Aero has recently been spurred by Coinbase’s decision to add a distributed exchange (DEXES) to the basic blockchain to its major applications.

As the biggest DEX, Aerodrome is poised to make a big profit from this shift, sparking investor optimism.

Aerodrome is in the spotlight

Open interest in aero has increased significantly, up 112% over the past five days. It now reaches $47 million, driven by traders who have signed short contracts out of fear that prices could fall from $22 million. However, market sentiment is changing as funding rates return to positive territory.

With the positive funding rate, it is clear that many people are betting on aero recovery. This could further increase buying interest and strengthen the bullish prospects for the token.

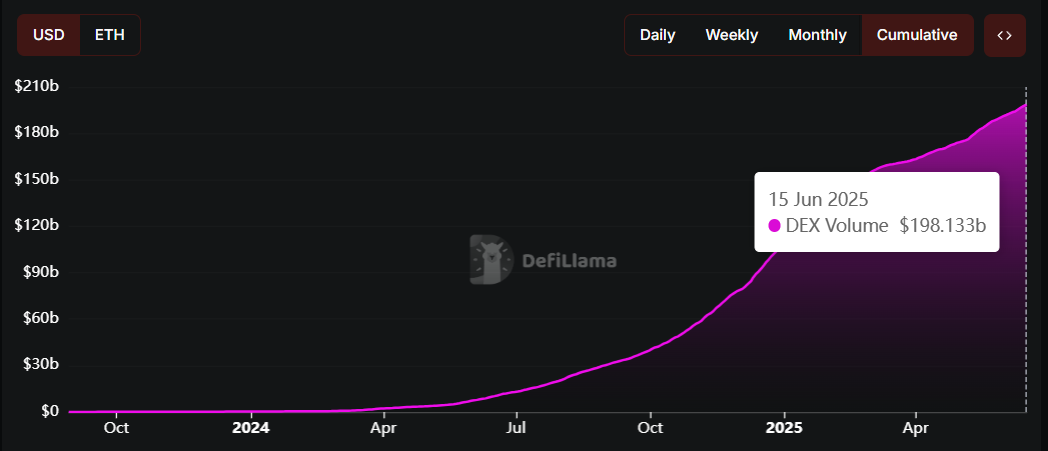

Aerodrome, a decentralized exchange platform, is gaining a significant amount of Dex volume, approaching the $200 billion mark. This is a notable achievement for the platform, highlighting its growing influence in the Decentralized Finance (DEFI) space. The recent addition of base blockchain to Coinbase’s main applications could further accelerate the growth of the platform and the volume of transactions.

As the largest DEX on the basis, Aerodrome stands to benefit a lot from this addition, attracting more users and liquidity. This increased activity is expected to increase the volume of DEX, creating a positive feedback loop that can further support Aero’s price.

Aero Price prepares you to reach your next goal

Despite a volatile market with limited profits for many altcoins in the second quarter, Aero has risen 72% since the start of April, improving its performance. Currently trading at $0.75, Aero shows resilience and positive momentum.

Aero’s next important target is $1.00, representing a 32% increase from its current price. Coinbase’s announcement to integrate the base blockchain into the platform is a major catalyst for this price transfer. To achieve this goal, Aero will need to secure a level of $0.85 in support.

However, if Aero doesn’t break past $0.85 or make a profit from investors, there could be a decline. A drop through a support level of $0.74 will cause the price to fall to $0.61, invalidating bullish papers, signaling a reversal of potential trends.

Disclaimer

In line with Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. Although Beincrypto is committed to accurate and unbiased reporting, market conditions are subject to change without notice. Always carry out your research and consult with an expert before making any financial decisions. Please note that our terms and conditions, privacy policy and disclaimer have been updated.