Solana (Sol) has dropped 5% over the past seven days, falling below $180 for the sixth consecutive day. Nevertheless, institutional interest in SOL has been growing, with large players accumulating and imbuing a significant amount of its potential Altcoin season.

However, technical indicators show signs of weakness, such as negative bbtrends, bearish mica cloud setups, and the impending EMA death cross. These mixed signals suggest that short-term momentum is under pressure while long-term reliability is increased.

Solana draws institutional interest, but one-sided clouds show uncertainty

Solana’s institutional accumulation intensified in May 2025, showing strong confidence ahead of the potential altcoin season.

Altcoin’s trading volume remains below previous peak levels, but major players are stacking SOL.

More than 65% of Sol’s supply is currently being piled up, reaching $1.2 billion in the first quarter of 2025, the strongest in a year. These trends combine with positive on-chain flow and ecosystem expansion, bringing Solana to the forefront when Altcoin’s momentum returns.

Solana’s limb cloud charts now reflect market indecisiveness with a slight bearish leaps. Price action floats inside the green clouds, suggesting a lack of integration and clear direction.

The Blue Tenkansen (transformation line) is located below the red Kijunsen (baseline), indicating short-term debilitating. The Chikou span (green lag line) is entangled with recent price action, enhancing the bias from neutral to bare.

First, the clouds shift to red and appear flat, referring to potential resistance and low momentum unless there is a strong breakout.

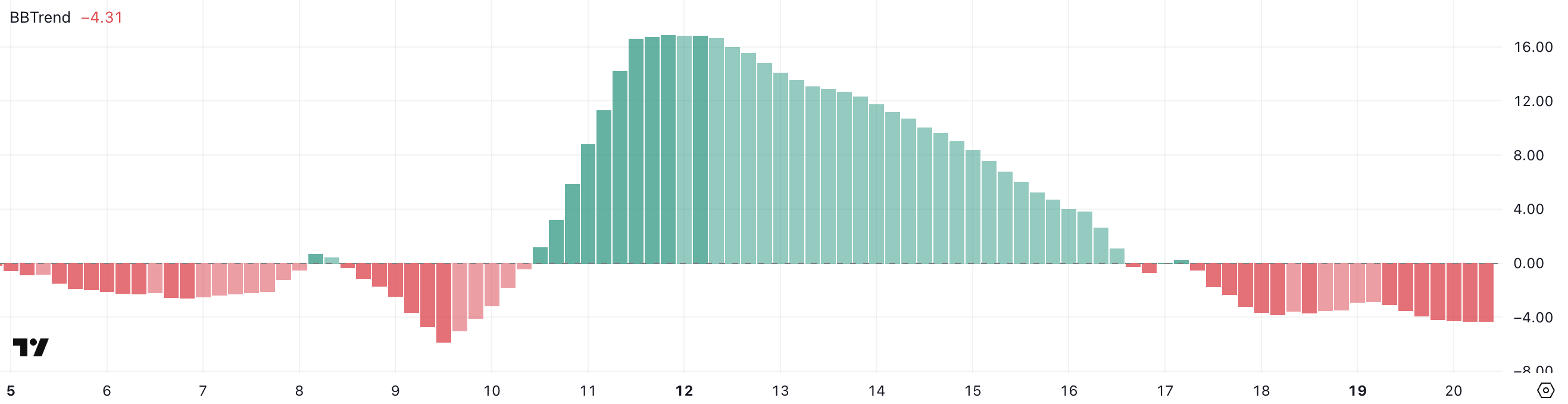

sol bbtrend is negative and bearish momentum is less than -4

Solana’s Bbtrend is currently -4.31, marking third consecutive day in negative territory.

Over the past few hours, the indicator remains stable around -4, suggesting consistent bear pressure in the short term.

Bbtrend (Bollinger Band Trend) measures the intensity and direction of price movement relative to the width of a Bollinger band.

Values above 0 usually indicate bullish momentum, while values below 0 indicate bearish momentum. The bbtrend at -4.31 reflects strong downward pressure and limited volatility in the reverse direction.

If this trend continues, it may point out further integration or even deeper pullbacks, unless a sharp inversion breaks the pattern.

Death Cross setup could push Sol back to $141 if $160 support fails

Solana’s EMA line is converging and could soon form a cross of death. This is a bearish technical signal that short-term EMAs cross under long-term EMAs. If that happens, Sol Price can test the support level for $160.

A breakdown below this level could reduce the price to $153.99, and Solana could drop to another $141 as the bearish momentum accelerates.

On the other hand, if Solana regains bullish momentum, her initial resistance to viewing would be $176.77.

If a breakout exceeds this level is successful, you can open the door to gather more towards the $184.88 zone.

Disclaimer

In line with Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. Although Beincrypto is committed to accurate and unbiased reporting, market conditions are subject to change without notice. Always carry out your research and consult with an expert before making any financial decisions. Please note that our terms and conditions, privacy policy and disclaimer have been updated.