Welcome to US Crypto News Morning Briefing. An essential summary of the most important developments in future cryptography.

Grab your coffee while analyzing the standard Chartered Bitcoin (BTC) price forecast. According to the bank, Bitcoin price could reach $500,000 as Bitcoin prices accumulate MSTR stocks of strategy due to indirect exposure to Bitcoin.

The day’s crypto news: Standard Chartered’s bold Bitcoin forecast

Bitcoin was trading $105,178which rose at a modest 2.27% over the last 24 hours. In recent developments, the Pioneer Crypto mayor has risen to an all-time high of $2.09 trillion.

To some extent, macro factors such as reduced PBOC rates and downgraded U.S. credit in the Moody provide tail winds.

However, analysts believe that institutional profits are heavily related to the surge in Bitcoin’s value. First, Bitcoin Exchange-Traded Funds (ETFs) provide traditional financial (Tradfi) players with indirect exposure to BTC and promote institutional interest.

Similarly, the institution has gained an indirect exposure to Bitcoin via the MSTR stock of the strategy. Recent US Crypto News publications show that as of May 19th, the Strategy (formerly MicroStrategy) held 576,230 BTC.

The MSTR stock price of a strategy that holds a significant amount of Bitcoin on its balance sheet is closely correlated with Bitcoin price movement.

Analysts attribute this correlation as dynamic where Bitcoin is the base layer and MSTR acts as a vehicle with different risks, mechanics, and rewards.

Against this background, Beincrypto contacted Geoff Kendrick, Head of Digital Asset Research at Standard Chartered. Bitcoin is still on the course of hitting $500,000 before the end of Trump’s second administration, according to Kendrick.

Kendrick attributes this to deepening institutional adoption, particularly through indirect exposure via MicroStrategy’s MSTR shares.

Standard Chartered says the increase in allocation to MSTR is bullish for Bitcoin

A newly released filing from the 13th Fed US SEC (Securities and Exchange Commission) in the first quarter supports the bank’s bullish papers. Specifically, the strategy increased allocation to MSTR by various global sovereignty and quasi-souberin entities.

“We believe that as more investors access their assets and volatility decreases, our portfolio will move from the starting position of Bitcoin’s underweight towards the optimum level,” Kendrick said in an email to Beincrypto.

Although direct holdings of Bitcoin ETFs have declined slightly overall, other entities have quietly increased their exposure via MSTR, primarily as the Wisconsin Investment Commission sells an entire 3,400 BTC equivalent position at BlackRock IBIT ETF.

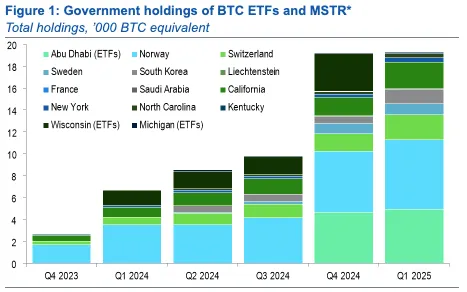

“Government agencies have increased their holdings of strategic corporations (MSTRs) that are normally traded like Bitcoin proxy. Norway, Switzerland and South Korea entities have reported significant MSTR increases, with Saudi Arabia adding a very small position for the first time.

Standard Chartered executives emphasized that while Bitcoin ETF flows are “exciting,” the trend in MSTR accumulation is a true story of the quarter.

“The details of the ownership of MSTR were where there was excitement,” he added.

Geoff Kendrick went further and detailed the Standard Chartered submission analysis. Based on their analysis:

Norway added 700 BTC equivalents via MSTR, and currently holds 6,300 BTC equivalents. Switzerland also added 700 BTC equivalents, reaching 2,300 BTC equivalents. South Korea added 700 BTC equivalents, bringing the total to 1,300 BTC equivalents. US state funds (California, New York, North Carolina and Kentucky) have added 1,000 BTC equivalents, which are currently 3,300 BTC equivalents. The Saudi Arabia central bank has opened a small MSTR position. This is the first.

Meanwhile, Abu Dhabi’s semi-Sovereign wealth fund Mubadara has added 300 BTC equivalents through ETF Holdings, increasing its position to 5,000 BTC equivalents.

“Q1’s SEC 13F data supports the paper that Bitcoin is attracting a wider range of buyers. The data on Bitcoin ETF holdings was disappointing, but MSTR-Bitcoin proxy MST saw an increase in purchases.

Beincrypto reported on how MicroStrategy Effect is spreading all over the world, and Tradfi companies have built Bitcoin War Chest.

This data strengthens the outlook for standard chartered, and that institutional and sovereignty flows are both direct and indirect, and will be a key driver of Bitcoin’s rise in the coming years.

The chart of the day

This chart shows the total government holdings of Bitcoin ETF and MicroStrategy MSTR stocks from Q4 2023 to Q1 2025. Based on the charts, the holdings grew steadily, peaking at around 18,000 BTC in the first quarter of 2025.

The chart shows that key contributors have been Abu Dhabi (ETFS), Norway, Sweden, South Korea, France, New York, Wisconsin (ETFS), Michigan (ETF), Switzerland (ETFS), Switzerland, Liechtenstein, California, North Carolina, Saudi Arabia and Kentucky earned a quarter.

Byte-sized alpha

Here’s a summary of more US crypto news that continues today:

Bitcoin has benefited from macroeconomic changes, such as China’s interest rate cuts and US credit downgrades, increasing its appeal as a hedge against instability. Bitcoin prices exceeded $105,000, driving institutional profits and causing more than $667 million in ETF inflows. Analysts warn that XRP futures could use strategies such as naked short stories and reprocessing to lead to price manipulation. Tron surpasses Ethereum in total USDT supply, with $75.8 billion in circulation and is the leader in stubcoin payments. The SEC is seeking public comment before controlling the Solana ETF, highlighting a careful regulatory approach. The ETH/BTC pair jumped 34% in a week, sparking hope for the Altcoin season, but only 18% of the top 50 coins currently outperforming Bitcoin. Blockchain analysis exposes bots that operate pumps. Abraxas Capital’s aggressive Ethereum accumulation has increased institutional reliability, with $837 million invested in ETH. Binance Alpha lists Tokyo Game Tokens (TGT) May 21stmake it The first platform to offer TGT trading. The PI network is facing a 40% crash, with the price currently at $0.73, decupted from Bitcoin, showing negative correlation.

Overview of Crypto Equities Pre-Market

Disclaimer

In compliance with Trust Project guidelines, Beincrypto is committed to reporting without bias and transparent. This news article is intended to provide accurate and timely information. However, we recommend that readers independently verify the facts and consult with experts before making decisions based on this content. Please note that our terms and conditions, privacy policy and disclaimer have been updated.