Amidst the ongoing geopolitical tension, three US economic indicators could affect crypto traders and investors’ portfolios. The future impact is even more concerning given the volatility seen at Bitcoin (BTC) prices over the weekend.

Traders looking to capitalize on anticipated volatility can update the following US economic events this week:

This week, US economic indicators to promote Bitcoin volatility

The US economic surprise index was the most negative this year, according to Lisa Abramowitz, co-host of Bloomberg Surveillance. More closely, the number of economic indicators is increasing is weaker than initially expected analysts.

Against this backdrop, amid ongoing geopolitical tensions this week, the following US economic indicators could drive Bitcoin volatility.

Powell’s testimony

Federal Reserve Chairman Jerome Powell will testify before the House Financial Services Committee on Tuesday, June 24th. Testimony is part of his six-month obligation to present the federal monetary policy report to Congress.

Powell will address US economy, monetary policy, inflation, employment and other economic factors before the House Financial Services Committee and the Senate Banking Committee.

Beyond the prepared statements, there will be a question-and-answer session with lawmakers. This could impact financial markets due to insights into future Fed policies.

This US economic indicator is particularly important given the US’s role in the ongoing geopolitical tensions in the Middle East.

Comments on rate policies in response to energy shocks are important after Iran attempted to close the Strait of Hormuz, effectively threatening about 25% of global oil flow and spurring energy risks.

Powell’s speech comes after the Fed decided not to change interest rates despite political pressure from President Donald Trump.

Hawkish’s speech showing concerns about higher interest rates or inflation could potentially curb Bitcoin, similar to what happened in April 2025 amid Trump’s tariff struggles.

However, the incredible tone suggests rate cuts, which could boost Bitcoin and, after the recent decline, could bolster positions above $100,000.

Neutral statements, such as what happened in February, could stabilize Bitcoin, but volatility could probably last.

“Chairman Powell testifies – the housing price and PCE inflation index market will begin to move new escalations away from the Middle East.

First unemployed claim

Beyond Powell’s speech, Crypto Markets also sees the initial unemployed claims as the US labor market gradually becomes a formidable macro factor for Bitcoin. In the week that ended June 14th, the number of U.S. citizens first filed unemployment insurance reached 245,000.

This exceeded expectations and increased the number of bills that reflected the highest measurements since last October. However, amid ongoing economic uncertainty, economists have predicted more unemployed claims, with a median forecast of 248,000.

The rise in claims could indicate economic softening, and could increase Bitcoin as traders predict Fed rate cuts, particularly amidst the Middle East geopolitical tensions that promote risk-off sentiment. On the other hand, lower bills could bolster the dollar and put pressure on crypto prices.

pce

This week’s list of US economic indicators with cryptographic impacts is PCE, personal consumption expenditure. This macroeconomic data point measures the average price change for the goods and services consumed by US households.

US PCE is the inflation gauge that the Fed prefers due to its wide range and ability to explain consumer alternatives.

PCE in April rose 2.1% year-on-year, with core PCE at 2.5%. According to MarketWatch data, economists predict that May PCE will rise to 2.3%, while Core PCE, which excludes food and energy, is projected to reach 2.6%.

More than expected PCE could inform sustained inflation and bolster the dollar and strain the price of Bitcoin, particularly amidst tensions in the Middle East. A drop in PCE could boost Bitcoin by increasing hopes of rate reduction.

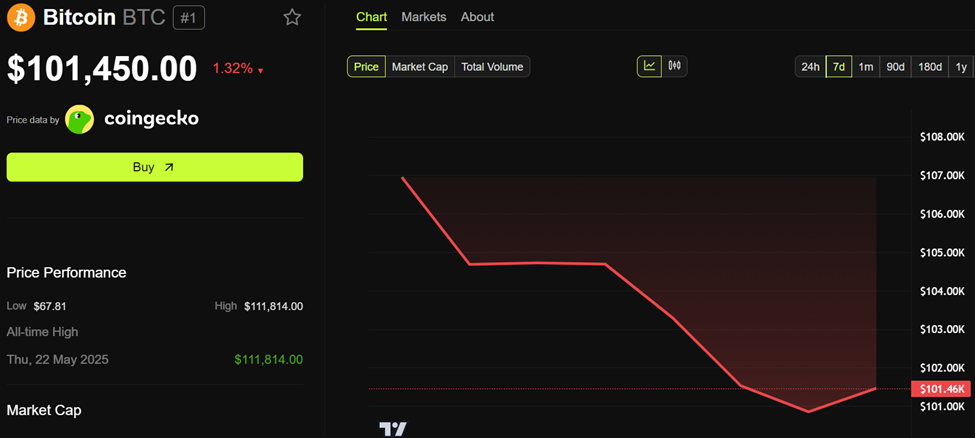

According to Beincrypto data, BTC was trading at $101,450, a 1.32% decline in the last 24 hours.

Disclaimer

In compliance with Trust Project guidelines, Beincrypto is committed to reporting without bias and transparent. This news article is intended to provide accurate and timely information. However, we recommend that readers independently verify the facts and consult with experts before making decisions based on this content. Please note that our terms and conditions, privacy policy and disclaimer have been updated.