Upbit, South Korea’s leading cryptocurrency exchange, has released its list of Raydium (Ray). Trades begin at 12:00 pm on Standard Time in Korea (KST).

Additionally, Bithumb will list Huma Finance (Huma) and Forta (Fort) at 3pm and 5pm KST, respectively. These lists sparked a double-digit gathering for all three tokens.

Upbit announces Raydium (Ray) listing

Raydium is a distributed exchange (DEX) and automatic market maker (AMM) built on the Solana (SOL) blockchain. Native token Ray has struggled recently, recording a 27.3% decline over the past 30 days.

The decline also halved the market value beyond $1 billion to about $500 million. However, Upbit’s decision to support Ray Trading has injected optimism into the market.

“Raydium (Ray) KRW, USDT Market Supported Market: KRW, USDT Market.

The announcement caused a 34.3% rise in ray token prices during the early hours of Asian trading. Beincrypto data showed that the price had risen from around $2.07 to $2.78 within minutes. Furthermore, the market capitalization has increased to more than $655 million.

A modest fix continued, but Ray was still able to hold some profits. At the time of writing, Ray’s trading price was $2.32, an 11.3% increase. The market capitalization has also been adjusted to approximately $637 million.

This rise coincides with the historical patterns observed in the Upbit list. Earlier this week, Altlayer (Alt) and Haedal Protocol (Haedal) also saw a similar surge. Additionally, last month, four Altcoins were acquired on the back of Upbit’s support.

Bithumb lists support Huma and Fort

In addition to Upbit, Bithumb also revealed two new token lists today. Huma and Fort will be added to Exchange’s KRW market, with trading beginning later today.

Huma saw a significant rise in prices, rising 12.0% before returning to $0.037. Despite the setback, the short spike highlighted the market’s interest in tokens after listing.

Meanwhile, Fort showed an impressive upward movement, rising 52.2% at the time of writing to $0.10. The ongoing appreciation for the fort reflects strong market sentiment and increased demand. In fact, the token even became the top daily winner at Coingecko.

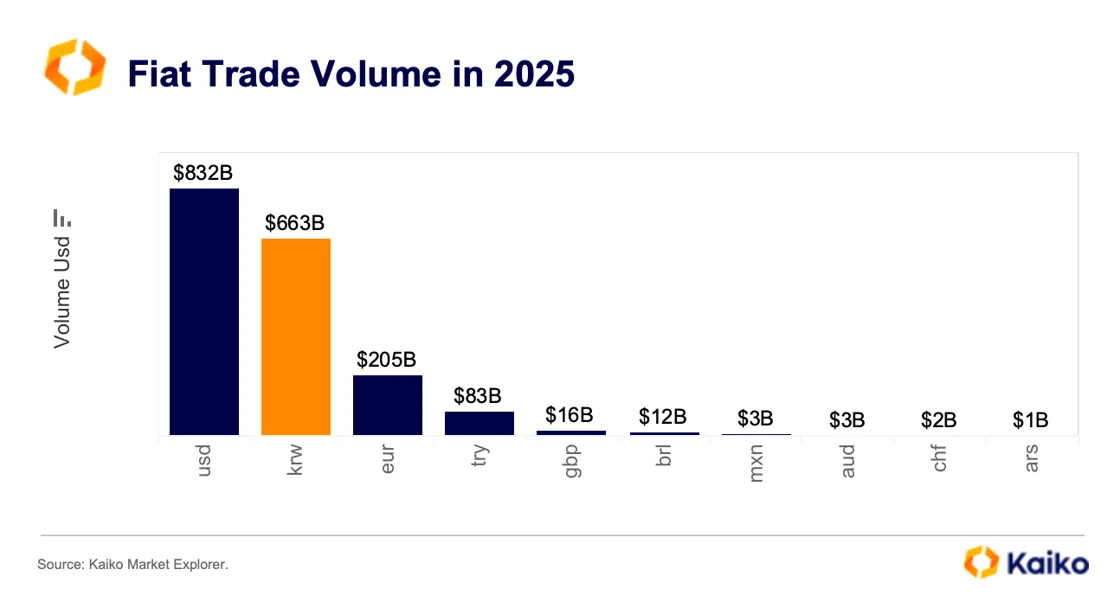

The expansion of products through both exchanges coincides with growing momentum in the Korean cryptocurrency market. According to Kaiko Research, KRW-controlled Crypto Trading in 2025 reached $663 billion.

This places South Korea globally as the second largest crypto market behind the US alone. Additionally, nearly one in three adults in the country owns cryptocurrency, twice the adoption rate in the US.

“However, sustainable barriers such as fragmented markets, adoption of low stubcoin and the persistent ‘Kimchi Premium’ are set to challenge institutional growth and product innovation in the Korean crypto sector,” Simuko added.

Disclaimer

In compliance with Trust Project guidelines, Beincrypto is committed to reporting without bias and transparent. This news article is intended to provide accurate and timely information. However, we recommend that readers independently verify the facts and consult with experts before making decisions based on this content. Please note that our terms and conditions, privacy policy and disclaimer have been updated.