The XRP price was $3.03, down 0.7% over the last 24 hours. Altcoin has been trapped in lateral ranges for several weeks, slipping 2.6% over the past seven days. The one-month return remains slightly negative at 1.4%, but the wider three-month image still shows a profit of nearly 30%.

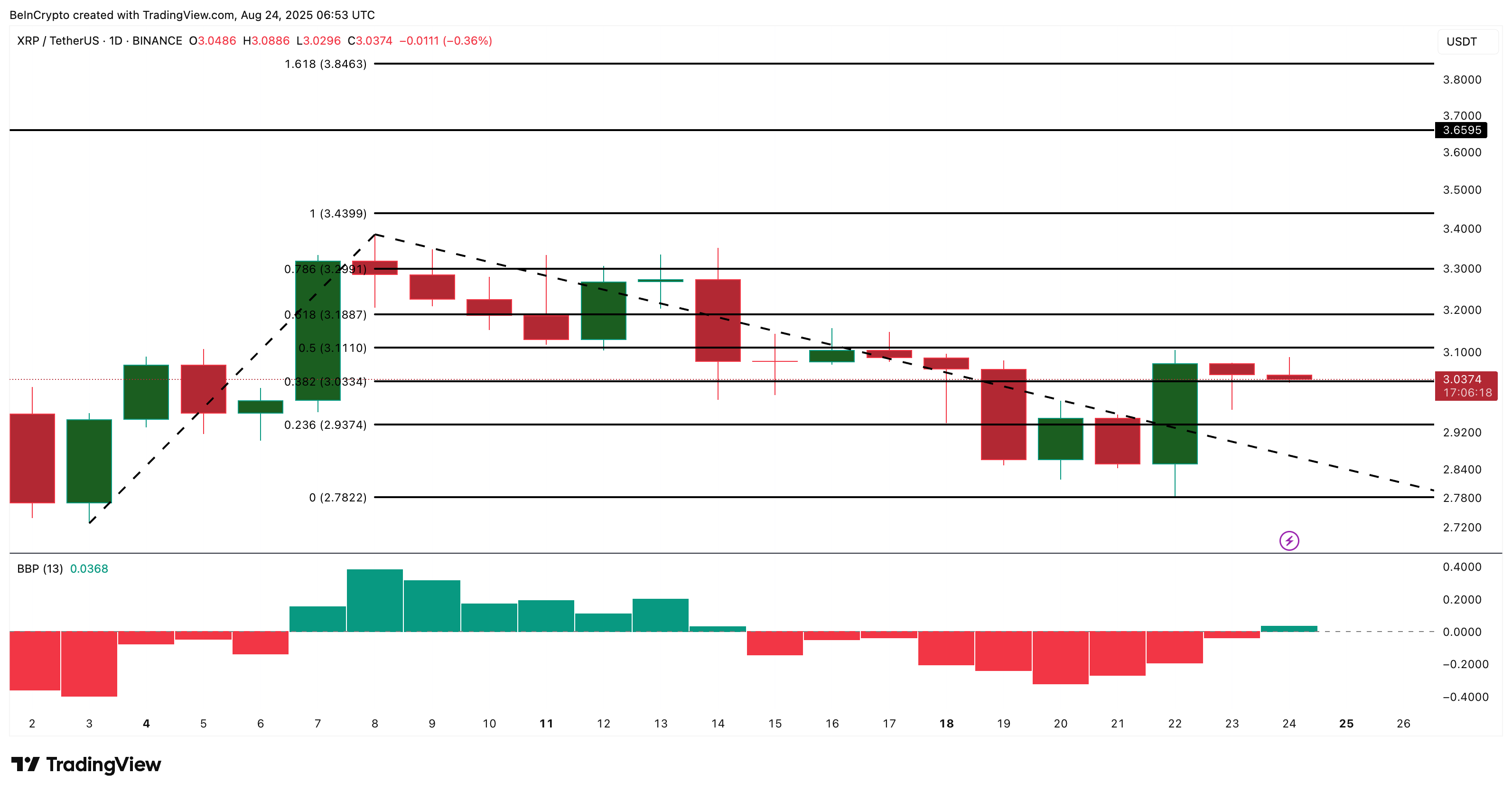

The chart suggests that the rally is stagnant for now, and that the higher the next leg depends on a single key barrier.

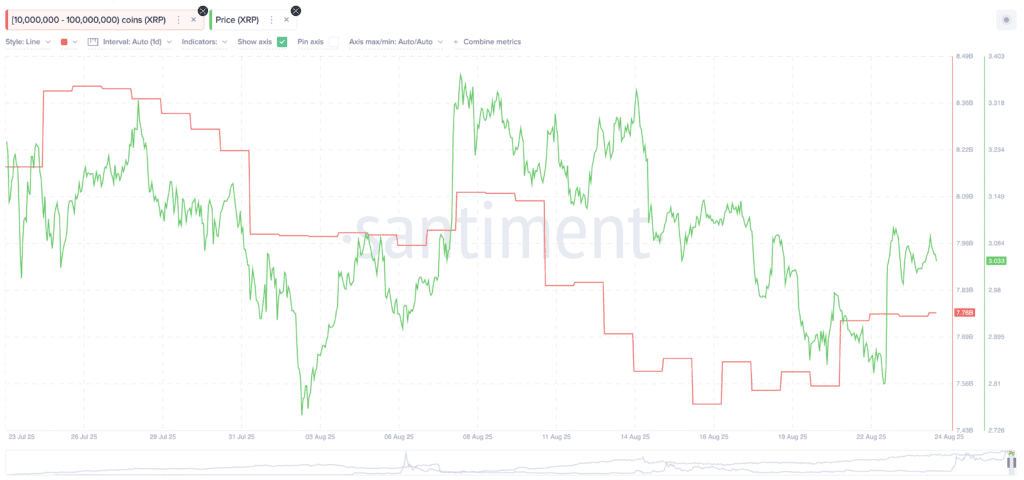

Large holders accumulate quietly

One of the strongest signals comes from the wallet of a large whale. Data on the chain shows that retention of 10 million to 100 million XRP has steadily increased positions over the past few days.

On August 16th, these wallets controlled approximately 75.1 billion XRP. By August 24th, that figure had risen to XRP 77.6 billion.

Want more token insights like this? Sign up for Editor Harsh Notariya’s daily crypto newsletter.

At a price of today’s $3.03, this accumulation amounts to around $758 million worth of tokens added in just a week. Such activities usually reflect trust among whales that tend to build a place before major movements.

Their purchases helped to absorb some of the sales pressure, but were not enough to push the XRP price up to the most powerful zone of resistance.

Heavy supply clusters are upside down

Its strong resistance zones become more clear in cost-based distribution heat maps. This metric identifies the price level at which the maximum amount of XRP changed hands last, effectively indicating a large number of supply areas.

Currently, the dense clusters range between $3.26 and $3.29, with over 1.05 billion XRP accumulated.

The zone concluded all upward attempts since early August. Even during short meetings, buyers struggle to clear it, reflecting the weight of the supply overhead. Further benefits may remain limited until the XRP breaks above this band.

Why this level is important for the next XRP price rally

A trend-based Fibonacci extension adds weights to this analysis. The 0.786 retracement line is almost perfectly consistent with the $3.29 level and confirms it as a pivot that requires a violation.

If XRP prices manage a critical breakout (close the full candle above), the immediate upside target will be displayed at $3.43, a previous all-time high of $3.65. A stronger push could pave the way for $3.84.

There is a precedent for such a move. XRP Bulls is controlling prices for the first time in nine days, highlighted by developing green candles.

In early August, the XRP jumped from $2.90 to $3.33 in the session after the Bulls temporarily controlled momentum. A similar response could continue, bringing the XRP price closer to the $3.29 barrier.

Until then, whale accumulation may continue to support prices from below, but the rally remains close with supply overhead.

Also, if the whale gets frustrated and starts dumping, you can search for support from the XRP price of $2.78. Violations under that would negate bullish prospects.

The XRP price rally was taking to break this key resistance zone, which first appeared in Beincrypto.