Following the example of strategy, companies are increasingly investing in Bitcoin. This is a trend that has been strengthened by rising cryptocurrency prices. However, these massive acquisitions raise concerns about market collapse if companies are forced to sell and ask questions about Bitcoin’s decentralized spirit.

Representatives from Bitwise, Komodo Platform and Sentora say benefits are far outweighing risks. Smaller and excessive companies could go bankrupt, but the market impact is minimal. Successful companies like MicroStrategy show no signs of liquidating their assets, so there is no immediate risk.

Growth trends in corporate adoption of Bitcoin

The number of companies participating in the company’s Bitcoin acquisition trend is increasing. Standard Chartered recently reported that at least 61 public companies have purchased the crypto, while Bitcoin Treasuries reports that the number has reached 130.

The strategy (previously the micro-strategy) continues to accumulate billions in unrealized profits from aggressive Bitcoin acquisitions, which have been strengthened by rising Bitcoin prices, so more companies may follow suit.

“The Wilshire 5000 Equity Index literally includes 5,000 public companies only in the US. It’s very likely that there will be a major acceleration in the Treasury adoption of Bitcoin this year and in 2026.”

There are several times more reasons to promote his beliefs.

How does Bitcoin volatility compare to other assets?

Although volatile, Bitcoin has historically demonstrated a very high return compared to traditional asset classes such as stocks and gold.

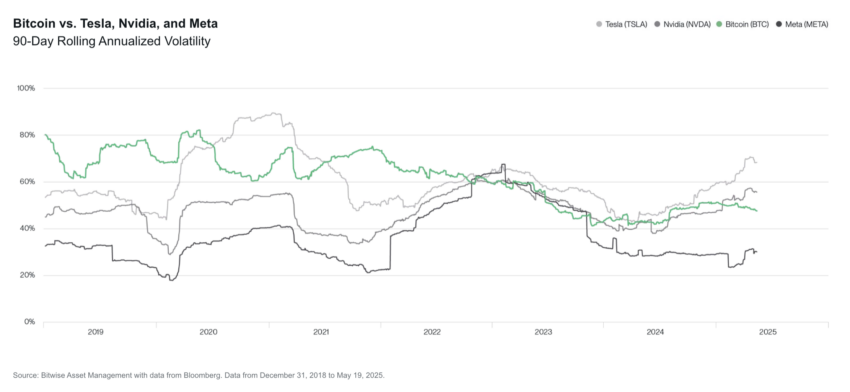

“One of the data points that is particularly interesting is the volatility of Bitcoin compared to major tech stocks such as Tesla and Nvidia. Many investors “never invest in something as unstable as Bitcoin,” said Ryan Rasmussen, research director at Bitwise, “At the same time, most investors own Tesla and Nvidia, and go through either Tesla and Nvidia, via Nvidia, or through either Tesla and Nvidia (Nasdaq-100). In recent months, both Tesla and Nvidia have been more volatile than Bitcoin.”

Past performance does not guarantee future returns, but the current performance of Bitcoin, particularly stable, could motivate more companies to buy assets.

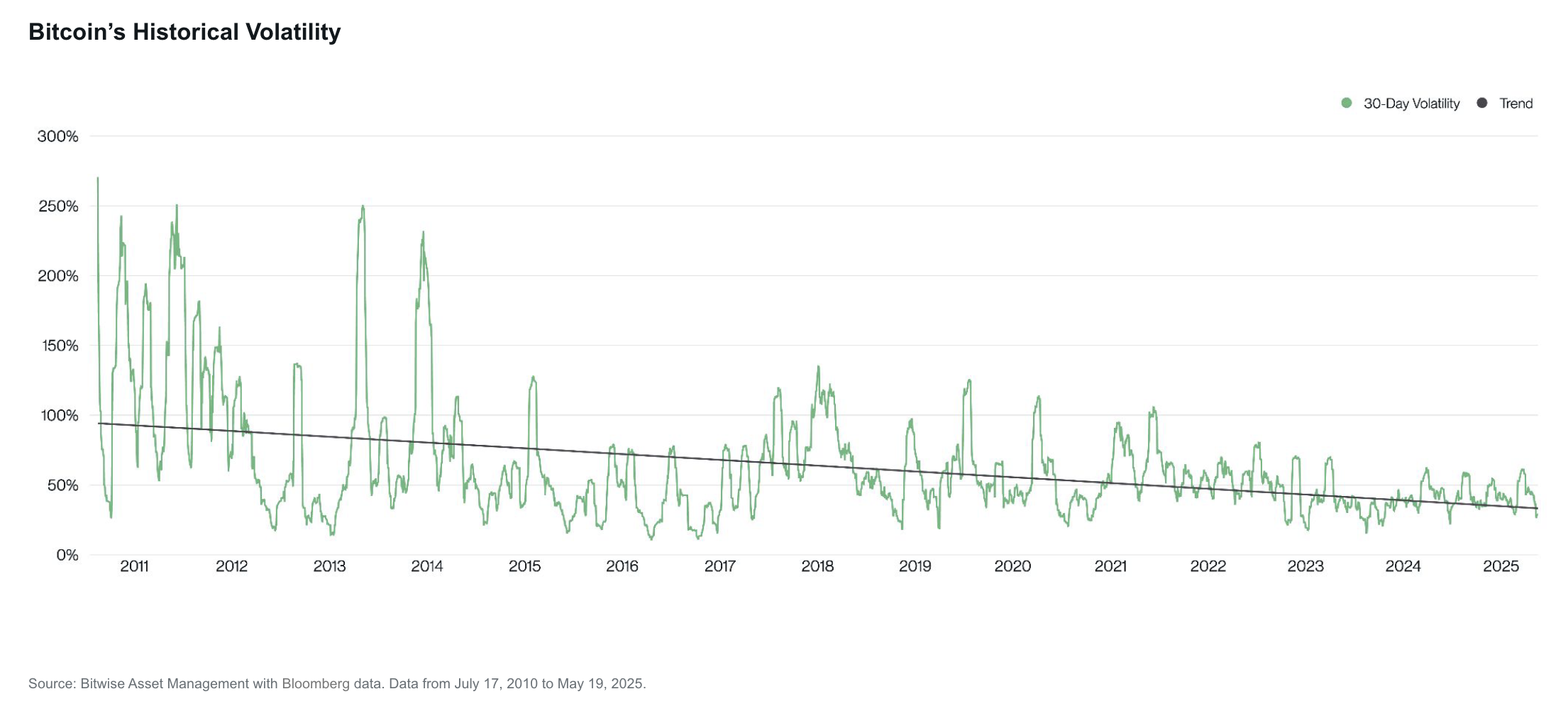

“Bitcoin’s volatility has declined over time, a trend that will remain in the near future. When Bitcoin discovers a true price, volatility will approach zero. It will slow demand. The Komodo platform told Beincrypto.

Meanwhile, as global markets tackle economic challenges, Bitcoin could become an attractive option to improve weak financial balance sheets.

Does Bitcoin make up for traditional safe havens?

The US and the global global economy are struggling with geopolitical tensions, rising inflation and a worrying budget deficit. Bitcoin, considered a “digital gold” and a valued sovereign neutral store, has piqued the interest of different shareholders, especially after the victory of the strategy.

“Pressure from existing shareholders will certainly increase over time, especially if inflation begins to re-accelerate due to rising geopolitical risks and increased monetization of fiscal debt by central banks.

He predicted that Bitcoin will eventually surpass traditional safe havens like the US Treasury bill and gold. A surge in adoption will reduce Bitcoin volatility and become an overall competitive asset.

“Bitcoin volatility has been a structural downtrend from the start, and the main reason behind this structural decline is that it increases rarity due to increased hulling and adoption, which tends to undermine volatility.

Bitcoin’s technical background, on the other hand, gives it a more competitive edge than other asset classes.

“We believe that the technical advantage over gold is likely to ultimately destroy the Treasury storage in the long term, like gold and other Treasury ministries.

However, not all companies are created equally. Some people benefit, but others don’t.

Differentiating a company’s Bitcoin strategy

According to Rasmussen, there are two types of Bitcoin finance companies.

They are profitable companies that invest extra cash, such as Coinbase or Square, or companies that ensure debt or fairness to buy Bitcoin. Regardless of type, their accumulation will increase demand for Bitcoin and boost prices in the short term.

Profitable businesses using excess cash to buy Bitcoin are rare and do not have a whole-body risk. Rasmussen expects these companies to continue to accumulate Bitcoin over the long term.

Companies that rely on debt and equity may face another fate.

“Bitcoin fundraisers exist only because the public market is willing to pay more than one dollar for Bitcoin exposure. This is an unsustainable long term unless these companies are able to increase Bitcoin per Bitcoin.

The success rate of these companies depends on the amount of profits they have to pay back their debts.

Mitigating Bitcoin risk for companies

Large and established companies always have more resources to manage their debt than smaller companies.

“Large and well-known Bitcoin finance companies such as Strategy, Metaplanet, GameStop should be able to issue capital to refinance debts or raise cash to repay debts relatively easily.

According to Dragosch, the key to avoiding such a scenario for small businesses is to prevent overvaluation. In other words, borrow something you can afford to pay back.

“The key factor that often breaks any kind of business strategy is potentially risky among other companies that copy MSTR’s Bitcoin acquisition strategy, starting on a higher cost basis. This increases the risk of forced liquidation and bankruptcy in the next bare market, especially if these companies accumulate too much process and excessive debt,” he said.

However, these liquidations minimize the market impact.

“It will create short-term volatility in Bitcoin and be harmful to the stock prices of those companies, but it is not an explosion risk for the broader crypto ecosystem. It will probably be a relatively small number of small companies.

The actual problem arises when a large player decides to sell his holdings.

Is large-scale holding a systematic risk?

More companies will add Bitcoin to their balance sheets, at least at the market level. The strategy is no longer the only company employing this strategy.

However, the strategy holdings are enormous. Today, it owns nearly 600,000 bitcoin, 3% of the total supply. This type of centralization actually carries liquidation risks.

“Currently, over 10% of all Bitcoin is held in the ETF’s managed wallets and the Ministry of Corporate Treasury. A significant share of the total supply. This concentration poses a systematic risk. If any of these centrally managed wallets are infringed or false, the fallout can ripple through the entire market.

Some experts believe that such a scenario is unlikely. If that happens, Stadelmann predicts that the initial negative outcome will ultimately be stable.

“If a micro strategy sells a large portion of Bitcoin, initially they will develop plans to do so without affecting the market. Ultimately, people will recognize what is going on and keep the price of Bitcoin even more extensive.

However, a significant amount of Bitcoin held by some large companies raises new concerns about centralising the assets themselves rather than competition.

Centralization as a trade-off of adoption

The accumulation of large companies raises concerns about the centralized ownership of a limited supply of Bitcoin. This challenges the principles of the core and creates anxiety about the confusion in its underlying structure.

According to Dragosch, that’s not the case. You cannot own most supplies and change the rules of Bitcoin.

“The beauty of Bitcoin’s Work Proof Consensus Algorithm is that you cannot change Bitcoin rules by owning a large portion of the supply that is different from other crypto assets like Ethereum. In the case of Bitcoin, the majority of the hashrate is necessary to change consensus rules or to corrupt/attack the network.

Second, Periker sees some truth in these concerns. However, he sees them as trade-offs for other benefits of widespread adoption.

“This centralization contradicts the spirit of Bitcoin’s self-strong ownership of individuals, but institutional detention still could be the most practical path to widespread adoption, providing the clarity, liquidity and ease of use of regulations that many new participants expect,” he said.

As businesses are increasingly using Bitcoin for strategic financial gains, the path to becoming a widely accepted reserve asset is accelerating. For now, it appears to include the risk of market collapse.

Disclaimer

Following Trust Project guidelines, this feature article presents the opinions and perspectives of industry experts or individuals. Although Beincrypto is dedicated to transparent reporting, the views expressed in this article do not necessarily reflect the views of Beincrypto or its staff. Readers should independently verify the information and consult with experts before making decisions based on this content. Please note that our terms and conditions, privacy policy and disclaimer have been updated.