Bitcoin has experienced a notable pullback since it hit an all-time high earlier this year. The cryptocurrency has briefly fallen below $110,000, sparking concerns of sustained bear pressure.

However, current data suggest that this movement is short-term variability than the beginning of a long-term downward trend, suggesting a possible recovery.

Bitcoin is safe

Risk signals in the Bitcoin market have been eased. According to Bitcoin Vector, the risk-off signal is receding and moving towards a low-risk regime. This change suggests that the market situation has stabilized after weeks of volatility.

Sponsored Sponsors

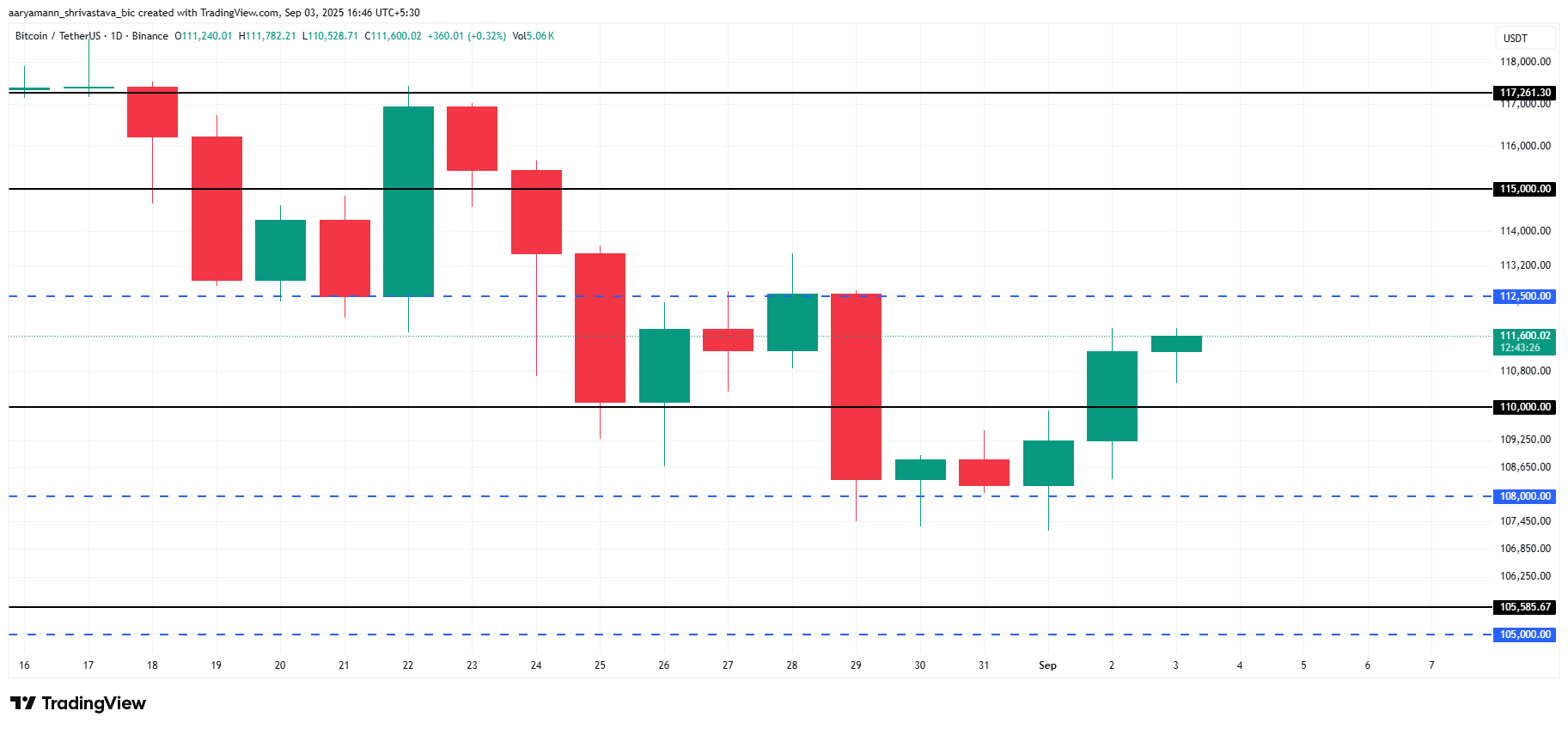

At the same time, Bitcoin has been freed from price compression since its high of $124,500. Recovering $110,000 confirmed the end of this compression zone. As resistance weakens, there is room for BTC to move higher, increasing the chances of recovery in the coming weeks.

Want more token insights like this? Sign up for Editor Harsh Notariya’s daily crypto newsletter.

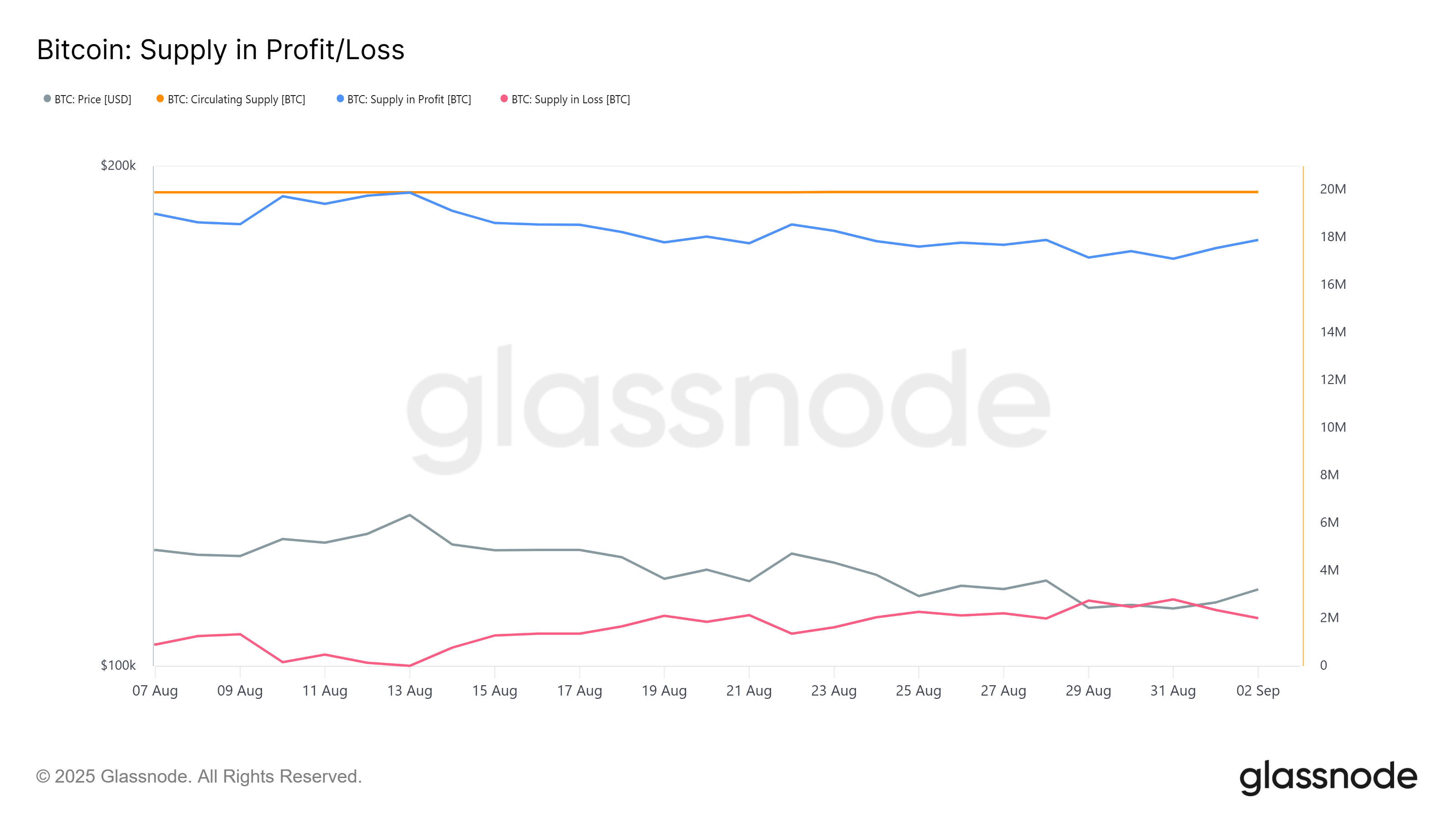

On-chain data supports this outlook. Of the 19.91 million BTC in circulation, only about 2.73 million coins are currently lost. This represents just 13.71% of supply, with normal losses well below historically related thresholds, exceeding 50% of circulating Bitcoin.

This indicates that Bitcoin is far from surrender territory. Despite the recent price decline, the majority of holders remained profitable and show resilience. The limited supply of losses reflects the convictions of strong investors, suggesting that BTC has a solid foundation to withstand sales pressure and maintain upward momentum in the near future.

BTC prices continue to rise

Bitcoin traded for $111,600 at the time of writing, a mere resistance of $112,500. The assets bounced back from $108,000 earlier this week, showing new strength. Over $110,000 provides stability and provides BTC with the foundation it needs to try to recover further to general market pressure.

If current momentum applies, Bitcoin could continue climbing. A breakout over $112,500 could pave the way for $115,000, reinforces bullish sentiment. The move confirms improvements in the market structure and informs new attempts to recover.

However, if sales pressure resurfaces, the risk remains. If Bitcoin fails to maintain momentum, it could be reduced to $110,000. In a deeper revision, the price could be revisited at $108,000, raising concerns among investors about the potential weakness of short-term debilitating.