Several altcoins entered September with imbalance on the liquidation map, highlighting the clear gap between bullish and bearish feelings. These conditions create a preferred setup for large-scale liquidation.

Below are three Altcoins that are at risk of liquidation in the first week of September, based on the latest news that are likely to affect liquidation data and price movements.

1. Ethereum (eth)

sponsor

Ethereum’s seven-day settlement map shows a major imbalance. If ETH rises to $4,925 this week, the short liquidation accumulated could exceed $6 billion.

Meanwhile, if ETH falls below $4,000, a long position worth around $3.96 billion will be settled.

Data shows that short-term traders are leaning towards Ethereum shorts this week. They made bigger bets and used higher leverage in short positions.

But they may face a setback. Chain data from the first day of September shows a large whale transaction selling BTC to buy ETH.

Lookonchain reported that Bitcoin Zilla wallets will continue to sell BTC and buy more than $4 billion in ETH.

sponsor

This whale’s activity, which exchanges BTC for ETH, can affect trader’s emotions. It could increase the price of ETH and cause losses in short positions.

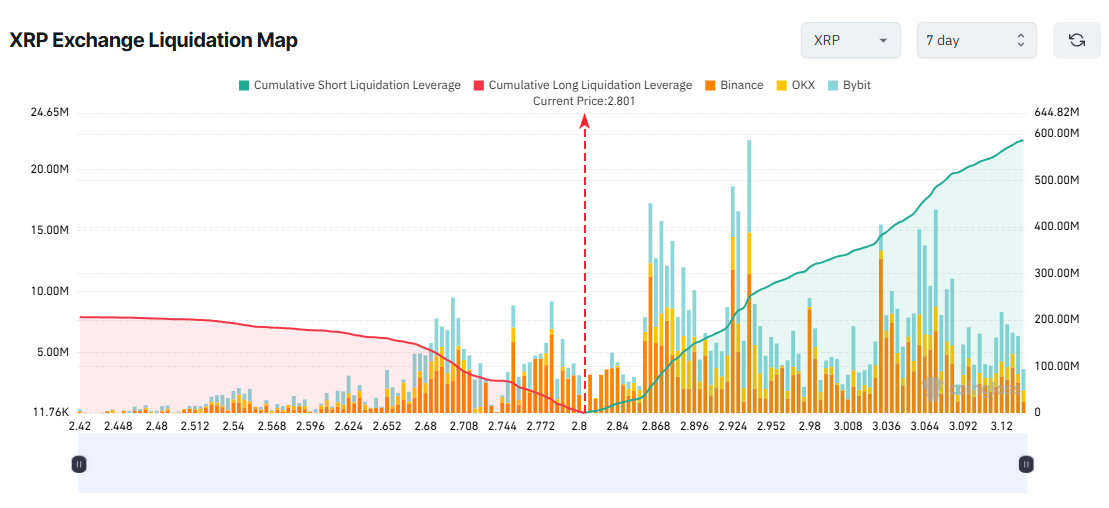

2. XRP

XRP’s 7-day liquidation map shows a serious imbalance. A short liquidation far outweighs a long liquidation. It appears that many short-term traders are betting heavily on a decline in XRP in the first week of September.

If XRP rises to $3, it will clear up a short position of over $500 million. In contrast, if XRP is classified as $2.42, it will only face liquidation in a longer position, with only about $200 million.

sponsor

From a technical standpoint, analysts warn that the current 2.70 level will serve as a strong support. Prices may rebound from here, making short positions more risky.

Additionally, 15 XRP ETF applications are still pending in the SEC. Positive news about these ETFs could spark a bullish wave among XRP investors.

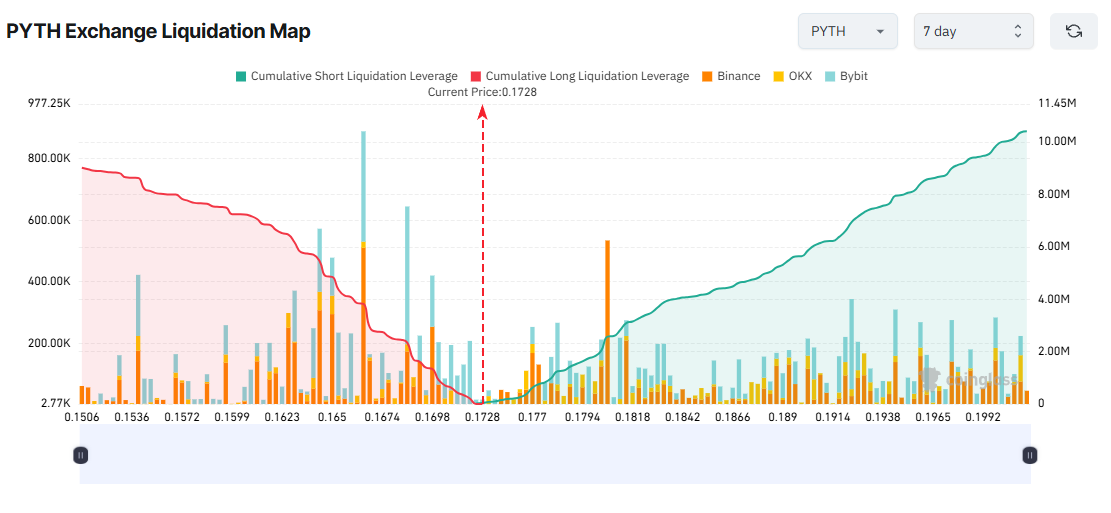

3. Pyth Network (Pyth)

On August 28, the US Department of Commerce surprised crypto investors by partnering with Pyth and ChainLink to place GDP data on the blockchain. Pyth prices have doubled in one day.

sponsor

That positive sentiment appears to have flowed in September. Short-term traders are actively working towards pis for a long time. If Pyth drops to $0.15 this week, they risk nearly $9 million in losses.

The chart shows that longer liquidation accelerates faster as prices reflected in the tall bars on the left side of the distribution drop.

sponsor

Conversely, if Pyth rises to $2 this week, the accumulated short liquidation could reach $10 million.

The good news may promote an excessive short-term happiness. But early buyers can also trigger “sell news” events as they make a profit. If that happens, Piss could get a deeper correction than long traders would expect.