The popular Altcoin Solana has seen a modest recovery with an uptick since August 2nd. Despite previous weaknesses, the tokens gathered nearly 10%, reaching $171.91 at press.

The rise suggests a potential change in emotions, while technical indicators suggest a continuing uptrend.

Sol Price Recovery Gets Steam

Measurements on the Sol/USD one-day chart show a gradual revival of bullish momentum among the Sol holders.

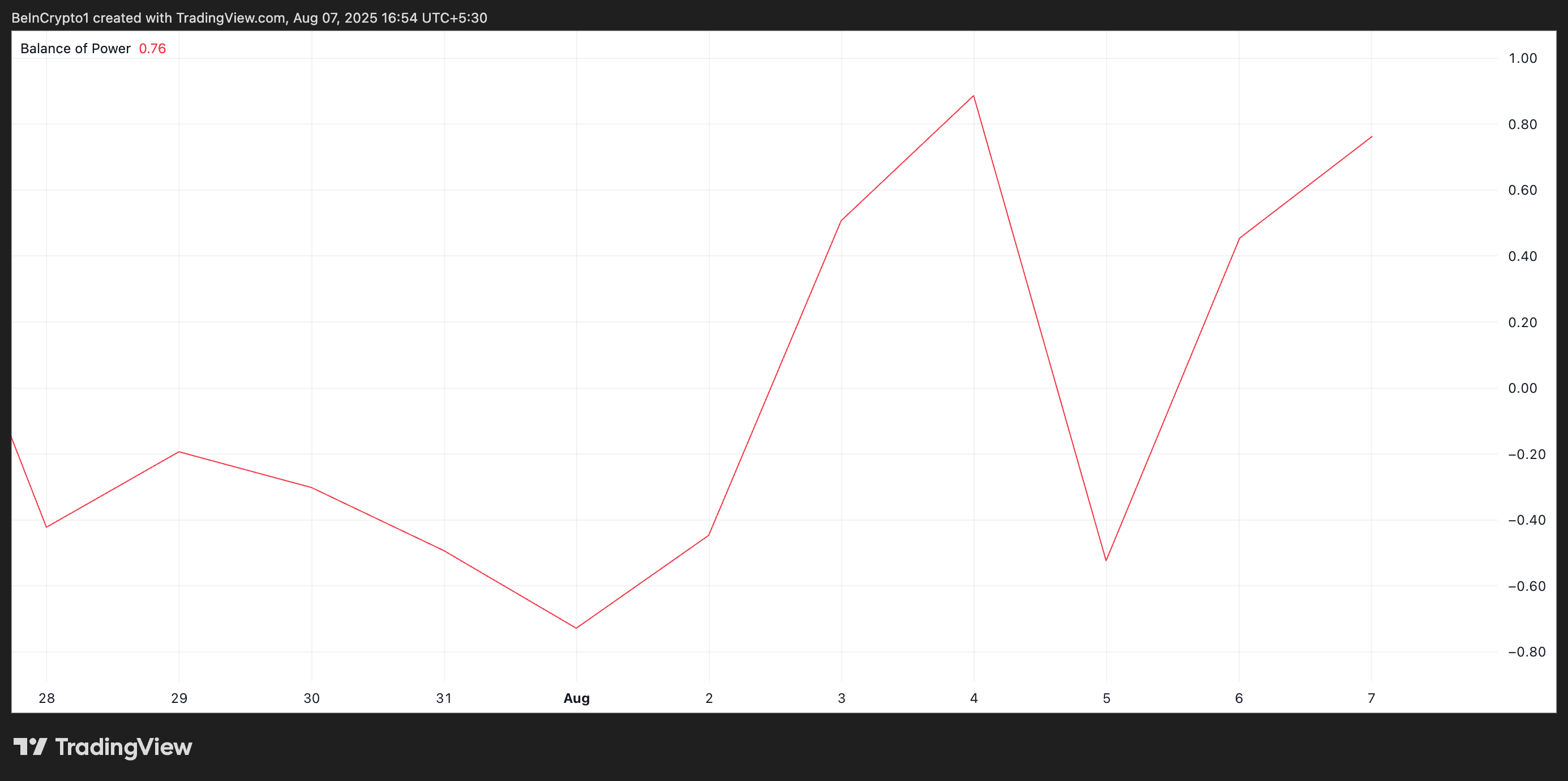

For example, at the time of this writing, its balance of power (BOP) is positive, indicating that the bias is currently skewed in favour of the bull. It is currently on an upward trend, at 0.76.

About Token TA and Market Updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s daily crypto newsletter.

BOP measures the strength of buyers and sellers in the market. Compare price movements during the trading period to determine which side has more control. Typically, the BOP value oscillates between -1 and +1.

A positive BOP suggests that the buyer is dominated and pushes prices higher by closing near the top of the range, while a negative BOP indicates that the seller has a top price near the bottom of the range.

In the case of SOL, the current positive BOP reading shows that the Bulls are gaining market control and are strengthening their continued price recovery.

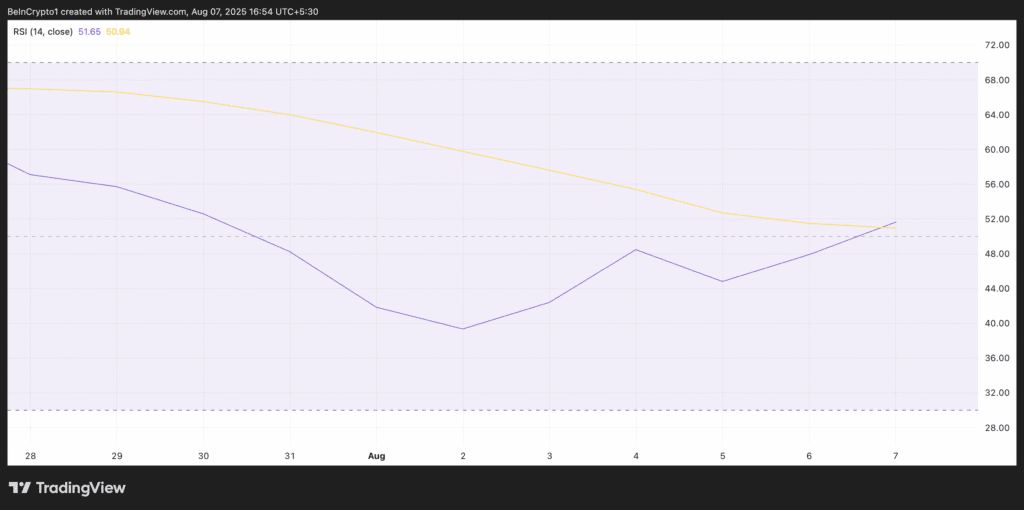

Additionally, the climbing relative strength index (RSI) adds to the bullish outlook for SOL. This important momentum indicator is currently at 51.65, with a clicking ticking indicating a steady rise in buy-side pressure.

The RSI indicator measures the market conditions for asset acquisitions and overselling. It ranges from 0 to 100. Values above 70 suggest that the asset is over-acquired and paid for a price drop, while values below 30 indicate that the asset is over-sold and may witness a rebound.

With 51.65 and climbing, Sol’s RSI proposes to strengthen bullish momentum. The buyer is gradually regaining control, leaving room for even more upside down if demand continues to increase.

Sol Price approaches the moment of makeup or break

A sustained wave of buying pressure could drive a breakout that outweighs Sol’s immediate resistance at $176.33.

If this level is cleared with strong momentum, Sol may be ready to pass the psychological barrier for $180, opening the door for further profit.

However, this can be prevented by emotional changes and new profits. If Bears regain control, Sol’s price risks pullback to a support level of $158.80, eliminating recent profits.

Solana’s post-technical indicator first appeared in Beincrypto as the Bulls targeted the $180 barrier.