Another meme coin riding on Solana’s summer hype once became something else for the early traders. Today, many people are recording six-figure profits.

However, when the token price collapses at around $0.28 and the smart money starts to fade, the problem is: How much can this meme float until the selling pressure wins?

You may already be profiting and are looking at the exit

According to the Geckoterminal Traders tab, nine of the top 10 wallets are deep in the green. One address increased profits realized above $1.19 million, while another closed $869,000. Even wallets that didn’t start much have turned five-digit purchases into monster flips.

This is not just “some profit.” I bought these wallets early, useless. The average admission price ranges from $0.008 to $0.09, and now it has dropped millions. As most people have already withdrawn most of their positions, the risk of further useless price dumping from the remaining bags is high.

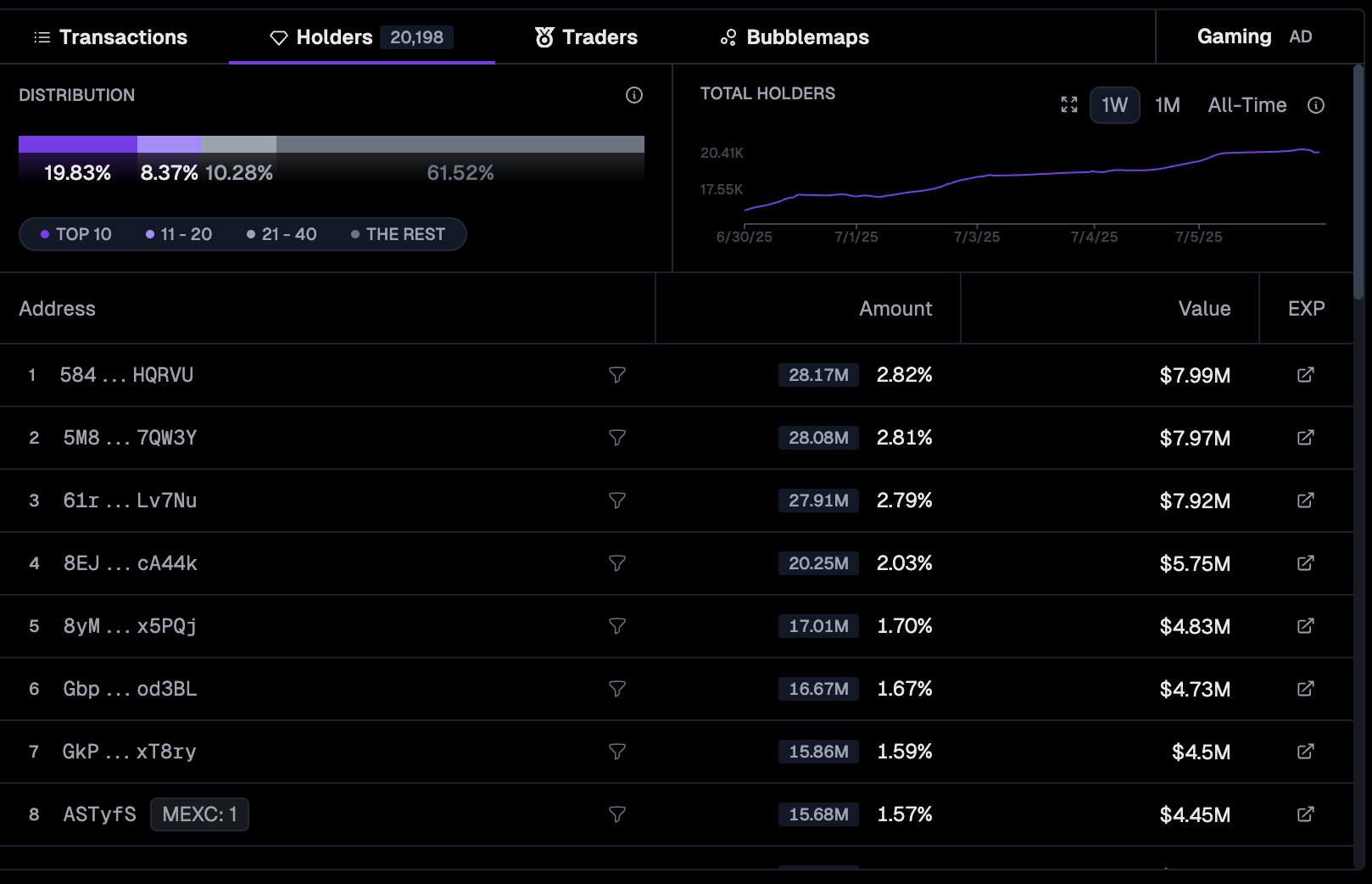

Distribution suggests control of whales

Looking at the Holder Concentration Chart, almost 20% of the total token supply is held by the top 10 wallets. The top address alone controls 2.82% ($7.99 million). This type of token concentration is likely to lead to aggressive sales.

Prices slide and sell volume spikes under VWAP

At the time of writing, the live transaction feed is Bloodbath. After-sale sales hit books, with only rare green candles in between. Another retail dump of 3,461 retail dumps ($982.84) and 1,223 tokens ($347.60) recently occurred.

In the price list, it broke from the rising triangle, a useless, classically bearish structure. Rejection on the top trendline, coupled with failing to hold volume weighted average price (VWAP) support ($0.2844), opens the room towards the $0.2615, $0.2339, and $0.2235 levels.

VWAP, or Volume Weighted Average Price, indicates the average price at which the trader purchased the token and is adjusted to volume. You can see that losing this level will weaken your buyer’s control.

Obvious branching confirms that it weakens momentum

The last hint? On-balanced volume (OBV). The obv is bleeding sideways despite the price being integrated near the high. This is a clear indication that real demand is not being maintained. The volume profile shows strength only during sales, with the exception of the July 7th candle, the buy side volume is weaker.

The obv, or balance balance volume, measures whether it flows into the token. If the obv stalls while prices are rising, it usually means that early buyers are quietly offloading.

Fibonacci levels have reduced the risk of breakdowns to about $0.25

Fibonacci’s retracement was drawn to $0.2218 from $0.3047 (recent high) and marked the lowest core before the bounce began. This was chosen because it was the last major drop before the buyer intervened. A clean local bottom that checks the full range of movement.

By fixing it here, you get a more distinct retracement zone at $0.2870 (0.786 FIB), which acts as an immediate resistance. If that fails, the price could slide to $0.2630 (0.5 FIB) or 0.2414 (0.236 FIB).

This structure helps map risk levels as failures deepen. With increased selling volume and fade support, the useless appearance is vulnerable to under $0.28.

The Fibonacci level is used to map the possibility of retracement zones during correction, with 0.5 and 0.236 often serving as important support lines.

The useless coin trader may still be a meme, but the data shows that serious wallets are out. With deep profits booked, sales volumes rise and OBVs checking for weaknesses, the chart points to one thing. The failure may already be running.

Disclaimer

In line with Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. Although Beincrypto is committed to accurate and unbiased reporting, market conditions are subject to change without notice. Always carry out your research and consult with an expert before making any financial decisions. Please note that our terms and conditions, privacy policy and disclaimer have been updated.