Stellar’s XLM has skyrocketed over 90% in the past month, making it one of the outstanding Altcoin performers in recent weeks.

Bitcoin (BTC) and other top assets are cooled down with modest pullbacks and price integration, but XLM is flashing fresh bull signals that could pave the way for another explosive gathering.

XLM forms bullish pennants as traders make big bets on breakout rally

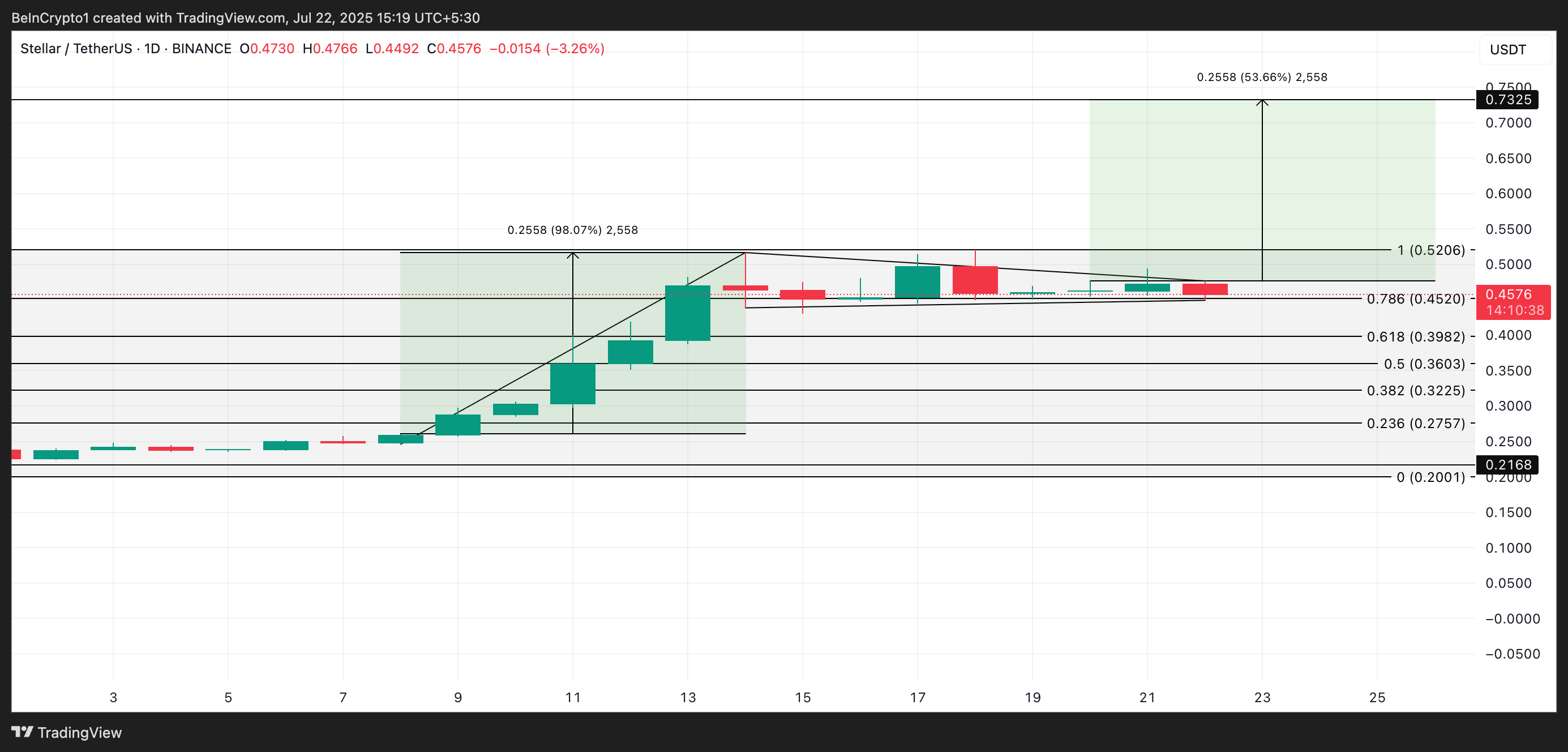

On the charts of the day, XLM formed a bullish pennant. This pattern appears when a strong upward price transfer (flag pole) is followed by a period of integration similar to a small symmetrical triangle (pennant).

This pattern usually suggests that buyers are temporarily suspended before continuing the uptrend. Traders look for breakouts above the top trend line of the pennant as a signal to enter a long position.

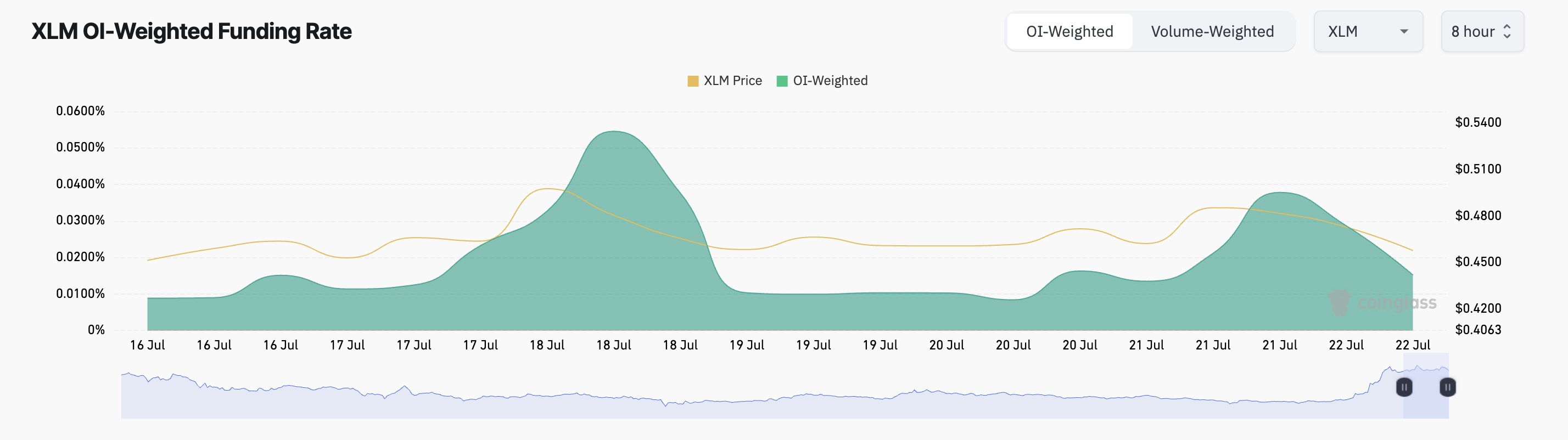

On-chain data confirms the possibility of XLM’s upward breakout on top of this pennant in the short term. For example, token funding rates remain positive, indicating demand for long positions. For each Coinglass, this is 0.0152% at press.

Funding rates are regular charges exchanged between long and short traders in a permanent futures market. The contract price is on par with the spot price. The positive funding rate means that traders are paying premiums to hold their long positions, indicating bull market sentiment.

For XLM, a positive funding rate indicates that the futures trader is leaning heavily towards its strengths. This has strengthened the bullish pennant setup and demonstrates confidence in the ongoing price increase.

XLM’s bullish pennants point to massive movements

These metrics indicate that XLM may be preparing for fresh profits. As demand grows and XLM successfully moves away from the bullish pennant pattern, traders can expect a strong upward move.

Usually, once an asset breaks out of this pattern, its price is expected to grow due to the surge in initial prices or the length of the “flag pole” that precedes the pennant class. This means that the price of XLM could potentially rise to $0.73.

However, if market sentiment shifts from bullish to bearish, the value of XLM falls below the pennant and drops to $0.39, negating the bullish outlook mentioned above.

Disclaimer

In line with Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. Although Beincrypto is committed to accurate and unbiased reporting, market conditions are subject to change without notice. Always carry out your research and consult with an expert before making any financial decisions. Please note that our terms and conditions, privacy policy and disclaimer have been updated.