XRP faces mixed setups as a positive news struggle to raise prices. Despite announcements such as the upcoming release of the XRPL EVM mainnet and the integration of USDC, XRP has dropped by 6.5% over the past three days.

Technical indicators such as RSI and DMI show early signs of momentum changing, while EMA signals remain bearish. Monday marks the final opportunity for Ripple and the SEC to resolve the lawsuit. If it fails, Legal Battle will expand in 2026, putting even more pressure on XRP’s short-term outlook.

XRP acquires utility, but prices ahead of legal deadlines

Despite the waves of positive development around Ripple, XRP prices have not followed suit. It reached 6.5% in the past three days. This is a key step in bringing Ethereum-compatible smart contracts to the XRP ledger, despite Ripple executives confirming that XRPL EVM Sidechain will be launched on MainNet in the second quarter of 2025. Recently, more companies have also begun building XRP reserves.

In parallel, Circle announced the launch of USDC’s natives in XRPL, showing deeper institutional support and greater utility across Defi, Payments and global settlements.

But the market is cautious as all eyes change on Monday and Ripple and the SEC turn into the final window to settle long-term lawsuits.

After a failed attempt in May, Ripple and the SEC filed an amended claim to reverse the ruling of key securities, but legal experts remain skeptical.

Critics argue that the new submission is free of substance and do not provide a compelling argument to change Judge Torres’ original decision. If the motion is rejected again, Ripple could face a ban on extending sales of retail securities, and the legal battle could be dragged into 2026.

Despite regulatory tailwinds and expanding infrastructure support, XRP appears to be trapped between bullish headlines and bearish price action.

XRP momentum shift: potential inversion of RSI and DMI signals

XRP’s relative strength index (RSI) rose significantly from 28.24 just two days ago. RSI is a momentum indicator that measures the speed and magnitude of recent price changes, typically on a scale of 0 to 100.

Measurements below 30 indicate that an asset may be oversold, while measurements above 70 suggest that it may be oversold.

The recent move from XRP’s territory to the mid-40s indicates a potential change in momentum, suggesting early signs of buyer interest returning, but has not yet crossed bullish territory.

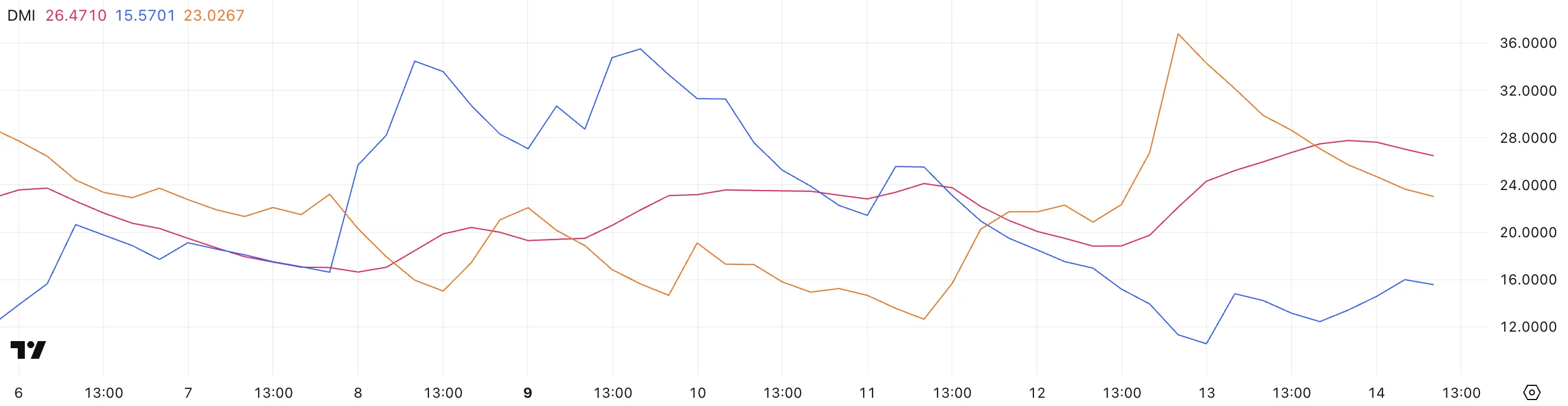

The average directional index (ADX) in XRP measures the intensity of the trend regardless of direction, but rises from 18.84 to 26.47, typically exceeding the key 25 threshold, which marks the beginning of a strong trend.

Meanwhile, +DI (positive directional index) rose from 10.56 to 15.57, and -DI (negative directional index) fell sharply from 36.77 to 23.

As this dynamic continues and ADX continues to climb, XRP may be set up to reversal the trend.

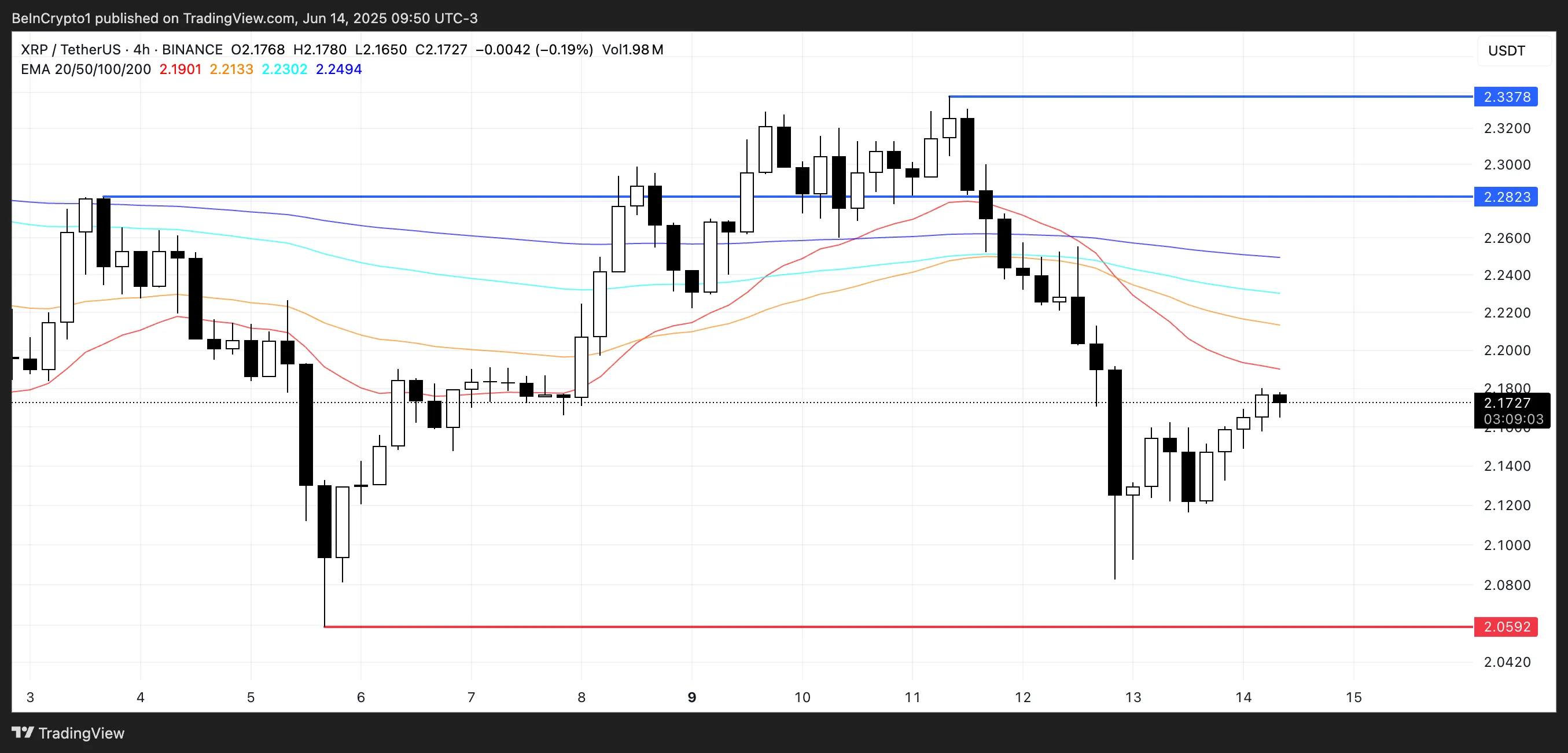

The EMA signal is still bearish, but XRP’s eyes break above $2.28

XRP’s exponential moving average (EMA) is still a bearish composition, with short-term lines sitting under long-term lines.

However, recent price behavior suggests that emotions may be changing. If XRP is able to push key resistance for $2.28 based on its recovery, it will be possible to open the door to move for $2.33 towards your next goal.

This potential breakout marks a major technical improvement and new bullish strength with signal.

However, you still need to be careful when setting up. If XRP fails to maintain its current upward push and faces rejection during resistance, the fix allows it to return to the support zone with a price of $2.05.

Disclaimer

In line with Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. Although Beincrypto is committed to accurate and unbiased reporting, market conditions are subject to change without notice. Always carry out your research and consult with an expert before making any financial decisions. Please note that our terms and conditions, privacy policy and disclaimer have been updated.