Hedera (HBAR) is under pressure, falling 3.6% over the past 24 hours and 13.6% over the past week. Its price is struggling at under $0.21 and is hovering near $0.185. Market capitalization fell below $8 billion, reflecting weakness in emotion.

Momentum indicators like RSI and Bbtrend are bearish, adding the possibility of EMA’s death crossing to the downside risk. HBAR is currently at a critical level where retaining support can prevent further losses.

Hbar’s momentum fades when Bbtrend is held under Zer

Hedera’s Bbtrend fell to -8.88, becoming negative at the end of May 16 after maintaining positive territory from May 16 to May 16.

Since then, the indicator has remained consistently bearish, hovering between -8 and -8.5 over the past day.

This sustained drop suggests that bullish momentum has completely faded, and the HBAR is currently experiencing stronger underside pressure.

Bbtrend, or Bollinger Band’s trends measure the strength and direction of price movement by analyzing how much price deviates from the average compared to volatile.

Positive values usually indicate bullish momentum, while negative values suggest bearish conditions. The token may be in the weakening trend phase as HBAR’s BBTREND is -8.88.

Unless the trend is reversed soon, this level indicates that HBARs can continue to face resistance difficulties or regain their upward momentum.

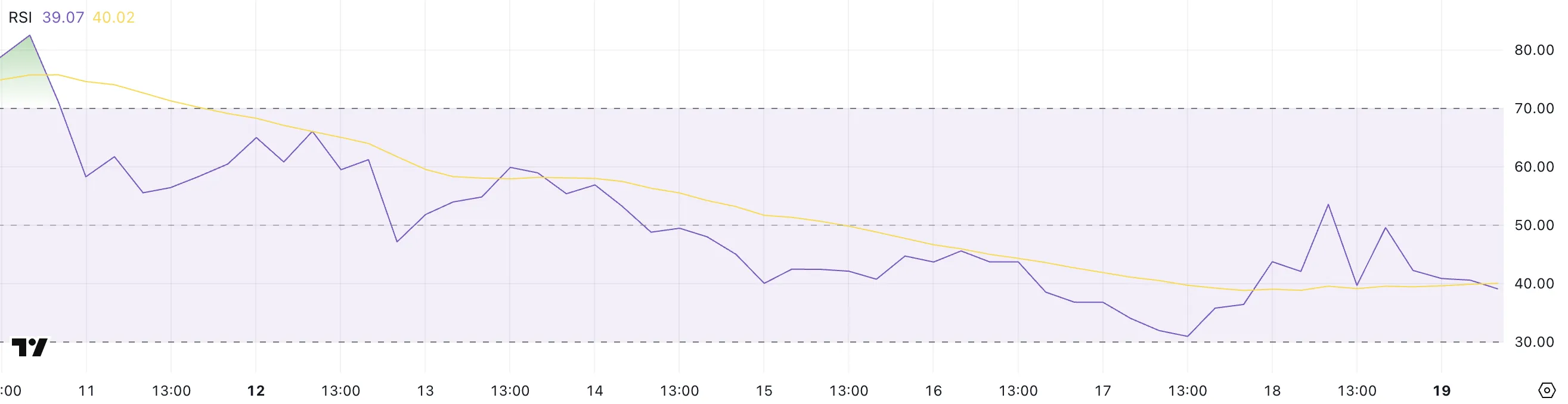

hedera rsi cannot keep recovery and returns to the bear zone

Hedera’s RSI is now 39 years old, reflecting the loss of momentum following a short recovery attempt. Two days ago, RSI approached the sales threshold, which sold at 30.92, suggesting that HBAR was under strong sales pressure.

Yesterday it rebounded sharply to 53.54, temporarily entering neutral territory, but soon returned to 39. He emphasized that bounces are short-lived.

This type of volatility in RSI often indicates a lack of convictions from buyers, and sellers still dominate the market in the short term.

The relative strength index (RSI) is a momentum index in the range 0-100 that is commonly used to assess whether an asset is being over-acquired or over-acquired.

Measurements above 70 suggest conditions and potential pullbacks, while values below 30 indicate that the asset may be oversold and ripe for bounce. At 39, Hedera’s RSI sits in bearish territory. It sucked out the sold zone, but still has no sign of strong buying pressure.

This mid-level suggests attention between traders. Unless RSI can recover and retain 50 levels, HBARs may face or stagnate negative risks without a clear trend reversal.

Hbar faces a make-up or break moment near $0.185

Hedera Price is trading at $0.185 near a critical support level, with the EMA line showing a potential death cross. In this case, the short-term moving average is below the long-term average and is often associated with the onset of a deeper downtrend.

If this bearish crossover occurs and the $0.185 support is not retained, the HBAR can slide to an additional $0.169.

A breakdown below exposes the token to additional losses, resulting in $0.160 as the next major support. Moves below $0.160 cannot be ruled out when sales pressures accelerate, particularly in a sustained bear environment.

On the back, if your HBAR avoids the death cross trigger over $0.185, you can find a new purchase right.

A successful support defense opens the door for a retest at a $0.192 resistance level.

A breakout there could push the HBAR to $0.202, and if momentum builds up, it could even reach $0.228.

Disclaimer

In line with Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. Although Beincrypto is committed to accurate and unbiased reporting, market conditions are subject to change without notice. Always carry out your research and consult with an expert before making any financial decisions. Please note that our terms and conditions, privacy policy and disclaimer have been updated.