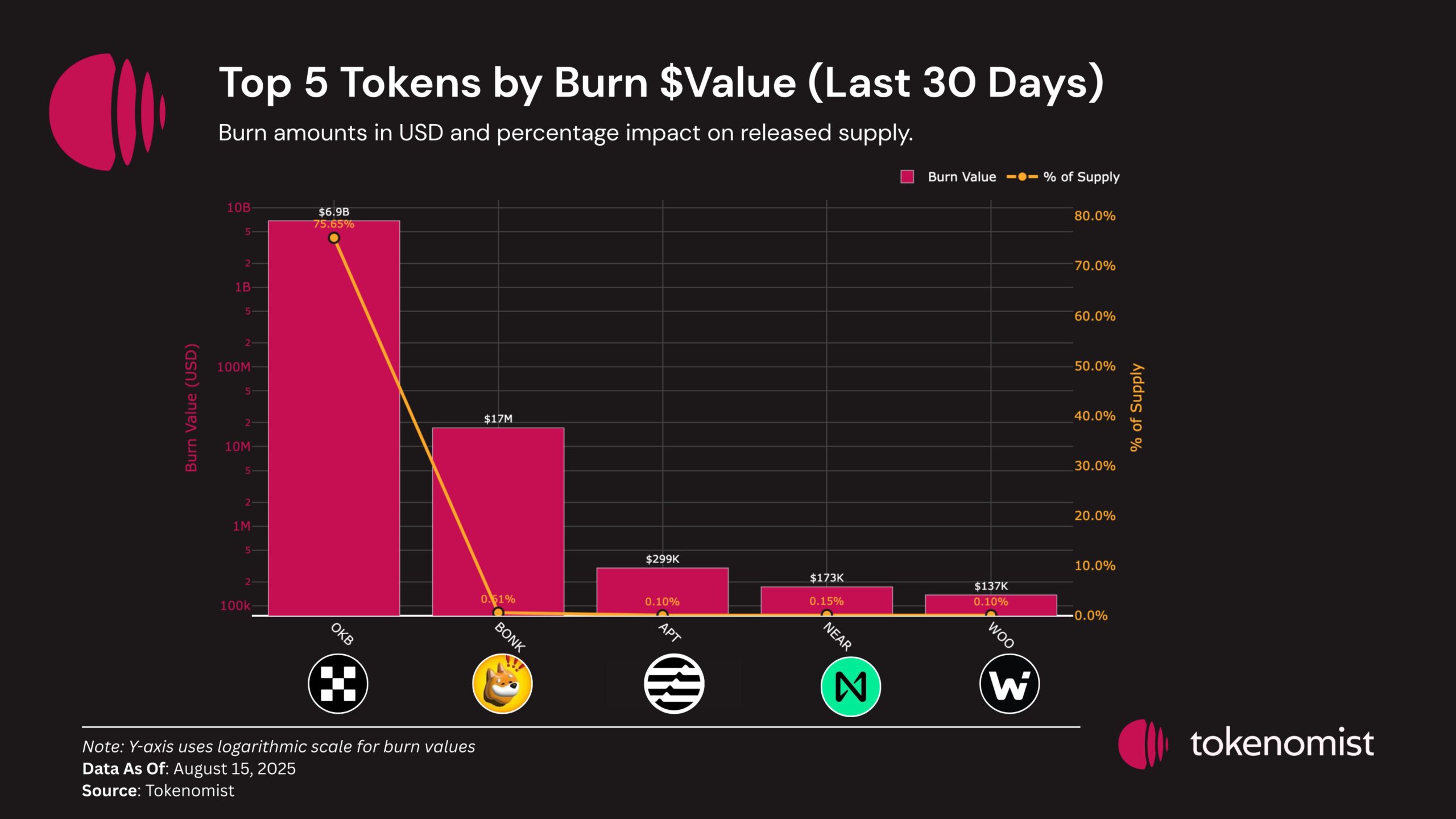

In 2025, token supply management strategies such as buybacks and burns have become an increasingly important tool for increasing value and investor appeal. OKX, one of the leading cryptocurrency exchanges, demonstrated this through its OKB token burn plan.

The problem is why this burn strategy allows OKB to outperform other tokens in the past month. The following analysis highlights the differences in the core.

Important differences between OKB token burns

Cryptobubble’s data shows OKB has recorded the highest growth in Altcoins over the past month.

The tokens earned almost 300%, surpassing other powerful performers such as Link, MNT, and Aero.

Unlike routine burns, OKB burns were placed as a near-redefinition of tocononomics. OKX has performed the biggest burns ever, permanently removing 65,256,712 OKBs, including previously repurchased tokens, reducing the fixed supply to 21 million.

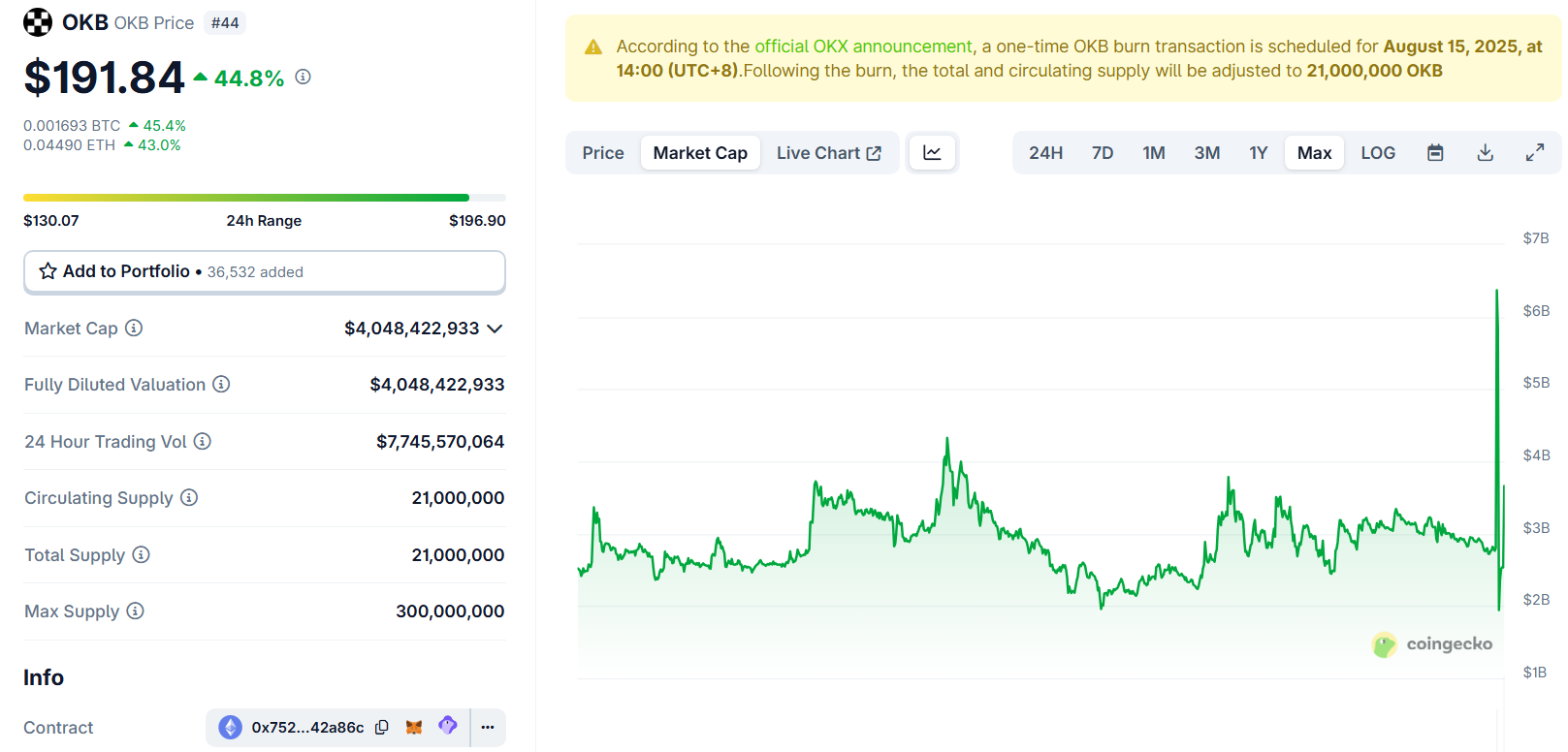

This adjustment in supply allowed the market to retaliate the capital letters of the token. Timing proved important as it coincided with the positive period in August, when analysts had high expectations for the Altcoin season.

Following the burns, OKB supply is currently choked at 21 million people. This number reflects the maximum supply of Bitcoin and creates a psychological link between OKB and the market benchmark assets. This move serves as a marketing factor and encourages investors to compare OKB to Bitcoin.

Other projects employ backback and burn models, but no fixed supply caps. For example, Tron has burned 7.1 billion TRX since its launch, including 820 million in 2025 alone, but the TRX has no biggest limit.

Smaller, cyclic burns without cap supply tend to dilute impact over time. In contrast, the removal of 65.26 million OKB by OKX was critical, introducing immediate deflationary pressures and driving a sudden price rise.

These structural differences softened OKB quadruple in August.

Will OKB continue to rise?

To assess OKB’s potential, we need to look beyond price movements and look at changes in market capitalization.

After burns, Coingecko’s data shows OKB’s current market capitalization equals a completely diluted valuation of just over $4 billion.

Historically, capital letters have fluctuated around $3-4 billion before and after burns. This indicates that price increases do not necessarily reflect a corresponding increase in total amounts.

“OKX reduced OKB total supply from 300 million to 21 million. Prices have skyrocketed three times, but history shows that Token Burns does not automatically generate sustainable value or liquidity,” commented Bitcoin Suisse AG.

The long-term benefits of BNB come from burns as well as adoption within the Binance Chain ecosystem. Similarly, TRX has maintained long-term growth due to increased demand for USDT trading.

Therefore, expanding OKB’s applications is important to maintain market capitalization growth.

A key competitive advantage of OKB may lie in the OKX ecosystem, particularly using the X layer. X-Layer is a public ZKEVM-based network developed in collaboration with Polygon, released in 2023. OKB remains the only gas and native token for the X layer.

The post, in which OKB Token Burn Strategy created a 400% meeting, first appeared on Beincrypto.