HBAR has recently experienced a significant drawdown, causing investors to be confused and face losses. After a long-term downtrend, HBAR has shown signs of recovery, rising 12% over the past 24 hours.

As Altcoin begins to recover, investors are optimistic that the recent surge could mark the end of a two-month downward trend.

Hbar has shots

The HBAR’s relative strength index (RSI) fell below the critical 30.0 threshold and fell into the sellout zone. This marked the lowest point in HBAR’s RSI in over 10 months. Typically, when an RSI enters a sold zone, it indicates a potential inversion. With the RSI bouncing, this could indicate that the downtrend is nearing its end and recovery is ongoing.

The recovery in RSI suggests that investors’ feelings are changing. It shows that as RSI rises from the territory where it was sold, purchasing pressure could begin to outweigh sales.

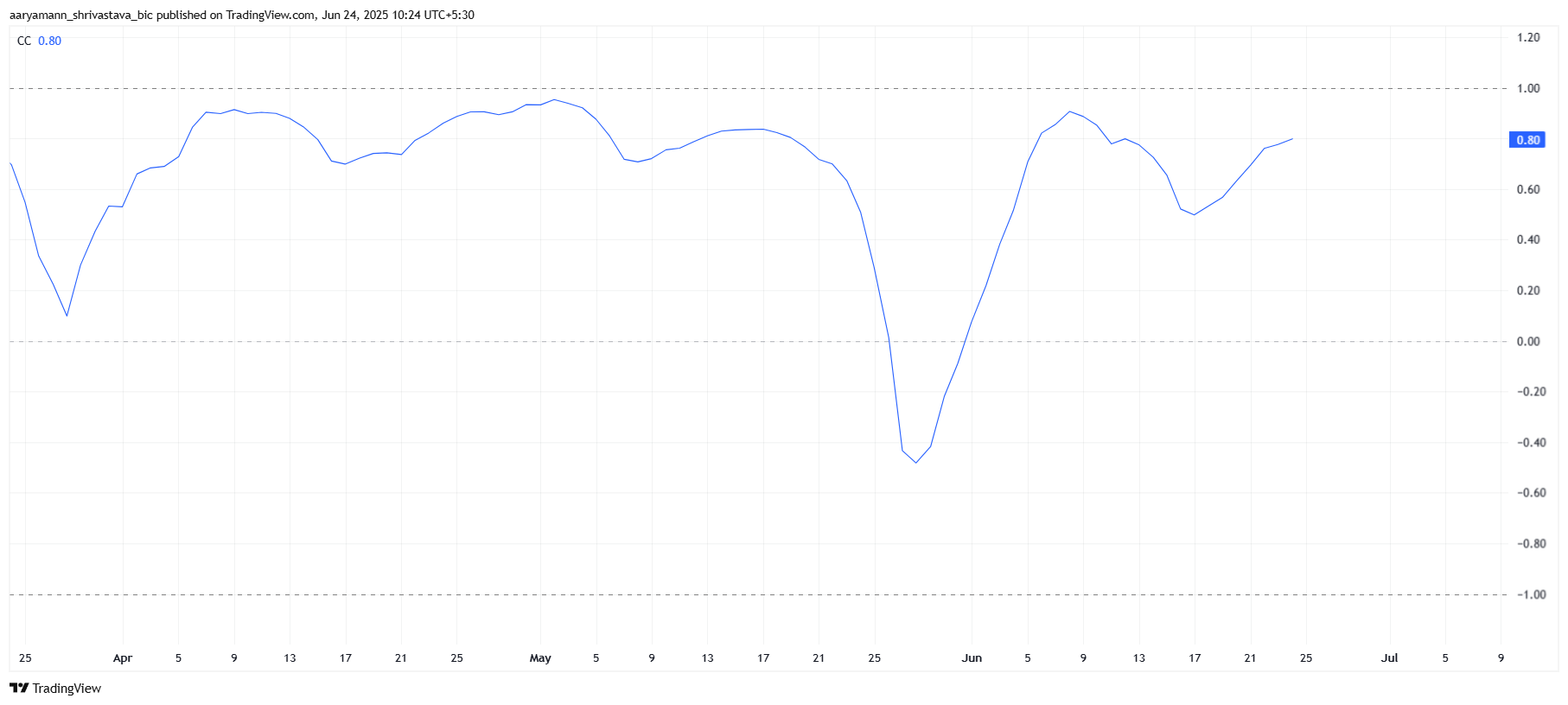

Price transfer in HBAR is closely correlated with Bitcoin, with a strong correlation coefficient of 0.80. This high correlation suggests that HBAR can mimic Bitcoin’s price movement, and benefits from Bitcoin’s potential growth. If Bitcoin continues its upward trajectory, HBAR could also harness the positive momentum of the broader crypto market, leading to AltCoin’s profits.

However, this correlation also presents risk. If Bitcoin goes through a recession, HBAR could follow the lawsuit and amplify negative price action. A strong correlation means that while HBARs can have a higher Bitcoin wave, they are equally vulnerable to Bitcoin volatility.

Hbar prices can work

HBAR has grown 12% over the past 24 hours, trading at $0.150. Currently, they face resistance levels at $0.154 and $0.163. Prices show positive momentum, but given the recent downward trend, reaching the $0.163 level could prove difficult. However, if bullish feelings continue, HBAR may be able to break through these resistance levels and end the two-month decline.

A sustained bullish momentum could potentially negate downtrends as price moves exceed $0.163. If HBAR can break through resistance, it could push towards a higher price target, providing bailouts to investors who are still in a recession. Important levels to look at are the resistance levels of $0.154 and $0.163. This is because breaking through these could indicate a full recovery.

However, if bullish momentum is not maintained, there is a risk that HBAR can retreat. When prices fall below the main support level, you can immerse yourself in about $0.139 or $0.133. Such a decline indicates that recovery is short-lived and bearish feelings can resume.

Disclaimer

In line with Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. Although Beincrypto is committed to accurate and unbiased reporting, market conditions are subject to change without notice. Always carry out your research and consult with an expert before making any financial decisions. Please note that our terms and conditions, privacy policy and disclaimer have been updated.