The SEC project Crypto, announced yesterday, has already caused a ripple on the market. The initiative promises to introduce US capital markets in chains as well. This is effective through regulated blockchain-based transactions, management, and tokenized securities.

The broad market has declined 7.2% a day since its announcement, but crypto whales have quietly stacked their tokens. Altcoins can become an essential infrastructure for this new era of fiscal age. What data reveals about the top three crypto whale picks, links, CPOOL and UNIs attract serious attention.

ClearPool (CPOOL)

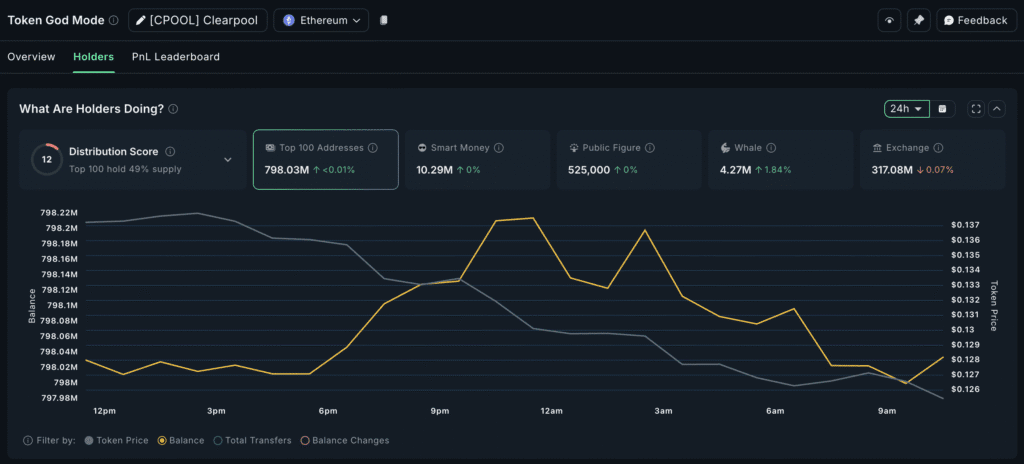

ClearPool, a Defi Credit Marketplace focused on Tokenized Real World Asset Lending, saw crypto whale holdings increase by 1.84% in 24 hours. This happened even as CPOOL prices fell nearly 8.7% a day.

The chart shows a flat exchange balance of 317 million tokens. This does not indicate significant selling pressure from the centralized platform. The top 100 addresses hold 49% of the supply, showing a moderately distributed distribution.

About Token TA and Market Updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s daily crypto newsletter.

This purchase can be linked to Project Crypto’s explicit inclusion of on-chain credit markets and tokenized securities. If the new SEC rules clarify tokenized bond offerings and credit pools, CPOOL can sit at the heart of a compliant on-chain lending infrastructure.

Crypto whales buying tokens while the price is correct don’t look like just a coincidence. For retailers, the combination of increased whale accumulation and low exchange inflows suggests that large players are positioning early ahead of potential regulatory green lights.

uniswap (uni)

The largest decentralized exchange, Uniswap is another natural beneficiary of Project Crypto’s vision of a regulated on-chain trading venue. Over the past seven days, Crypto Whale Holdings rose 7.26% despite a 6.7% drop in the same period.

Uniswap’s Cryptographic Whale Holdings reached 6.09 million UNIs after accumulation. This stack is currently worth around $56.76 million based on UNI’s current price. Although Project Crypto was announced just a day ago, the weekly Uni accumulation suggests early positioning.

The chart shows that the exchange balance has dropped by 0.14%, indicating that more UNIs are leaving exchanges with independence, a sign of a long-term conviction.

A distribution score of 15 indicates that the holdings are still concentrated but are improving, suggesting wider ownership over time. As US securities transactions move in chains, Uniswap’s infrastructure could become a central market for tokenized stocks and bonds, and despite DIP, the whale’s position is no surprise.

For retailers, a decline in whale stacking and exchange supply could indicate a potential bounce as broader market sentiment recovers.

ChainLink

ChainLink’s role in providing reliable price supplies and payment data makes it essential for a regulated, blockchain-based securities ecosystem. Over the past 30 days, whales have accumulated 13.54% links, but token prices fell nearly 7.7% each week, providing an entrance to long-term bets.

The 13.54% increase in Chain Link Whale Holdings corresponds to an increase in around 462,702 linked tokens worth around $7.69 million.

The chart reveals that exchange balances have fallen by 1.84%. This means there are fewer tokens available for immediate sales. Furthermore, the distribution score of 13 reflects improved token variance among top holders.

Project Crypto’s success requires an Oracle at an accurate, auditable price. This is the space ChainLink already controls. This element makes the link one of the most strategically placed altcoins.

Post 3 Altcoins Crypto Whale buys the “Project Crypto” announcement after it first appeared on Beincrypto.