At the time of pressing, HBAR prices were trading nearly $0.240 after nearly 3% rebounding in the last 24 hours. The bounce comes after a weak month where HBAR has dropped by 16.5% and shows a clear decline.

The seven-day chart shows profits exceed 2%, suggesting that the tokens are only beginning to stabilize. Still, technical and chain signals show deeper changes, with early signs of bullish reversals appearing.

RSI Divergence shows that buyers are back

The most important indicator is the relative strength index (RSI), which measures momentum buying and selling. Usually, when prices drop, RSI is lower too. However, between August 19th and 25th, HBAR prices were lower and RSI was lower.

This discrepancy is called bullish divergence. That means that even if prices went down further, sellers were weaker than before. Buyers absorbed more pressure and prevented momentum from falling apart.

Such divergence is often seen before trend reversals, suggesting that HBAR prices may be approaching ending a one-month decline. But that’s not the only bullish sign.

About Token TA and Market Updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s daily crypto newsletter.

Netflow and Bullbear power supply add confirmation

Hedera (HBAR) Netflows also supports cases. On August 26th, the token experienced a net inflow of approximately $3.2 million in exchange, indicating sales pressure.

By August 27th, this had reversed to a spill of nearly $695,000. This shift represents a swing in net flow in just one day. This is a sign that buyers were beginning to regain control.

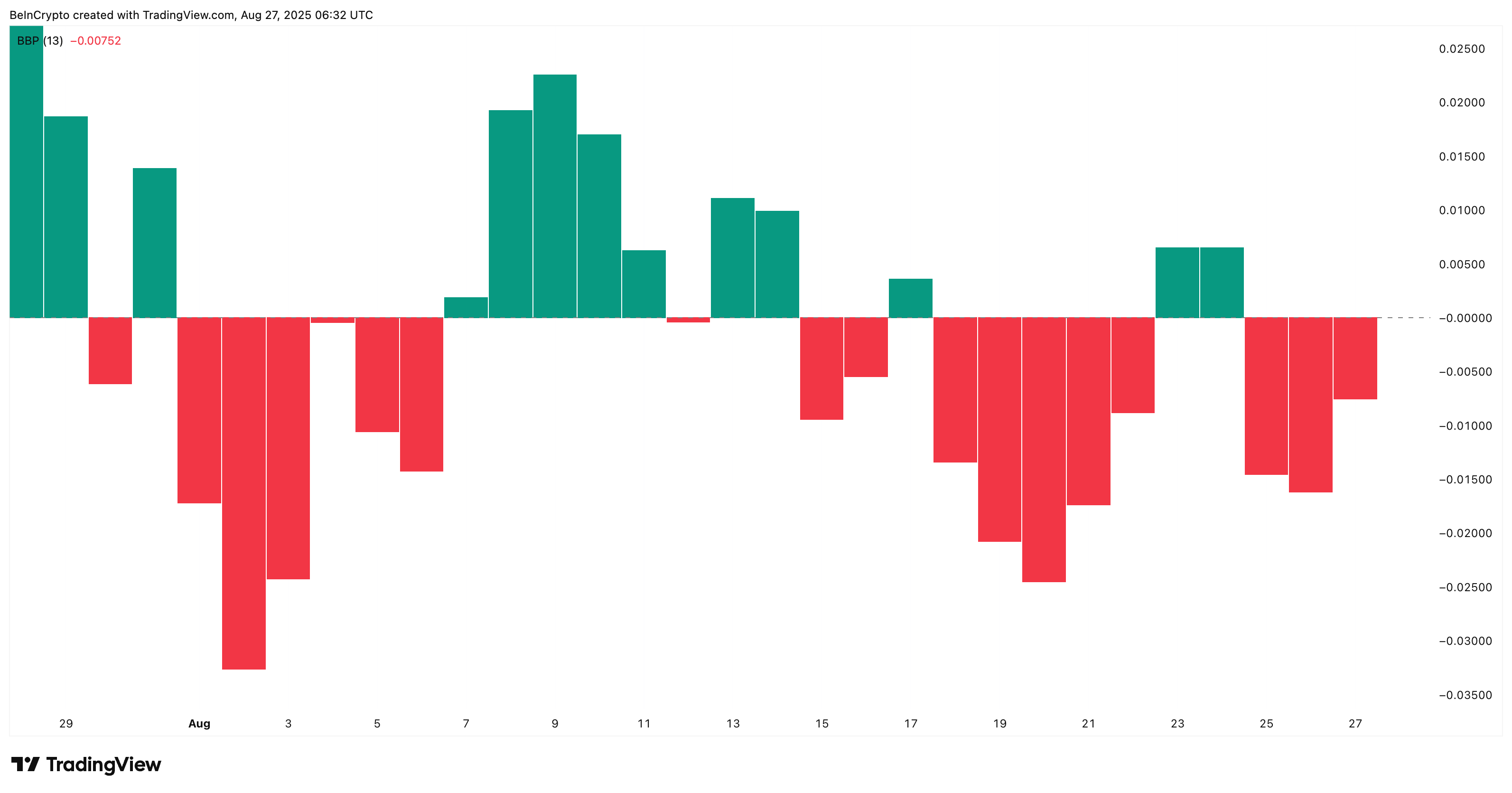

The Bull Bear Power (BBP) indicator, which compares bullish strength with bearish pressure, also showed improvements. As with the drops seen between August 15-16 and August 21-22, the bearish momentum fell from August 26-27.

In both cases, Hbar Bulls temporarily controlled it. The current shift appears to be repetitive, adding another layer of support to the bullish case. This time, the price of Hedera (HBAR) could be the trigger that is being watched while the bullish divergence occurs.

HBAR price levels indicate important inversion zones

HBAR prices support a key level of $0.239. This is because levels once considered resistance often act as bases when retested.

If HBAR prices hold this base, their next upward targets are $0.246 and $0.252. Breaking $0.257 confirms a comeback, but a move above $0.276 reestablishes a full bullish momentum and ends a month’s downtrend.

However, if $0.239 fails, the HBAR price could return to $0.228, potentially disabling the bullish setup.

The price of the HBAR rebounds as bullish divergence hints first appeared.