Bitcoin prices range in the past few days and are consolidated between $117,261 and $120,000. However, recent market conditions and external influences, such as the Federal Open Market Committee (FOMC) meeting on Wednesday, have caused a temporary decline.

As of now, Bitcoin is at a price of $118,419 and is recovering slightly after soaking it in $115,700. Despite this recovery, Bitcoin’s pass remains uncertain due to factors such as sales forces.

Bitcoin shows signs of decline first

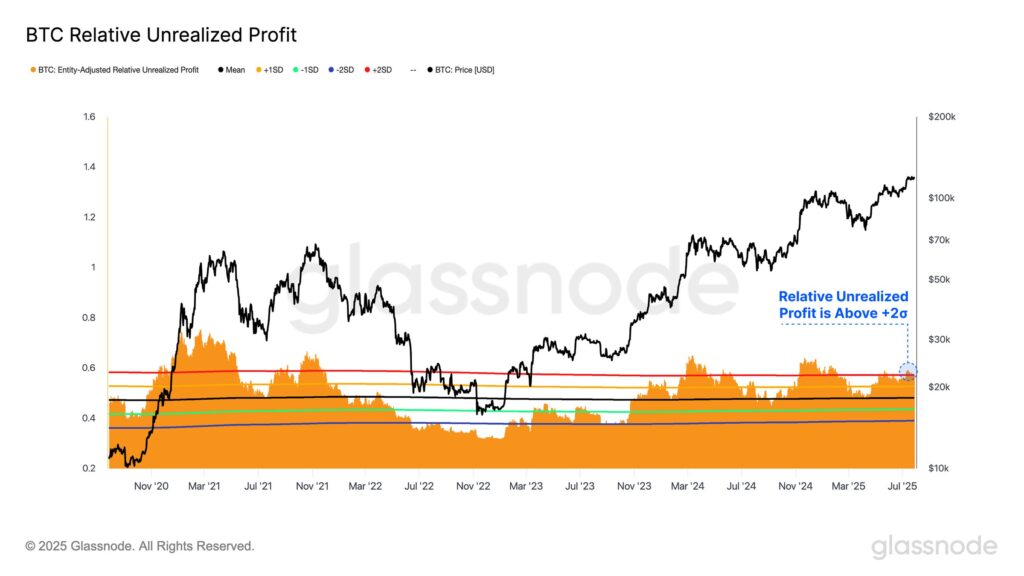

Relative unrealized benefits (RUP) have recently surpassed the +2σ band, a level associated with the euphoric market stage. Historically, this setup has preceded the top of the market, indicating potential sell-side pressures that could ultimately lower prices.

The current state of RUP indicates that a pullback could be likely to occur in the coming days, and that Bitcoin prices could be withdrawn from the combined range. Given past patterns, the shift to sales could create even more downward pressure.

About Token TA and Market Updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s daily crypto newsletter.

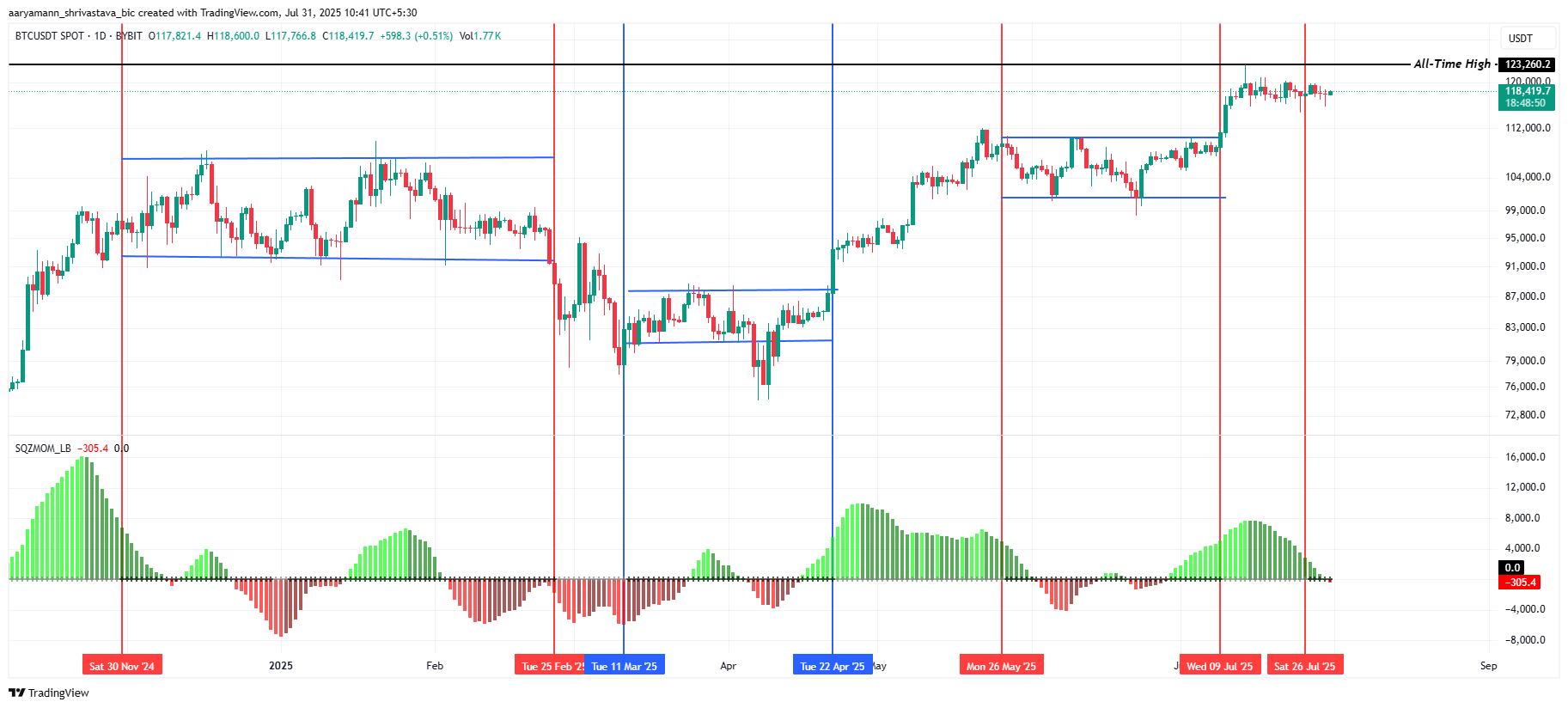

The Squeeze Momentum Indicator (SMI) indicates that Bitcoin is in the integration phase. Historically, these integration periods, where price movements are more restricted, have preceded large price movements when apertures are released.

As squeezes continue to be built, Bitcoin prices are poised to make sharp moves in one direction. Bitcoin can see a sharp decline, especially if SMI sees this negative trend in the coming days.

BTC price should jump

Bitcoin is currently trading at $118,410 after falling to $115,700 on Wednesday when the FOMC report was released. The market response to the Federal Reserve decision not to change interest rates has led to a recovery in BTC, but the underlying market situation still poses risk.

Bitcoin prices could drop even further if investors start booking profits, potentially below the cryptocurrency support level of $117,261. Drop past this support could lead to Bitcoin price under $115,000.

The only way this bearish outlook will be invalidated is if Bitcoin succeeds in reviving $122,000 in support over $120,000. Surges above these levels could provide the momentum needed to push Bitcoin to a new high. But until that happens, Bitcoin prices will remain vulnerable to fluctuations and market pressures.

Post FOMC reports cause a dip in bitcoin. It first appeared in Beincrypto.