Ethereum, which has been revised by more than 2% in the last 24 hours, fell below $4,500 for a short time, before rebounding to trade above $4,600. This decline came amid a slide in the broader crypto market that erased more than $240 billion in value and caused nearly $1 billion in liquidation.

However, despite high sales pressure, Ethereum’s on-chain and technical signals suggest that the bull still holds the advantage.

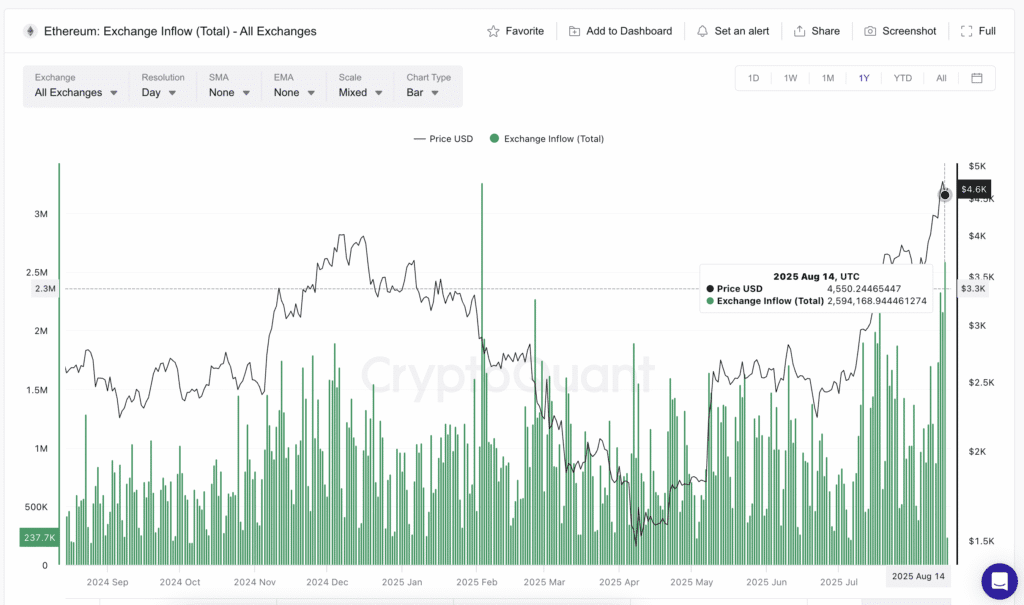

The second highest exchange inflow signal of the year to sell pressure

Ethereum moved to the exchange on August 14th, marking the second highest daily exchange inflow of 2025, tracking only the 3,264,688 ETH spike on February 3rd.

Exchange inflows usually show potential selling pressure, and this surge has been driven in part by Ethereum Foundation Wallets, one of the biggest sellers in recent years.

Historically, as seen in the first part of 2025, the top historically high inflow areas has led to price revisions. At the time, Ethereum prices were on a downward trend, with each exchange top being influxed.

Things were different as seen on July 18th (2,381,361 ETH) and August 12th (2,335,642 ETH). Unlike the downtrend-driven spikes in February, these recent influxes have occurred on an upward trend. This is the context in which sales pressure is offset by strong shopping forces. This purchase absorption is currently an important factor in keeping Ethereum’s bullish structure intact.

About Token TA and Market Updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s daily crypto newsletter.

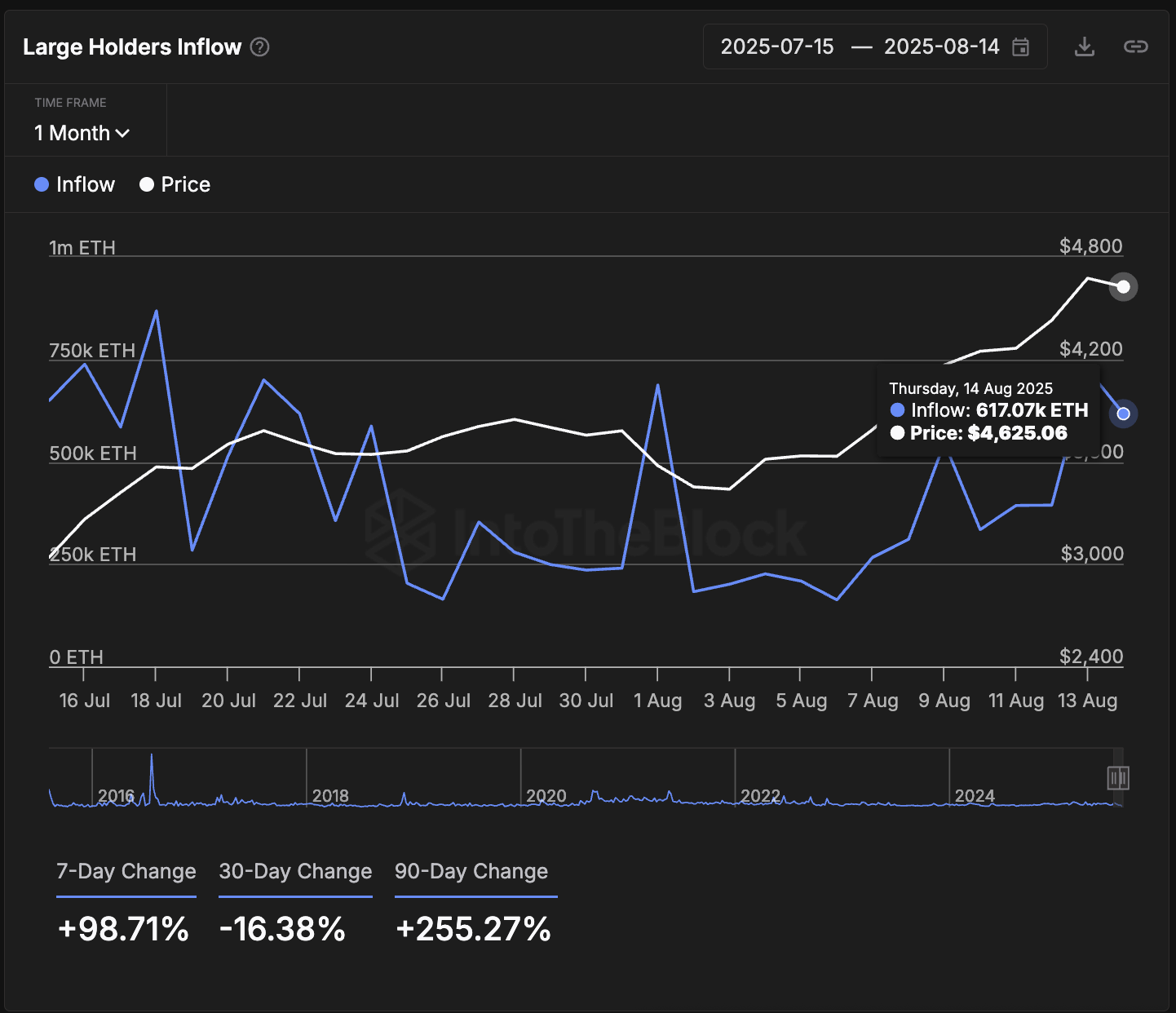

Large-scale holder inflows indicate purchasing power absorption supply

Its absorbent narrative, supporting a massive influx of holders — dealing with holding at least 0.1% of the total ETH supply — remains strong. Despite a small DIP on August 13th, the seven-day change was +98.71%, while the 90-day change was surged by +255.27%. These wallets are known to accumulate actively during dips.

For example, between July 31 and August 1, if ETH prices fell from $3,781 to $3,577, the massive influx of holders jumped from 240,190 ETH to 687,290 ETH.

Even after a short pullback, these influxes continue to generate high prices on monthly charts. This figure reached 725,000 ETH on August 13th, stabilizing over 617,000 ETH. This is a sign that deep pocket buyers are still building their workplaces.

Exchange inflows track coins moving into exchanges, and often inform potential sales. Meanwhile, large holder inflows measure the amount accumulated by wallets that hold at least 0.1% of the supply. This is a measure of purchasing pressure from major players.

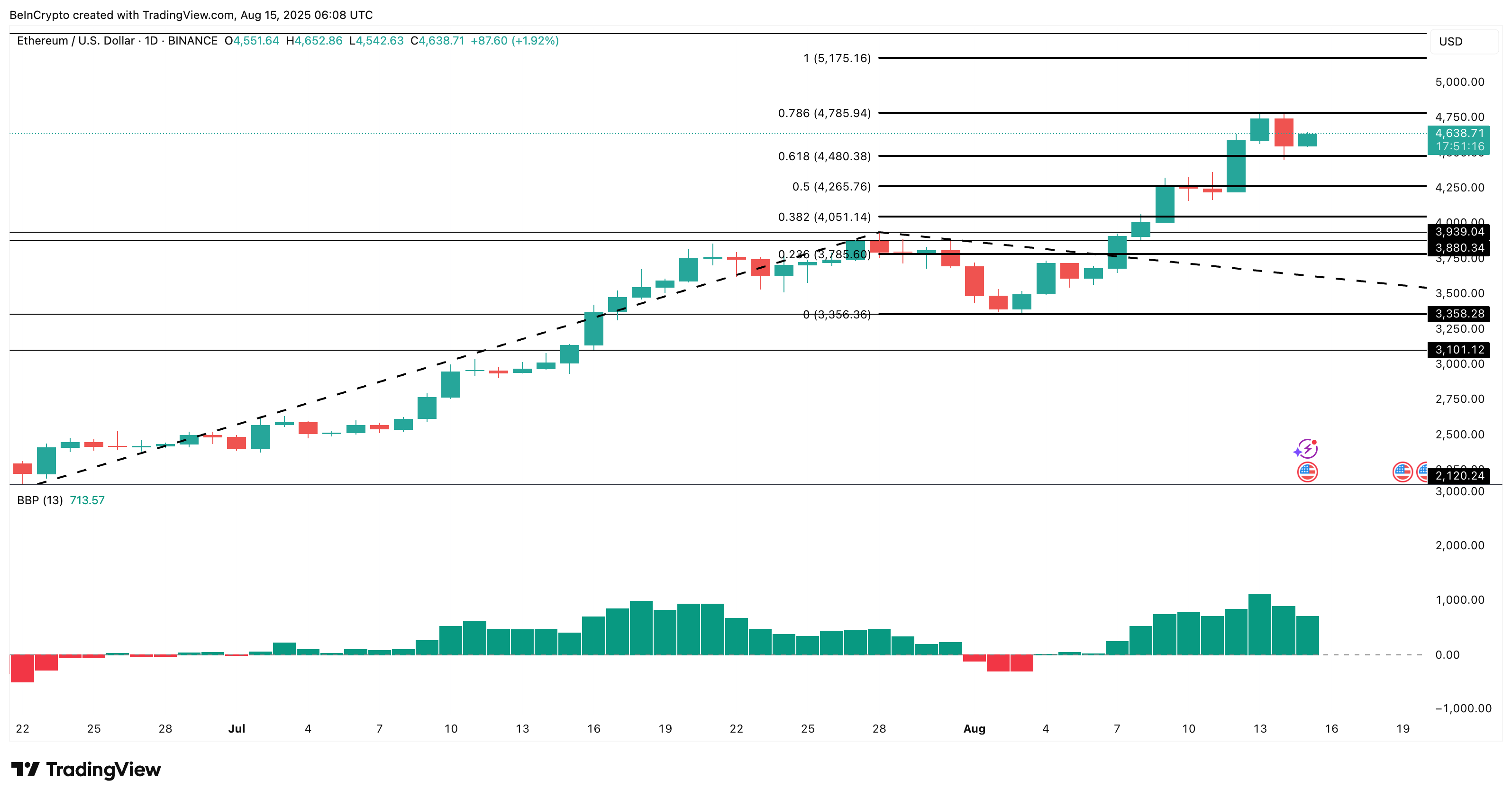

Ethereum’s price structure is retained as the Bulls maintain control

Technically, Ethereum prices are on the rise, with the $4,480 zone serving as strong support during the latest dip. Immediate resistance is $4,785, with Fibonacci expansion levels important. A daily closing that surpasses this could run towards a psychological $5,000 level of $5,175, to be precise.

The Bullbear Power Indicator continues to support buyers, indicating that the bear is out of control despite the heavy exchange inflow.

Annulling the bullish hypothesis requires a decisive (full candle) break below $4,480. This should be combined with a sustained increase in ETH exchange inflow and DIP with a large 30-day holder inflow. Conditions that have not yet been met.

Post Ethereum faces the second highest annual cell wave – $5,000 still playing? It first appeared in Beincrypto.