Bitcoin recently achieved its new all-time high (ATH). This rekindled bullish sentiment among cryptic enthusiasts. However, as prices approach new highs, investors are skeptical.

Some investors are confronting profits and creating uncertainty about whether this rally can be maintained. The problem remains. Will Bitcoin be able to continue its bullish momentum, or is the current price action sign of the future?

Bitcoin investors remain uncertain

Bitcoin’s vibrancy, an important metric used to track long-term holders (LTH) activities, has reached its highest level in nearly four years. This vibrant increase indicates that long-term holders are beginning to sell, indicating that they may be securing profits after the recent surge in Bitcoin prices.

LTH is usually seen as the backbone of Bitcoin’s price stability, and their sales behavior often suggests that investors’ feelings are changing towards skepticism.

When LTHS decides to sell, it often marks a turning point in the market. Their sales could lead to increased market volatility and potential price adjustments. As more LTHS withdraws the market, Bitcoin faces additional pressures that could further hinder price increases in the short term.

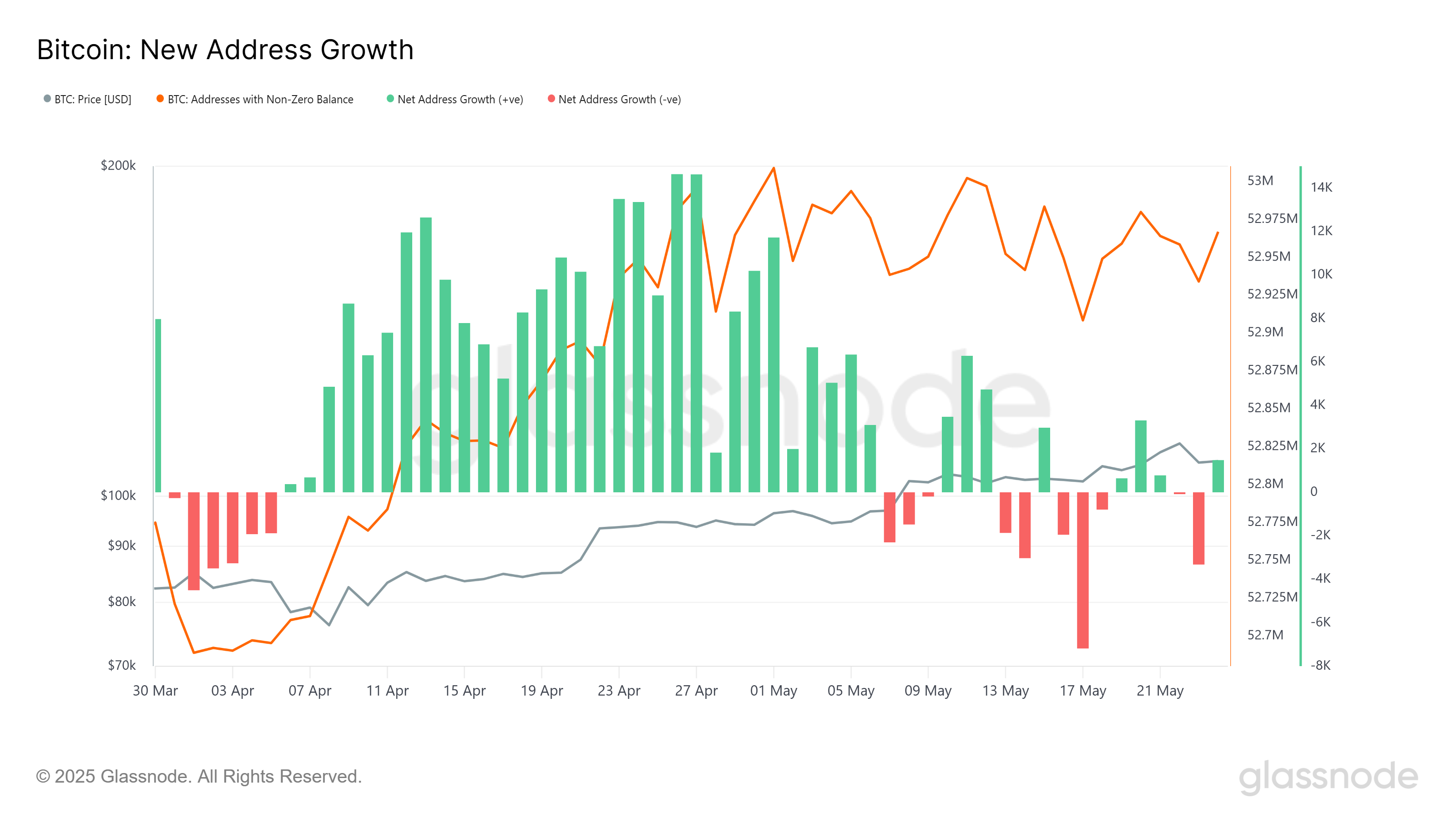

The growth of new Bitcoin addresses has been extremely volatile this month. The number of new addresses reached a new high at the beginning of the month, but now the red bar on the chart has dropped sharply.

The slower address growth suggests that fewer new investors enter the market and existing holders are choosing to leave. This could indicate a cleansing of your wallet. This is a move seen during periods of growing skepticism.

Compared to April, address growth was quite volatile this month. As Bitcoin prices rise, investors are becoming more cautious and focused on securing profits.

Volatility in the growth of the new address reflects the uncertainty surrounding Bitcoin’s future price action, and investors remain vigilant about the long-term sustainability of the rally.

BTC prices aren’t too far from ATH

Bitcoin now priced at $106,708, just under 5% from the $111,980 ATH achieved last week. However, the path to reach this level depends heavily on how investors respond to current market conditions.

If skepticism and sales continue, Bitcoin could face difficulties in regaining bullish momentum.

If prices continue to slide, Bitcoin could struggle to recover. Below the $106,265 support level could result in a further decline, potentially reducing the price to $105,000 or even $102,734 in the short term.

However, if Bitcoin can buy more than $106,265 and you’re looking at interest on new purchases, it could easily override your bearish outlook. A $110,000 resistance level violation will provide the required momentum to push $111,980, paving the way for a new ATH.

Disclaimer

In line with Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. Although Beincrypto is committed to accurate and unbiased reporting, market conditions are subject to change without notice. Always carry out your research and consult with an expert before making any financial decisions. Please note that our terms and conditions, privacy policy and disclaimer have been updated.