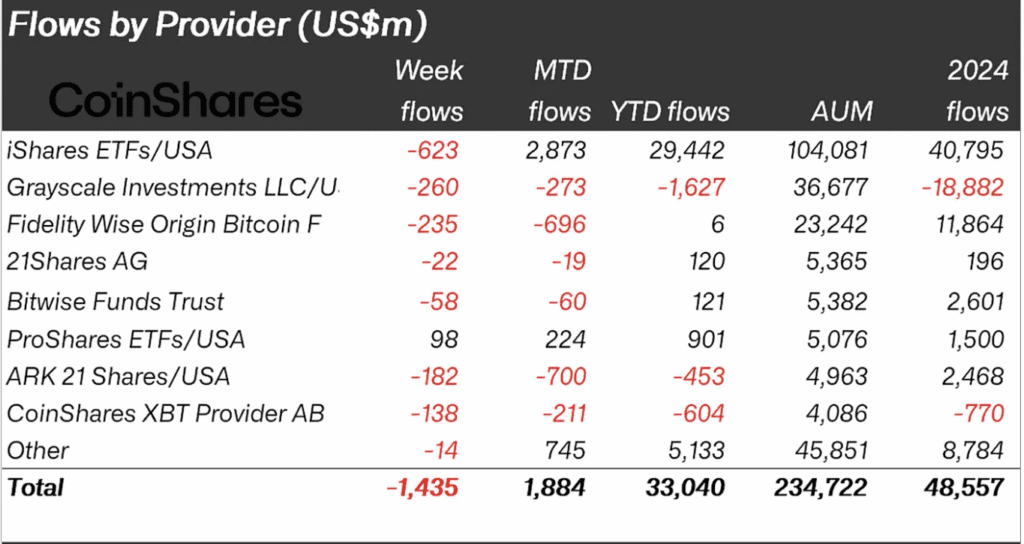

Coinshares released a weekly report on digital asset investments, analyzing the intense outflows across the Crypto ETF market. In total, Crypto Investment Products saw a $1.43 billion spill last week.

The decline in hopes of lower interest rates strengthened much of this pessimism, but there was something like a comeback. Still, the situation is unstable and it is unclear what will happen next.

Crypto ETF leaked last week

Crypto ETF investments have taken the world by storm since early 2024, but recent patterns of outflow have been causing investors to be nervous. ETFs Shortly after the influx of ETFs surpassed Bitcoin, the entire asset category began posting major losses.

Coinshares will release a report on this trend and analyze it better:

Essentially, the report assumes that US bearish hopes for interest rate cuts have driven these ETF outflows, and Jerome Powell’s unexpected reconciliation efforts during Jackson Hole’s speech slowed some of the hostile momentum. Intimate analysis of each of the key funds and tokens provides useful cues.

The importance of institutional investors

Ethereum, for example, is more sensitive to these swings than Bitcoin, reflecting its status as a hot product among institutional investors.

Throughout August 2025, ETH inflows exceeded BTC by $1.5 billion. This is truly an unexpected turnaround. In other words, the new investment narrative for Ethereum has a real impact.

It appears that institutional investors are the main market motives here right now. Independent data from other ETF analysts support this hypothesis.

Coinshares is considering not just ETFs but all digital asset fund investments, so there is some interesting information in its leaked data.

For example, XRP and Solana performed better than Bitcoin and Ethereum in this sector, but the associated ETFs have not won approval.

In other words, Digital Assets Treasury (DAT) investments could form part of this total.

However, for clarity, this sector is particularly vulnerable to macroeconomic factors.

Despite the large DAT inflows this month, investors’ fears and stock dilution concerns have pose serious problems for some major companies. Even strategies that are clear market leaders face several important warning signals.

That’s why the situation is quite unstable at the moment.

It is difficult to extrapolate this data to make future predictions, but one thing seems clear. Ethereum’s new inconspicuousness is very noticeable and could have a major impact on Altcoins.

As ETH emerged, institutional investors’ power Crypto ETF leaks first appeared in Beincrypto.