The mantle (MNT) made a strong impression by reaching the highest level in five months. This surge came alongside an astounding 450% increase in trading volume.

So, what triggered this Layer 2 Altcoin breakout in August? Below are some of the key drivers behind the recent price rally.

What’s behind the mantle’s explosive comeback?

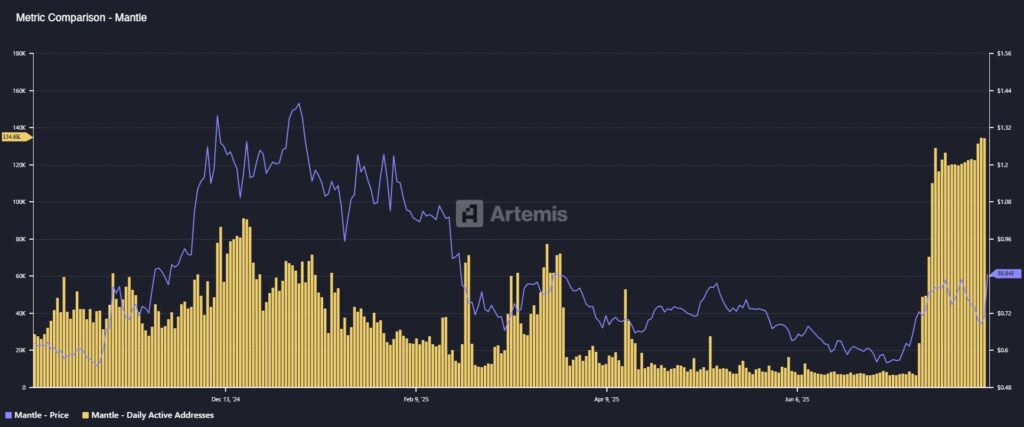

According to Artemis Analytics data, the number of daily active addresses skyrocketed by 1,600% in just one month. This jumps from 7,000 to 120,000.

This surge clearly indicates that user participation in the mantle network is returning. It reflects increased trust and increased use from the community.

Data shows that the mantle began to gain traction in mid-July and maintained its momentum in August. At the same time, Mantle officially joined Strategic Eth Reserve (Sold) by allocating 101,867 ETH (equivalent to $392 million) to the Treasury.

This ETH assignment means Mantle is currently one of the largest ETH holders of Web3 entities, ranking 8th on the SZξR leaderboard. Meanwhile, ETH prices have skyrocketed from $3,000 to $4,000 since mid-July. This strategic preparation allowed MNT to maintain a correlation with ETH and increase its prices.

“The whales are buying dips for this beast for reasons. The mantle has participated in the Strategic ETH Reserve (S);

Institutional exposures increase mantle reliability

Another important element of this strategy is the METH protocol. It is a staking platform built on a mantle network and is designed to maximize ETH yield through staking and reconstruction mechanisms.

“The mantle holds one of the Treasury Departments, where the largest ETH in the chain is de-inducing, exceeding $320 million across Meta, Cmeth and ETH,” said Meth Protocol.

Some public companies, such as Republic Technology, converted a significant portion of their accumulated ETH into stimulants in the second quarter of 2025. This move has helped the mantle network increase reliability among investors.

Additionally, the launch of UR has added more utilities to MNT.

UR is a smart cryptographic application that combines traditional finance (TRADFI) and distributed finance (DEFI). Built on a mantle network, the platform aims to bring blockchain technology to mainstream banking services.

“MNT is starting to move again. It has gained a lot of momentum and shows no signs of a halt. I think the price increase is linked to the UR that was recently launched.”

These developments demonstrate the mantle’s clear efforts to open more doors for institutional capital inflows.

Top 10 MNT Wallets Holds Over 89% of Total Supply

Beincrypto data shows that MNT hit $0.88 (the highest level since March). The 24-hour trading volume exceeds $500 million, more than twice the average volume last month.

However, CoinMarketCap data reveals that the top 10 MNT wallets control 89% of total supply. Mantle’s Ministry of Finance owns more than 49% of the supply. These tokens are used to fund development, staking and strategic investments.

MNT has skyrocketed over 30% since early August, but has been well below the all-time high of $1.50 since 2024.

Postmantle will be his first hit in five months. This is why investors flock to MNT, which first appeared in Beincrypto.