Interest in XRP is chilled, with key on-chain metrics showing potential short-term weaknesses.

By waning bullish sentiment across the broader market, these factors suggest that XRP prices are likely to deepen in the upcoming trading session.

XRP Trader Tap Out: Fear of $222 million exit signal

A decline in the estimated leverage ratio (ELR) of XRP for major exchanges confirms a decrease in investor confidence and a decrease in risk appetite. According to Cryptoquant, the ELR is currently at 0.36.

The ELR of an asset is used by the average leverage used by traders to perform transactions in cryptocurrency exchanges. It is calculated by dividing the public interest on an asset by the exchange reserves for that currency.

The reduced ELR of XRP indicates a decrease in risk appetite among traders. Investors are cautious about the short-term outlook for tokens, suggesting they are avoiding high-leverage positions that can amplify potential losses.

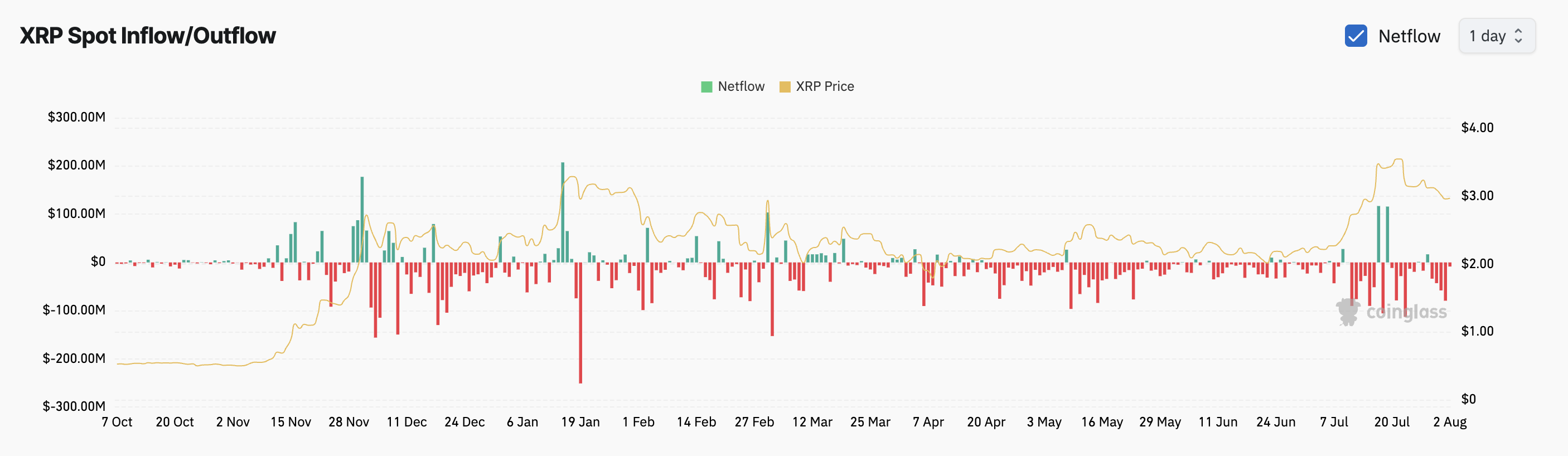

This trend does not differ among participants in the spot market. According to Coinglass data, XRP has recorded negative Netflows of over $222 million since July 29th, indicating a sustained sell-side advantage and weak buyer pressure.

When assets record negative spots Netflows, traders are profiting by selling their holdings, but fewer buyers are stepping in to replace them.

This trend could exacerbate the current downward trend in XRP as assets are declining.

The XRP Bears are approaching $2.71, but still have a breakout of $3.39

Once sell-side pressure is achieved, the XRP plunges to $2.71. If this support floor is not retained, Altcoin could witness a steep slope dropping to $2.50.

Meanwhile, if you’re bolstered by buying momentum, breakouts beyond the $3 price level are still possible. A successful move to pass this threshold could pave the way for a rally to $3.39.

Disclaimer

In line with Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. Although Beincrypto is committed to accurate and unbiased reporting, market conditions are subject to change without notice. Always carry out your research and consult with an expert before making any financial decisions. Please note that our terms and conditions, privacy policy and disclaimer have been updated.