Bitcoin prices have steadily risen, up about 4% over the past seven days. This trend reflects an increase in market sentiment and an increase in optimism among investors.

Once momentum is built, key-on-chain indicators show the potential for sustained gatherings in future trading sessions.

Bitcoin miners hold tight

Bitcoin miners resumed accumulation, with the coin’s minor reserve reaching 1.8 million btc a week.

Want more token insights like this? Sign up for Editor Harsh Notariya’s daily crypto newsletter.

Bitcoin Minor Reserve tracks the number of coins held in miners’ wallets. This represents a coin reserve that the miners have not yet sold. When it declines, miners are checking bearish feelings towards BTC by moving coins from their wallets and usually selling them.

Convergently, as they climb, the miners hold many of the mined coins. This usually reflects confidence in future price increases and bullish prospects.

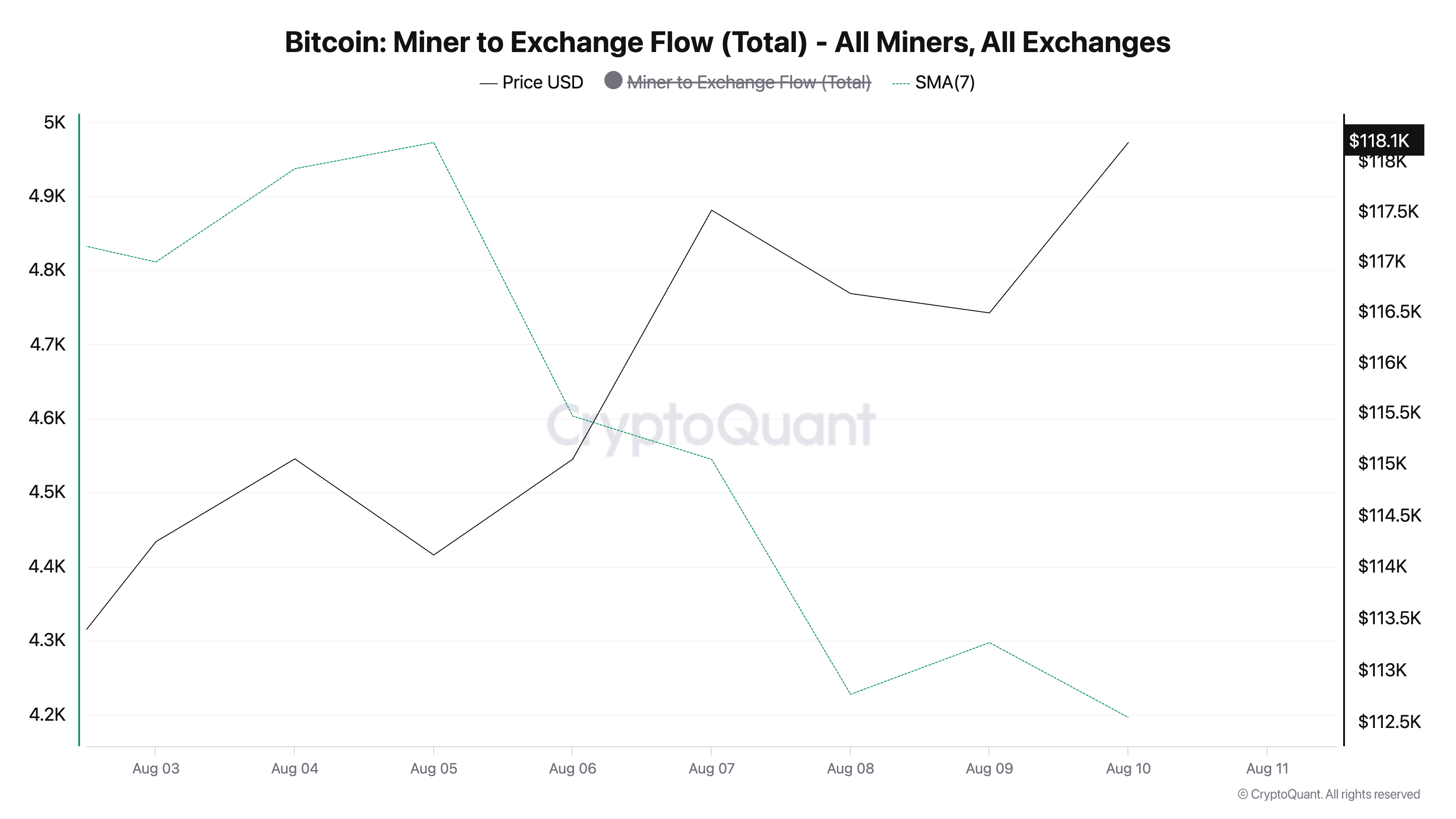

Furthermore, the decline in the exchange flow from BTC miners highlights the accumulation trends of miners on the network over the past seven days.

According to Cryptoquant, the metric measured the total amount of coins sent to exchanges from minor wallets, and fell 10% during that period.

When the exchange flow drops from BTC miners, miners block sales and exchange coins. This will help to reduce sales pressure, which has increased reliability on BTC prices, and to strengthen the gathering.

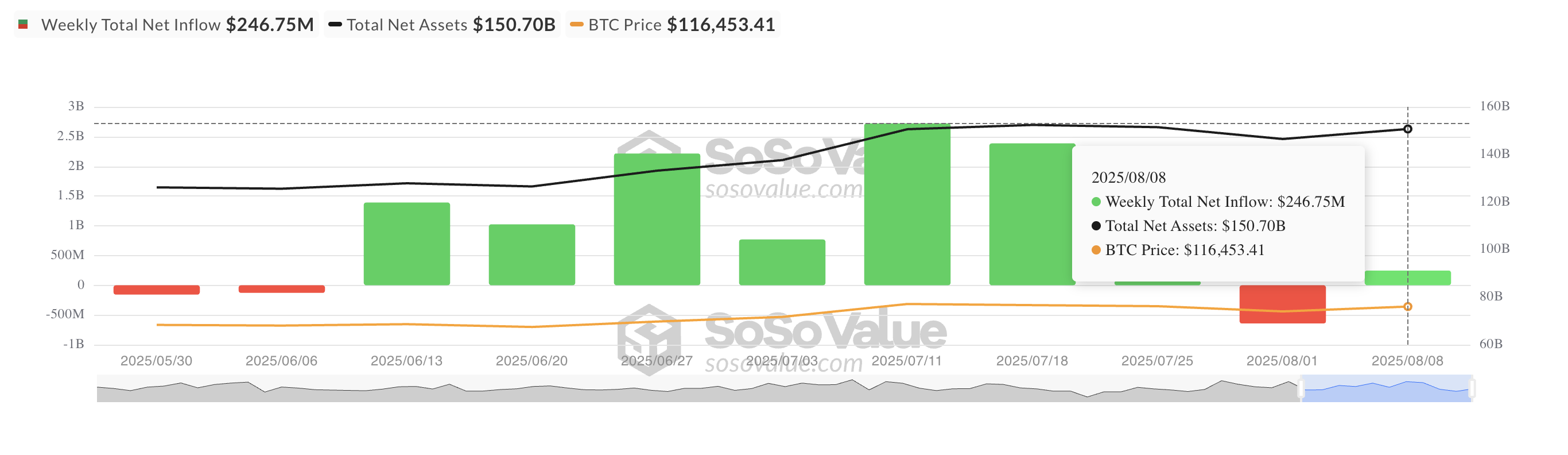

Additionally, last week, a weekly influx into Spot Bitcoin ETF tested positive, reversing the negative outflow recorded the previous week. For each Sosovalue, between August 4th and 8th, the total capital inflow into these funds was $247 million.

This shift updated the change in market bias towards institutional purchase profits and BTC. Institutional investors are confident that the coin will extend profits and increase exposure directly through ETFs.

Can BTC push beyond $118,851 to $120,000?

The combination of updated institutional demand and miner trust enhances cases where short-term returns for BTC exceed $120,000. However, for this to happen, Kingcoin must first outweigh the resistance at $118,851.

On the other hand, if accumulation stalls, the coin could resume its decline, reaching $115,892.

A post that allows Bitcoin Miners to drive BTC’s new all-time bests has first appeared on Beincrypto.