Vaneck’s proposed Spot Solana ETF (Exchange-Traded Fund) is officially registered with Dository Trust & Clearing Corporation (DTCC) under Ticker VSOL. This illustrates a major step towards potential regulatory approval.

The List Signal will increase the momentum behind Solana’s institutional adoption and bring it closer to trading on US exchanges.

VSOLETF in vaneck approaches approval after DTCC list

The DTCC list confirms that the fund is entitled to approve future electronic transactions and pending approvals from the US SEC (Securities and Exchange Commission) based on the “Active and Pre-Pre-Learnization” category.

It is essential to note that you cannot create or redeem VSOLs for Vaneck yet. However, while the company considers the list to be an important part of the launch process, it does not guarantee approval.

Bloomberg ETF analysts James Seifert and Eric Balknath estimate that the SEC will be able to approve the fund immediately. However, this prediction is subject to smooth filing.

“The SEC is engaged to S-1 to S-1. It’s a *very positive sign. Still, the timeline of approval is not IMO,” Seyffart said in a post.

In fact, this registration comes shortly after the SEC directs the issuer to submit an amended S-1 filing for the Solana ETF. Analysts say this means continuing involvement between regulators and fund managers.

Several companies, including Bitwise, Coinshares and Franklin Templeton, raced to offer Solana-based ETFs. However, the SEC delayed its decision on Franklin Templeton’s Solana ETF.

Vaneck has previously introduced Bitcoin and Ethereum futures ETFs and several global digital asset funds. It aims to provide regulated exposure to next-generation blockchain networks like Solana.

SEC engagement and increased reliability for poly-general odds signal SolanaETF

The SEC has already approved the SpotETF for Bitcoin and Ethereum, but Solana is waiting. But optimism is growing.

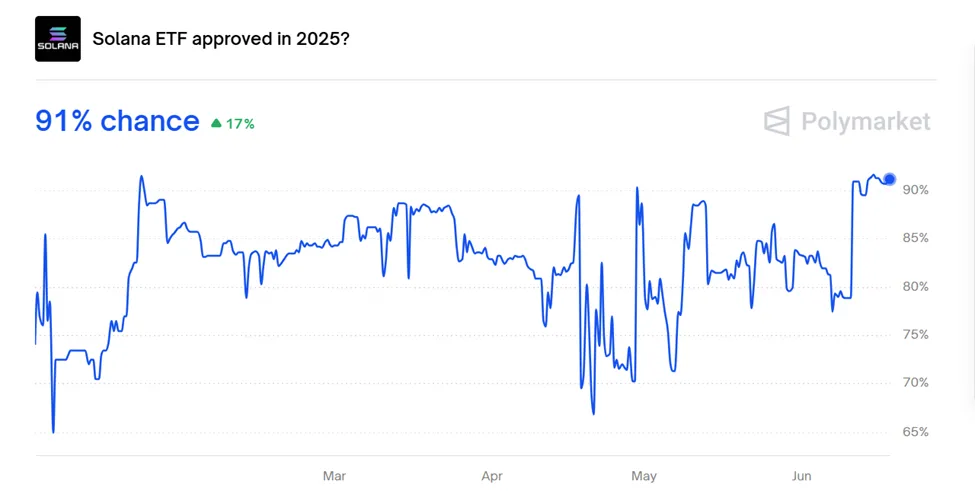

On the decentralized forecasting platform Polymarket, traders assign a 91% chance that the Solana Spot ETF will be approved in 2025.

The perception of VSOLs in DTCC follows a trend toward expanding institutional preparation. Earlier this year, the organization also listed futures-based Solana ETF, Solz and Solt, but they remained redemption-only status.

Beyond ETFs, DTCC shows a deeper interest in blockchain infrastructure, including plans to launch Stablecoin and tokenized collateral platforms.

With Solana’s high transaction throughput, an active developer ecosystem, and growth in NFT and NFT use cases, it is positioned as a reliable candidate for mainstream financial products.

The SEC willingness to attract Spot Solana ETFS and the approval of Solana’s futures in the CME suggests that the network could soon become the third cryptography to gain full ETF status in the US.

Vaneck has not set an official VSOL trading date, but being featured on the DTCC list is a major milestone. If approved, VSOL could potentially catalyze further ETF innovations, including potentially staking-enabled products or multi-asset crypto baskets.

The move could also drive a surge in Solana prices. However, despite the DTCC listing, Sol was trading at $148.72 at the time of this writing, down almost 3% over the past 24 hours.

Disclaimer

In compliance with Trust Project guidelines, Beincrypto is committed to reporting without bias and transparent. This news article is intended to provide accurate and timely information. However, we recommend that readers independently verify the facts and consult with experts before making decisions based on this content. Please note that our terms and conditions, privacy policy and disclaimer have been updated.