum (XLM) bull flag breakout shows a crack as momentum fades first appeared.