Hedera’s native token, Hbar, has been experiencing a steady upward trend recently, attracting investors’ attention. While a surge in prices has contributed to an increase in trading activity, this can lead to a major liquidation for traders, especially those who hold short positions.

Although Altcoin is expected to continue its rise, the situation may be difficult for those who oppose the situation.

HBAR traders are at risk

The Chaikin Money Flow (CMF) indicator shows a strong influx into HBAR, indicating bullish investor sentiment. The CMF bounces past the zero line for the first time since December 2024, showing strong demand.

The inflow shows investors continue to pour money into their assets and strengthen their price movements. A positive CMF will increase the chances of sustained growth for HBAR, as long as the broader market maintains a bullish tone.

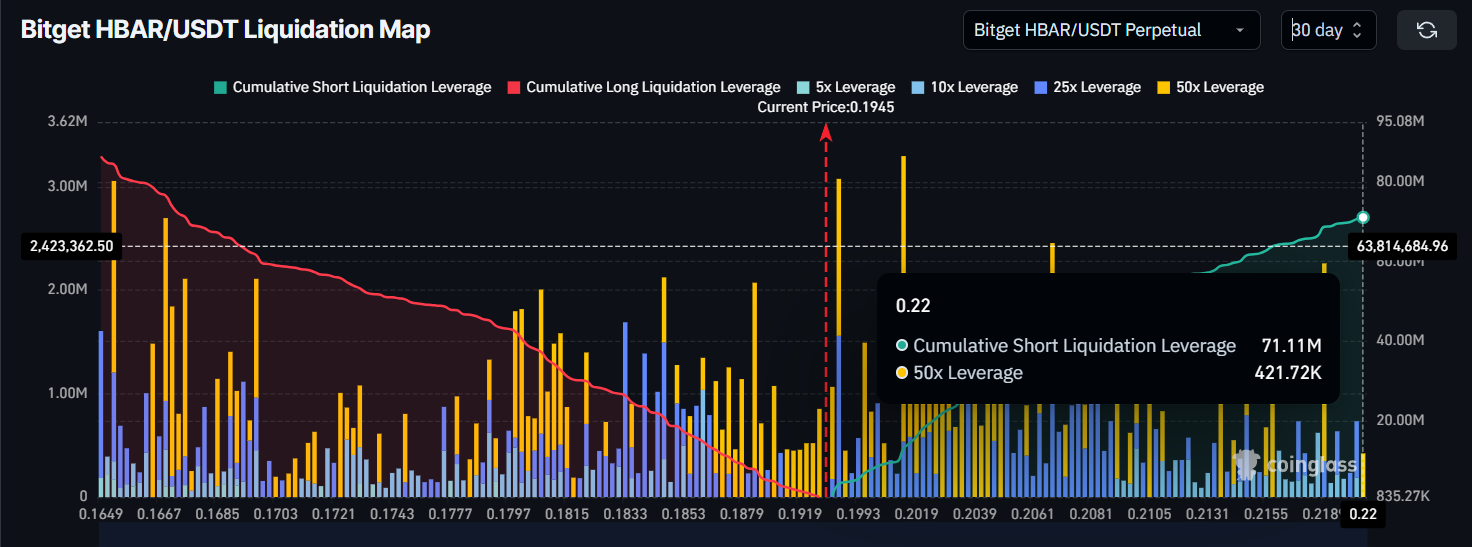

HBAR’s liquidation map, which tracks short positions, shows that as prices continue to rise, traders betting on assets could face significant losses. The current price for the HBAR is $0.19, not far from the main resistance level of $0.22. If HBAR violates this resistance, it could liquidate a short position worth about $70 million, leading to further upward pressure. This scenario highlights the fierce battle between bullish investors and bearish traders.

Short traders betting on HBAR are at risk now as wider market sentiment pushes Altcoin higher. The increase in momentum driven by a strong influx can catch many short positions off guard and force them to liquidate. If this liquidation occurs, HBAR prices could rise sharply, further strengthening the bullish outlook.

Hbar Price continues that trend

The HBAR is currently trading at $0.194, just below the heavily level of resistance at $0.200. Altcoin has shown consistent growth over the past month and could continue to rise due to current positive market sentiment. A successful break of over $0.200 can confirm bullish momentum and pave the way for further profits.

If HBAR supports $0.200, it is likely that the rise to $0.220 will continue, causing a short liquidation of $70 million. This creates additional upward pressure, accelerates price movements for HBARs, potentially higher in the short term.

However, if the HBAR fails to maintain its upward trajectory and falls below the uptrend line, the price could slip at a support level of $0.182. Such a decline is likely to result in HBAR at around $0.167, negating the current bullish outlook. Therefore, traders must closely monitor these important levels to determine the next step in HBAR’s price action.

Disclaimer

In line with Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. Although Beincrypto is committed to accurate and unbiased reporting, market conditions are subject to change without notice. Always carry out your research and consult with an expert before making any financial decisions. Please note that our terms and conditions, privacy policy and disclaimer have been updated.