Tron Price is against gravity considering Justinsan has just returned from space. Most of the top 20 cryptocurrencies are bleeding weekly, but the TRX has increased by 3.3% over the past seven days, just over $0.33.

But the bigger issue now is that after it set its previous all-time high in December 2024, Tron’s prices can once again leave.

When BTC pair repeats breakout fractal, whales buy hype

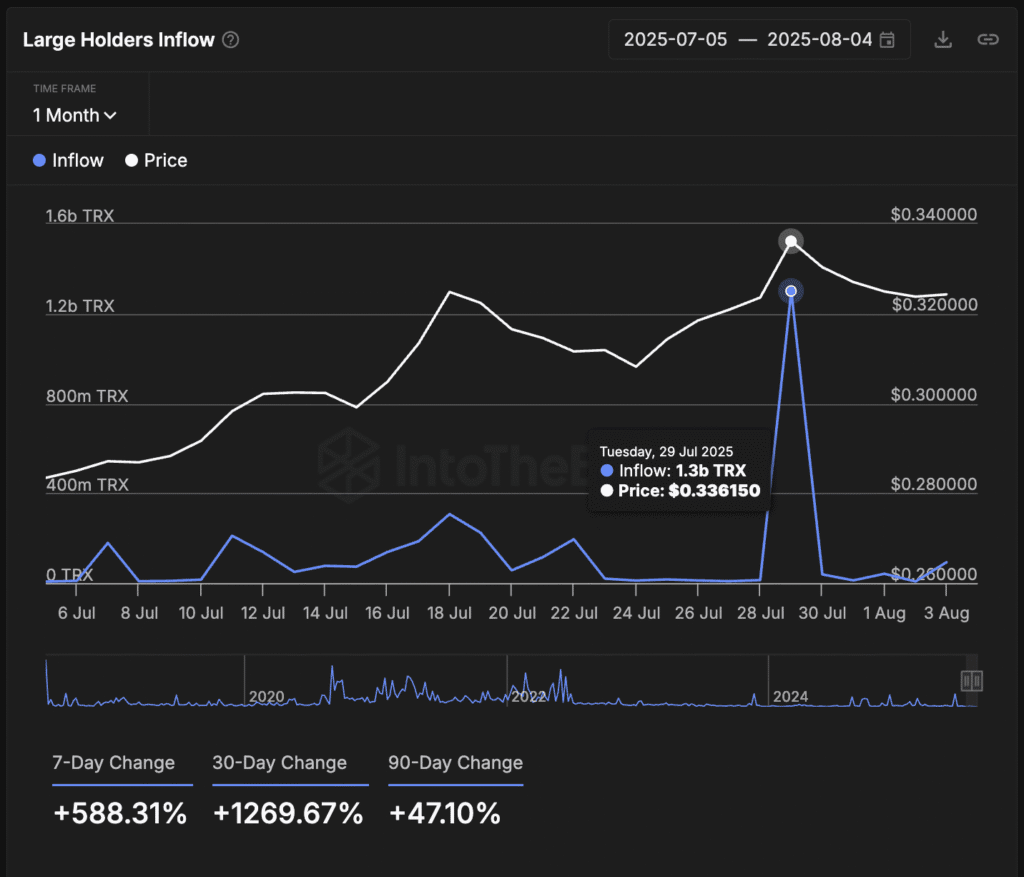

The Tron’s biggest wallet, the wallet holding at least 0.1% of the supply, has now come to full accumulation mode. On July 29th, these whales’ inflows into the wallet reached 1.3 billion TRX, jumping 588% each week.

In the viewpoint, this is even higher than the 10.3 billion TRX inflow spike recorded just before the TRX’s last ATH in December 2024. However, this time, surges are not macro conditions, but rather in line with the topic surrounding Justinsan’s blue-origin spaceflight.

Note: This metric shows how much TRX is being moved to the whale’s wallet. Unlike exchange inflows, this usually indicates accumulation rather than sales.

It appears that the market is buying stories. Tron’s BTC pair is caught in a triangle that is roughly the same as the pattern printed before last year’s breakout.

As TRX/BTC approaches 0.00000293 BTC, breakouts can cause spill overrriage to the TRX/USDT market.

The TRX/BTC chart compares Tron’s performance with Bitcoin. As trends increase, TRX means they are gaining strength even against market leaders.

About Token TA and Market Updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s daily crypto newsletter.

The momentum is slower, but traders are still betting for a long time

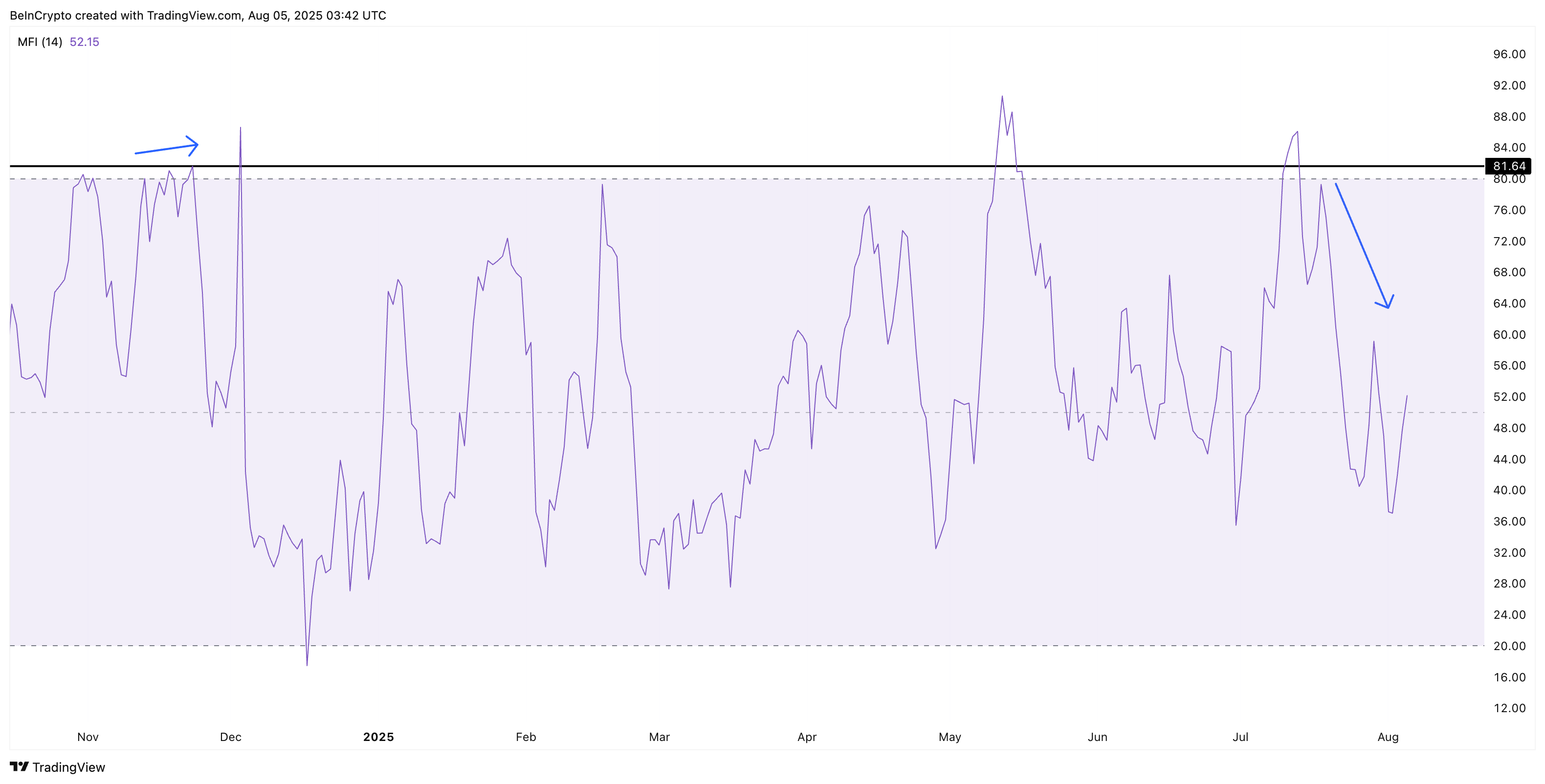

Despite whale optimism, momentum remains restrained. The Money Flow Index (MFI) now 52 years old is printing low highs. This is in stark contrast to the over 80 consecutive highs that facilitated Tron Price’s 2024 rally. This indicates that wider liquidity has yet to keep up while the larger wallet is preparing for the lift-off.

And that may be an important reason why Tron (TRX) prices may take a little while to reach an all-time high despite positive whale activity.

The Money Flow Index indicates whether money is flowing into the TRX and combines price and volume to discover purchase or sales pressure.

Still, Tron’s long/short ratio suggests that retailers are positioning for the rise. As of August 5th, the long/short ratio had risen to 1.36, with almost 58% of all open trades favoring long. This indicates an increase in speculative demand. If momentum catches up, it could amplify a bullish breakout. Longer biases can trigger higher MFI.

This ratio helps measure the sentiment of the market by comparing how many traders bet on price increases (longer) versus lower (short).

In short, traders are buckling early. Now they need fuel.

Tron Price requires a final push to pass this key level

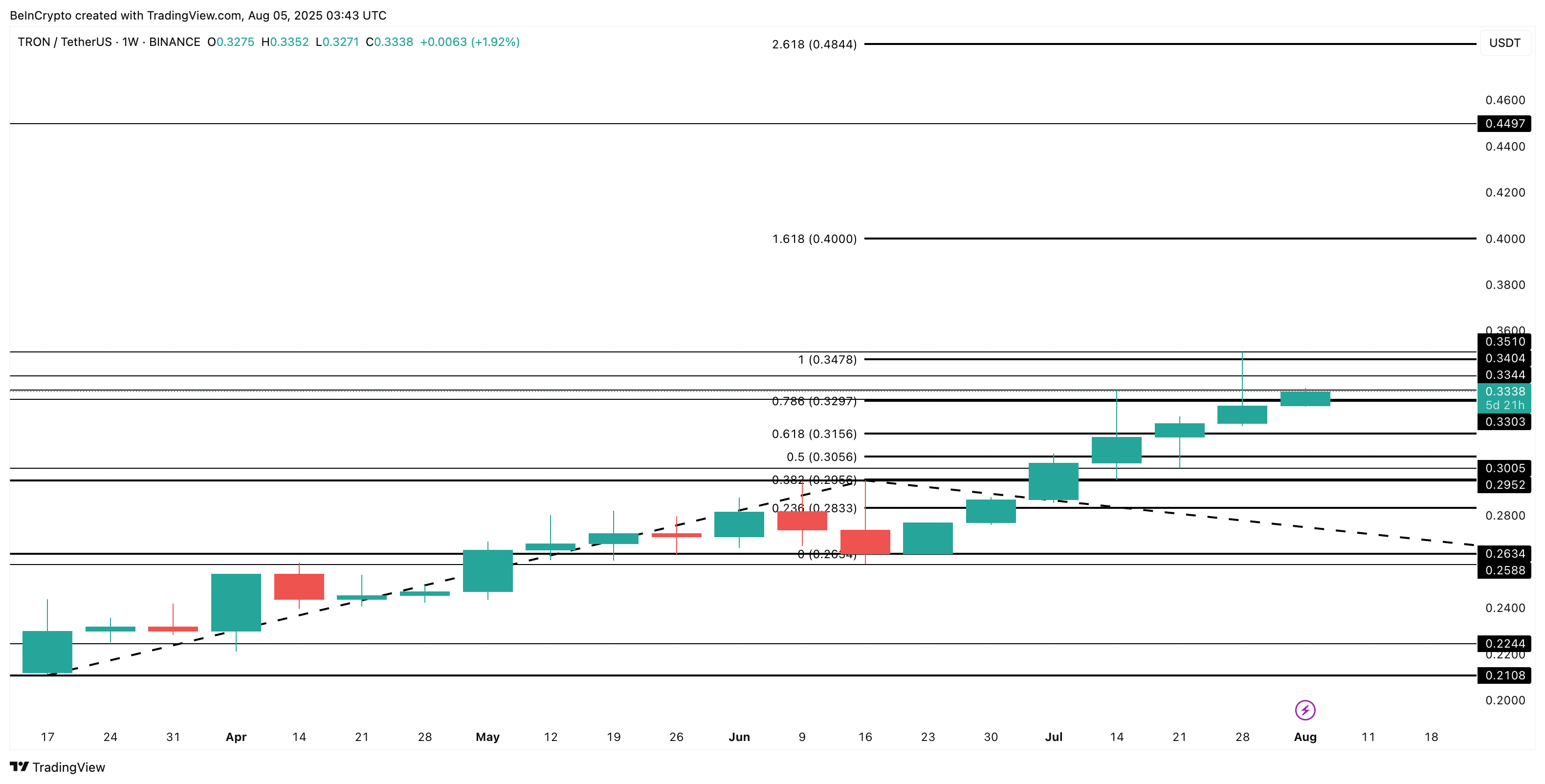

Tron Price Action on the weekly charts looks poised, but hasn’t been released yet. After beating past $0.31, the TRX is now integrating a consolidation of nearly $0.33, approaching its main support level of $0.32, which has turned to resistance.

Key breakout levels remain at $0.34. As the Bulls manage their weekly close above it, the path to $0.40 becomes clearer, with the full expansion target sitting at $0.48, marking the best newest of all time.

However, if Tron Price defeats the main support level for $.30, the bullish hypothesis is invalid. If your weekly calendar falls below $0.29, you can change the wider structure slightly weakly in the short term.

Will Tron reach its all-time high by the end of 2025? It first appeared in Beincrypto.