Peanut Squirrel (PNUT) surged more than 12% after a vague Elon Musk tweet that burned code speculation.

The tweet did not directly mention the coin, but Digicle and Meme Hunter quickly pulled out the connection and bought it. But under the hype, on-chain indicators tell a very different story. From flips inflows and funding rates to chaikin’s divergence, the real PNUT price movement appears to have belonged to early people rather than retail.

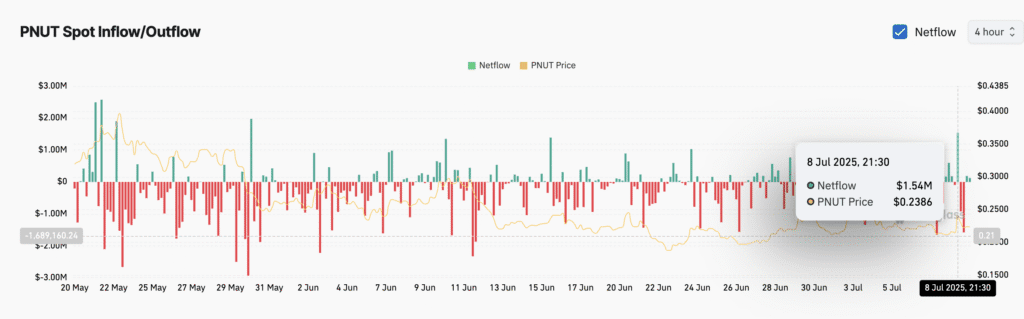

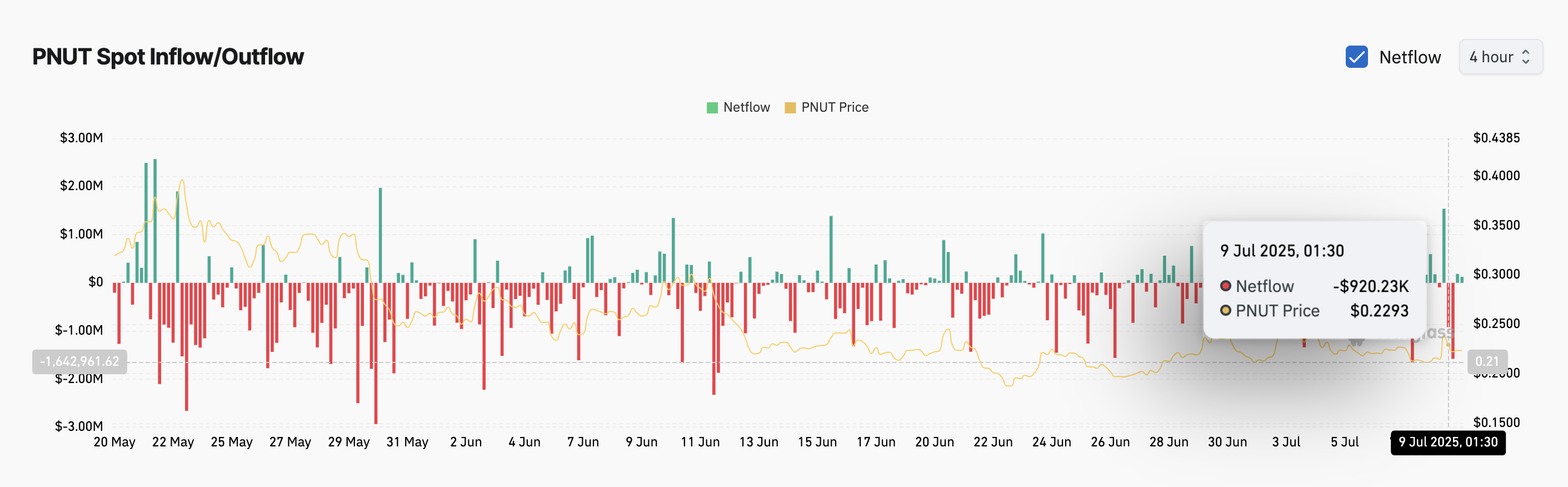

Netflows flipped over after tweets, but retailers sold the top

The first sign of movement came before the mask tweet, not before the mask tweet.

On July 8th, Exchange Netflows reversed positively, with $1.54 million worth of PNUTs moving to the exchange, possibly positioning traders towards selling.

That was a few hours before prices peaked.

Four hours later, Outflows surged again as PNUT reached $0.2398 (up from $0.2136), with the approximately $920,000 token being withdrawn. The pattern is clear. Early players moved before tweeting, but retailers ended late by buying the top.

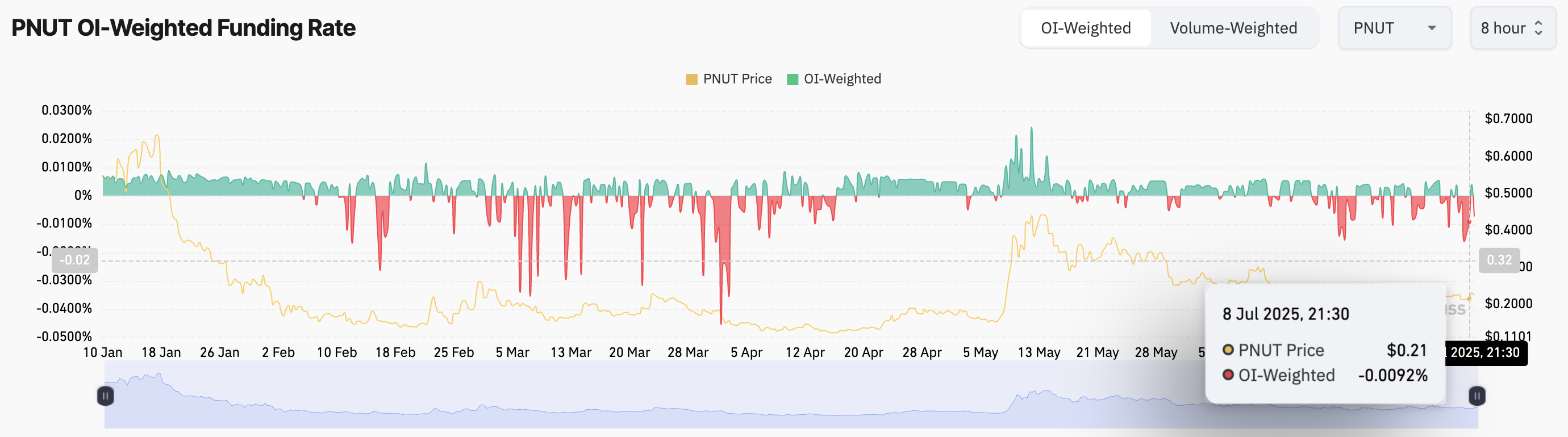

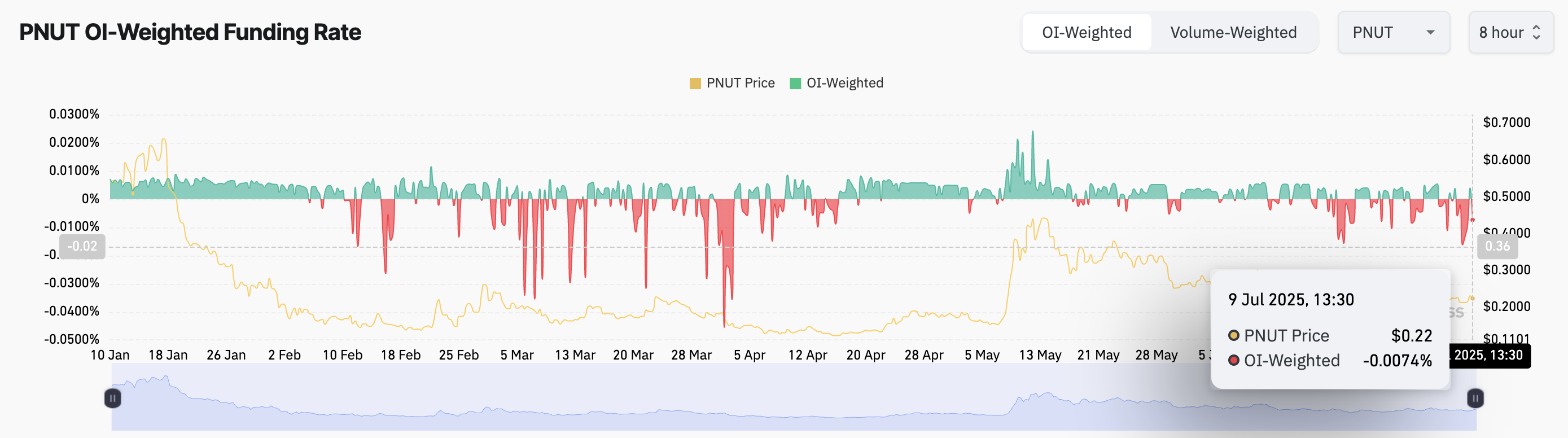

Funding rates will move to zero for the first time in a few weeks

For days, PNUT’s funding rate has remained negative, indicating that more traders are betting on a price that will drop. But that changed shortly after the mask tweet on July 8th. The rate approached zero, reaching -0.0074% on July 9th.

That is, some traders have begun to open up long positions in the hopes of price increases. However, the rate was still negative, indicating that he is still not confident. They’re testing trends rather than jumping completely. This shift suggests a growing interest, but it is not a strong bullish signal.

Funding rates are fees paid between long and short traders. If the funds are negative, the short traders dominate. A positive rate means that long traders are under control.

PNUT price faces FIB resistance and shows invalidation

A Fibonacci retracement, drawn from high to high (July 3) from the previous swing, shows that the PNUT price was retested at 0.382 FIB level at $0.2386. That zone, along with $0.245 and $0.256, remains a significant level of resistance. PNUT prices are now back at nearly $0.22 and are struggling to regain the bullish trend.

If PNUT Price managed to get a clean return of $0.245, the move to $0.256 is back on the table.

However, a drop below $0.216 (key trend line and 0.786 FIB) destroys bullish structures and gives you a lower PNUT than the long-standing trend line. This twitches short-term bias.

Elon Musk’s post causes Pnut Price Buzz, but on-chain data tells another story that first appeared in Beincrypto.