The cryptocurrency market has rebounded slightly this week following President Trump’s announcement on Monday about a ceasefire between Israel and Iran.

Since then, some assets have extended their gatherings, while others have posted lukewarm performances and have struggled to maintain their upward momentum. Amid this mixed market recovery, on-chain data reveals that Crypto whales are quietly accumulating some Altcoins, such as UNI, WLD and sand.

uniswap (uni)

This week, the Decentralized Finance (DEFI) token UNI is attracting whales’ attention. This is reflected in large owner Netflow, which has increased by 190% over the past seven days, with each Intotheblock.

Larger holders are investors who hold more than 0.1% of the distribution supply of assets. Their Netflow measures the difference in the amount of tokens they buy and sell over a specified period. Such a surge indicates a strong accumulation by whales, suggesting a stronger confidence and a bullish outlook for assets.

Furthermore, a massive rise in holder Netflow could encourage retailers to bolster UNI accumulation. If this purchase pressure continues, Altcoin could break into the $7 price range.

On the other hand, if demand drops, the token price could immerse itself in $5.91.

WorldCoin (WLD)

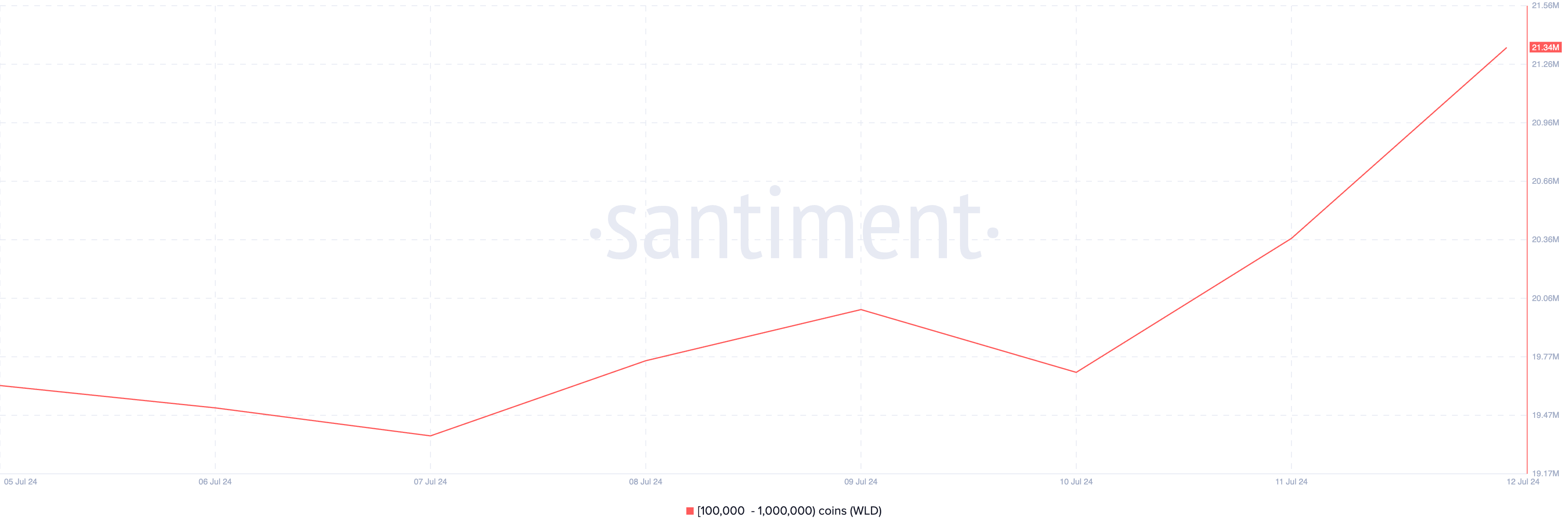

WLD, the token that bolsters Sam Altman’s WorldCoin, is another Altcoin purchased by Crypto Whale this week. Data from Santiment shows a noticeable increase in coin retention for whale wallet addresses holding 100,000-1 million WLD tokens.

During the week of review, this cohort of WLD owners acquired 1.72 million tokens, and is currently valued at over $3 million.

If demand for this whale rises sharply, it could drive WLD prices that exceed resistance in the short term by $0.97.

However, if emotions are bearish and whales are sold for profit, WLD can throw away some of its value and plunge towards $0.57.

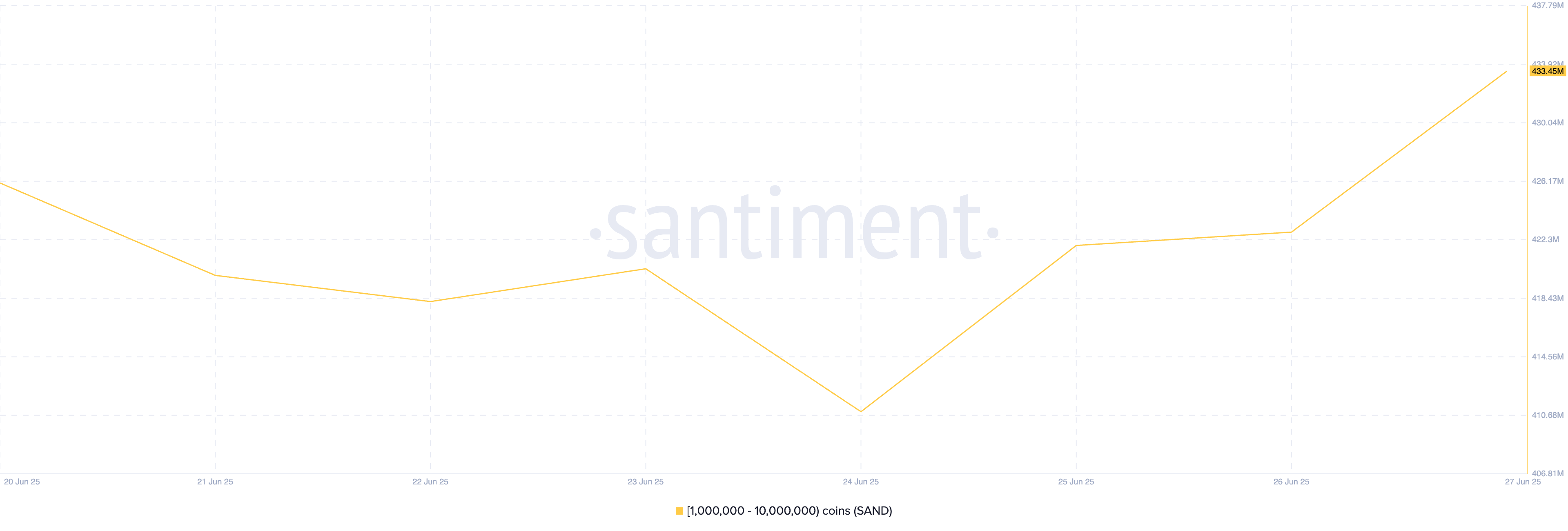

Metaverse-based token sands is another asset that has surged into crypto whale activity this week. According to data from Santiment, large investors with between 1 million and 10 million tokens accumulated 7.45 million sand last week.

This substantial increase in whale accumulation suggests increased confidence in the long-term potential of sand.

If this buying trend expands to retailers, it could further strengthen the bullish momentum of the token over the coming weeks, pushing the price to $0.30.

On the other hand, if demand buying activity drops, the value of the sandwich could immerse in $0.21.

Disclaimer

In line with Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. Although Beincrypto is committed to accurate and unbiased reporting, market conditions are subject to change without notice. Always carry out your research and consult with an expert before making any financial decisions. Please note that our terms and conditions, privacy policy and disclaimer have been updated.