In the crypto market, the $4.1 billion Bitcoin (BTC) and Ethereum (ETH) option contracts expire today. This mass expiration date can affect short-term pricing measures, particularly as both assets have been declining recently.

With Bitcoin options at $3.5 billion and Ethereum at $565.13 million, traders have potential volatility.

Expiration of high stake script options: what traders should see today

According to Deribit data, the Bitcoin option expiration dates will involve 33,972 contracts compared to last week’s 27,959 contracts. Similarly, Ethereum’s expiration options have decreased from the 246,849 contracts the previous week.

For Bitcoin, the maximum pain for expired options is $105,000, with a put-to-1.00 ratio. This indicates that traders can be split equally between bearish (purchase) and bullish (telephone) outlooks.

This reflects uncertainty or integration stages in the market in line with Beincrypto’s recent report on Bitcoin’s resilience amid geopolitical tensions. Pioneer’s cryptography remains surrounded by scope, with institutional support and low volatility strengthening its position.

Nevertheless, call and open interest suggest that it suggests mild bearish feelings and hedges.

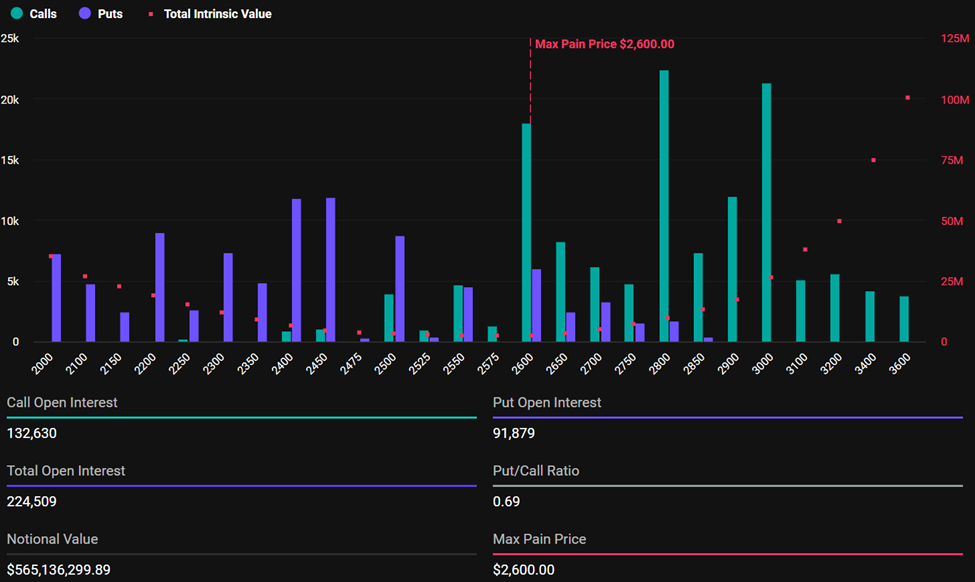

In comparison, their Ethereum counterparts are wasting bullishness with a put-to-call ratio of 0.69 and a maximum pain of $2,600.

The biggest problem is the key metrics that frequently guide market behavior. This represents the price level where most options have expired worthlessly and have given the biggest financial “pain” to the trader.

Traders and investors need to embellish volatility as options satisfaction often leads to short-term price fluctuations and causes market uncertainty. Based on the maximum pain theory, the price of an asset tends to be drawn to each maximum pain or strike price.

Ethereum trades the largest pain level at $2,506 at this writing; It means bullish outlook and describes the call options when traders bet on price increases. Meanwhile, the greatest pain level is also below, but Bitcoin shows a more balanced positioning with a put-to-call ratio of 1.0.

“The BTC shows a more balanced position near the maximum pain, but ETH bullishes with the call that calls the call dominates the curve. How will the market respond this time?” Delibit analyst pauses.

However, the market usually stabilizes immediately after the trader adapts to the new price environment. With today’s massive expiration dates, traders and investors can expect similar results, which could impact crypto market trends over the weekend.

Geopolitical risks and Fed Outlook places emphasis on emotions

Elsewhere, analysts at Greeks.live note that market sentiment among crypto derivatives traders has become particularly bearish in the short term. This comes after Federal Reserve Chairman Jerome Powell’s latest FOMC statement.

The trading group is widely positioned for negative side risk through July and has maintained long-term optimism in the fourth quarter (quarter 4).

“Traders are running a negative delta in their July position, planning on adding a positive delta to Q4,” Greeks.live wrote in the post.

Geopolitical tensions, particularly the increasing risk of US involvement in the Middle East, have emerged as the dominant short-term catalyst. Several traders reportedly have been on the verge of longer than the potential US involvement and Iranian tensions, opposed to further market slump.

Disclaimer

In compliance with Trust Project guidelines, Beincrypto is committed to reporting without bias and transparent. This news article is intended to provide accurate and timely information. However, we recommend that readers independently verify the facts and consult with experts before making decisions based on this content. Please note that our terms and conditions, privacy policy and disclaimer have been updated.