If traders had crystal balls, their biggest wish is to know how to buy XRP at the bottom. This is especially true in the cryptography where the mantra is still: “Wen Moon?” translation: “Are you finally at the bottom?”

First, heads up: Some of the technical analysis tools and methods discussed here may differ from traditional wisdom. why? Because, like in other areas, trading theory and best practices evolve. It can take years for these updated practices to be fooled by professionals by retail traders. Sometimes, professionals are late to adopt these changes!

For this work, we will analyze the anatomy of the bottom of the market using XRP, one of the most widely held cryptocurrencies.

First and for the first thing

The news is anecdote.

It’s a polite way to say, “News is not important.” If you track professional certifications like CMT (Chartered Market Technician) or CFTE (Certified Financial Technician), you’ll jump into works like James Montier’s “Behavioral Investment.”

tl; dr? News is only important when prices move. If prices do not respond meaningfully, the news is irrelevant. People simply watch the news as an explanation or as a reason for what happened.

If you want to buy XRP at the bottom, there are a few tools that can help you identify and time correctly. The two tools I’m trying to focus on are social sentiment data from RSI and StockTwits.

RSI: It’s not about the blind level, it’s about the context

If you want to buy XRP at the bottom, RSI can help. Heads Up: Probably you’re using RSI incorrectly, or at least not as efficient as possible. But don’t feel bad. The way experts interpret RSI has shifted nearly 20 years ago… But again, even professionals can take ages to adapt.

RSI (Relative Strength Index) is one of the best known and used indicators among traders.

1978, J. Wells Wilder introduced the RSI. At the time, it was revolutionary. why? As RSI thrives in a range of markets, it is precisely what investors experienced during Wilder’s time

Updated RSI usage

In 2008, Connie Brown, arguably one of the world’s greatest living analysts and traders, changed the way RSI is understood in her book, the technical analysis of trading professionals (certified readings such as CMT and CFTE).

If you don’t go into the roughness of the core, RSI should now be considered either a bull market or a bear market. Also, although each equipment and time frame differ slightly, typical AB (over-purchase) and OS (over-sell) levels are as follows:

Bloom Market:

OB 1 – 80 OB 2 – 90 OS 1 – 50 OS 2 – 40

Bear Market:

OB 1 – 65 OB 2 – 55 OS 1 – 30 OS 2 – 20

Suitable Case: Daily XRP Charts from May 2019 to June 2020

In particular, during this time frame, RSI level 65 served as a relatively consistent source of resistance, with 30 and 20 serving as support.

But how can you tell whether RSI is bullish or bearish? Simple – Some people overlay these levels and adjust them to your recent movements.

Looking at XRP’s weekly charts, my interpretation is bullish as XRP respects 50 OS levels as support.

StockTwits Social Sentiment: Cheat Code?

StockTwits’ social sentiment data is another powerful tool when you’re trying to buy XRP at the bottom. StockTwits captures insights only from traders and investors. There is no random chatter from general social media.

This is what I found particularly valuable:

If the volume of the message is rising, but sentiment remains flat or drops, you’re looking for a bullish setup. People often talk about doing something before actually doing it.

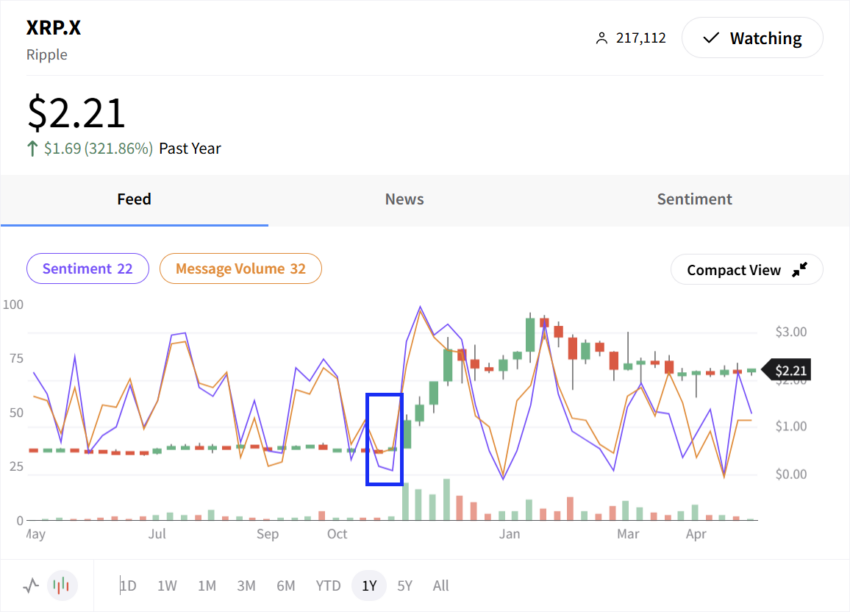

November 2024 shows this perfectly:

Week of October 27, 1014: Sentiment 24, next week’s Volume 30: Sentiment will drop to 22, volume will rise slightly to 32

This emotion/volume venting is usually an indication of bullish momentum going forward.

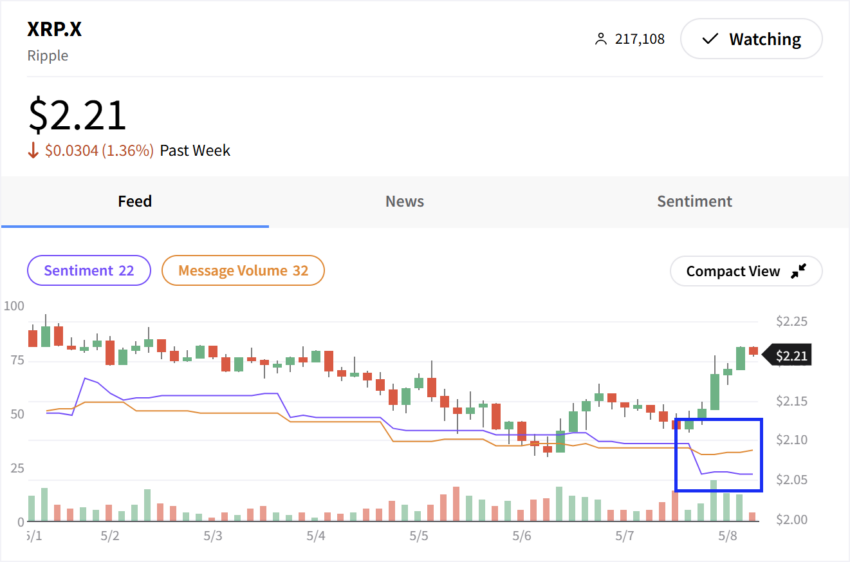

Recent XRP Sentiment Activities

There is even more dramatic divergence now.

Another important pattern: flattening prices and steadily dropping sentiment indicates that traders are slower to recognize market direction. For me, it’s not just a flying signal. It’s a signal to secure a prime seat before anyone else runs in.

In short, identifying the bottom of the market is not the first thing to do. It involves understanding the context, leveraging updated analytical methods, and deciphering subtle market sentiments. That’s the anatomy of the bottom – XRP edition.

Disclaimer

In line with Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. Although Beincrypto is committed to accurate and unbiased reporting, market conditions are subject to change without notice. Always carry out your research and consult with an expert before making any financial decisions. Please note that our terms and conditions, privacy policy and disclaimer have been updated.