On June 20th, key on-chain metrics tracking the behavior of ETH long-term holders (LTHS) closed the installation of sales pressures from this cohort at an all-time high.

This occurs when the momentum in the wider market has cooled considerably. Bearish sentiment is growing as ETH demand is weakened and investors are largely on the sidelines amidst the sustained market lull.

Ethereum vibrancy hits record high

According to GlassNode, ETH’s vibrancy surged to an all-time high of 0.69 during Friday’s trading session. This metric tracks the movement of long/dormant tokens. This is done by measuring the ratio of the coin days of an asset to the total accumulated coin days.

If this metric drops, the LTHS of the asset is moving the asset out of exchange. This is a movement that is considered a signal of accumulation. Meanwhile, like ETH, when it climbs, lths is moving to exchange coins and sell them.

This surge in ETH’s vibrancy to 0.69 suggests that its LTH is increasingly liquidated as uncertainty increases. This reflects increased confidence in the coin’s short-term price recovery.

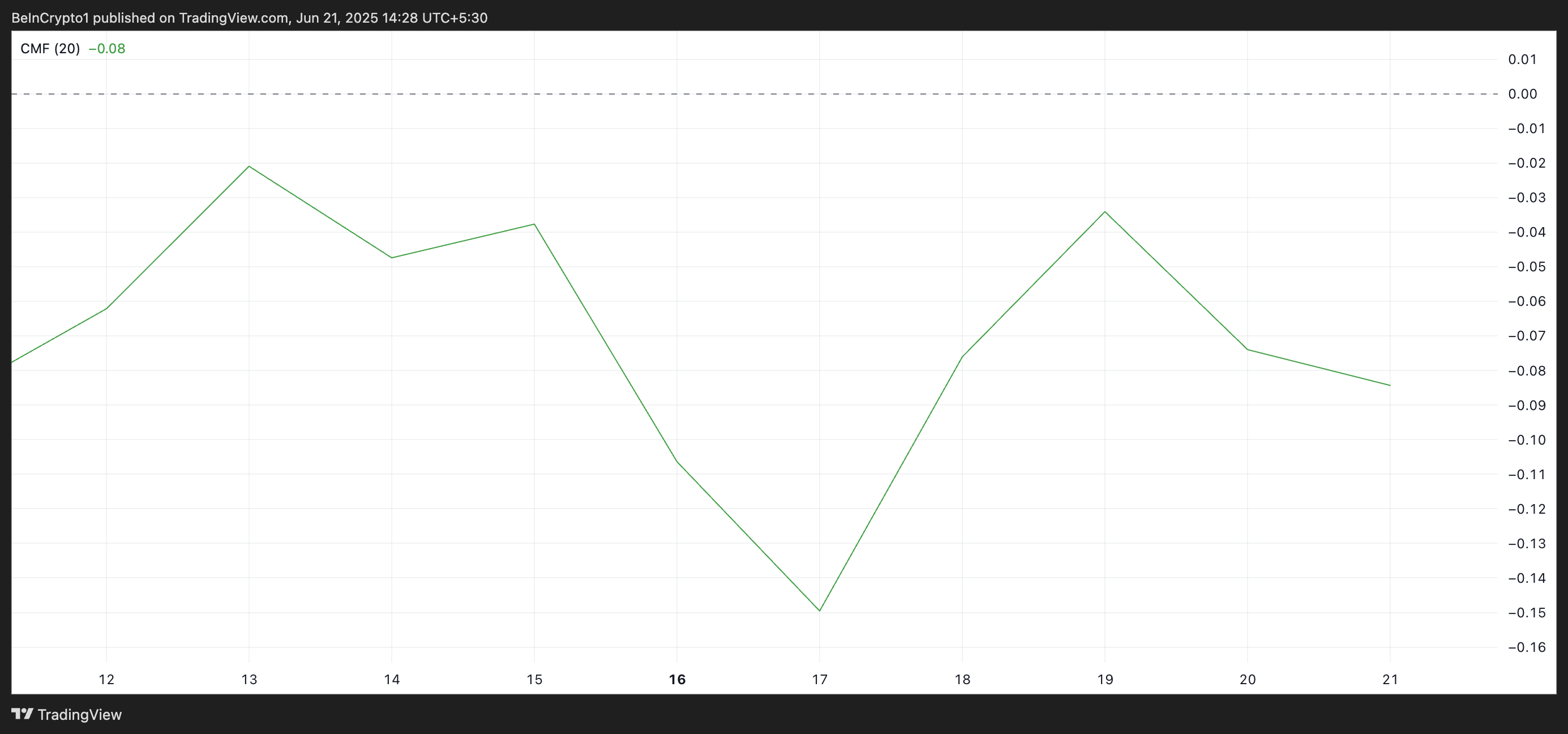

An additional confirmation of this bearish trend can be found on ETH’s daily charts, with the coin’s chaikin money flow (CMF) being negative and heading downwards. At the time of this writing, ETH’s CMF stands at -0.08, indicating a decline in capital inflows.

The CMF indicator measures the flow of in and out of assets. If its value is negative, it shows low purchase interest and examines a shift to distribution rather than accumulation.

ETH eyes fall to the low level of May

Permanent offloading by long-term ETH holders, combined with a decline in overall market demand for coins, could lead to deeper corrections in the near future.

At press time, the major Altcoin trades for $2,429. If the sale continues among veteran ETH owners, the coin could drop to $2,185. If this price floor is not held, the coin could immerse itself in another $2,027, reaching its last in May.

Conversely, a revival of new demand for Altcoin negates this bearish outlook. In that scenario, its price could reverse the downtrend and rise to $2,745.

Disclaimer

In line with Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. Although Beincrypto is committed to accurate and unbiased reporting, market conditions are subject to change without notice. Always carry out your research and consult with an expert before making any financial decisions. Please note that our terms and conditions, privacy policy and disclaimer have been updated.