Trump, a Trump coin, has been attracting attention after a debated Trump dinner and has recently faced a challenging price action. The token has lost traction, its prices slip, and bearish sentiments are creeping into the market.

As prices continue to struggle, the possibility of further decline outweighs the potential recovery, putting traders in a volatile position.

Trump traders face losses

Trump’s liquidation map reveals data on traders. If Trump’s price rises to $14.52, a short contract worth about $31 million is at risk of liquidation. This is an important threshold for shorts as the position will be settled if the price rises beyond this point.

Price drop demand indicates that many investors no longer believe in the potential for further profits. Instead, they position themselves for a fall in prices, suggesting that Trump’s short-term outlook is waning optimism.

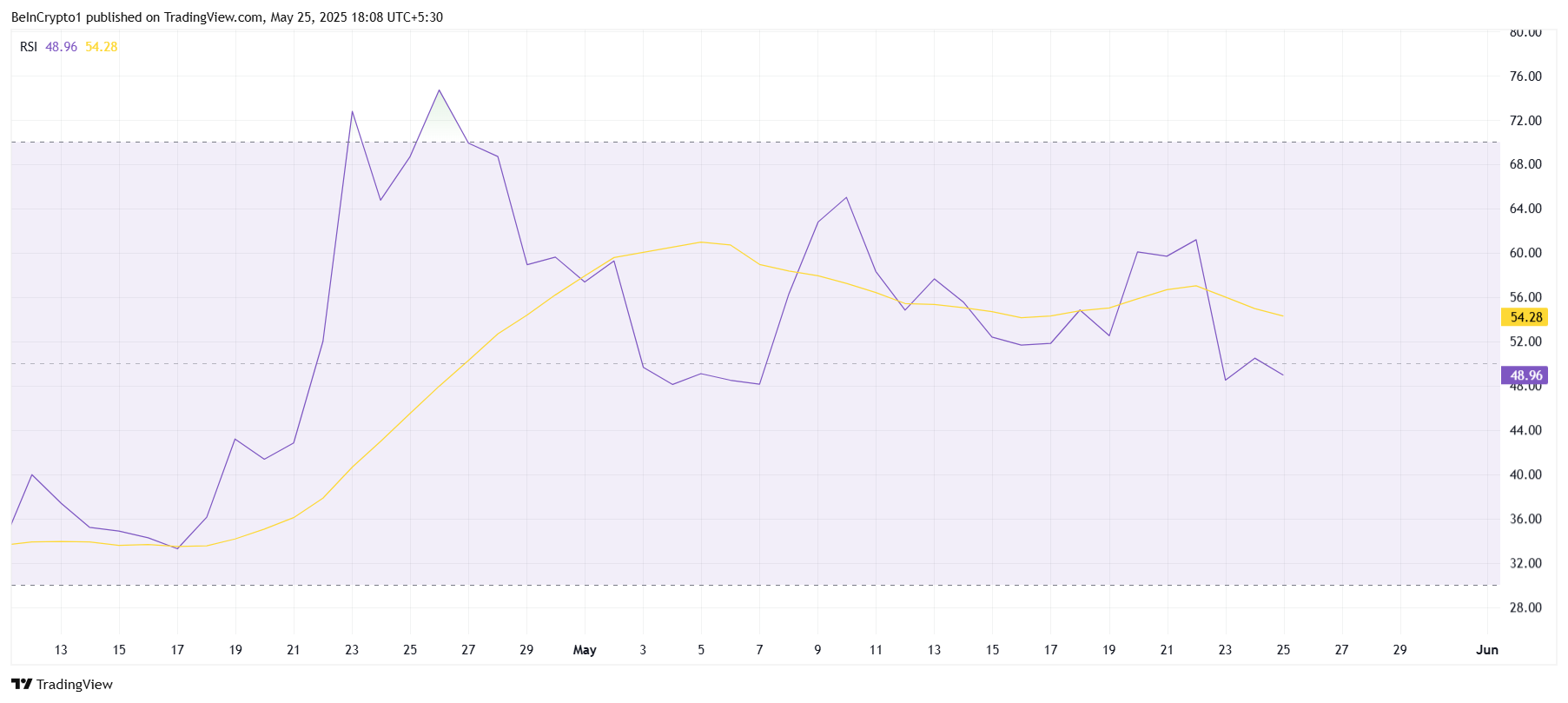

At a macro level, technical indicators draw bearish pictures for Trump. The relative strength index (RSI) has recently fallen below the neutral 50 mark, indicating a shift towards the bear zone. This decline in RSI indicates that Trump’s prices are more vulnerable to downward pressures if negative momentum is strengthened.

As RSI continues to decline, Trump will be more susceptible to price drops. The token remains unstable as it cannot regain bullish momentum, and if the current trend persists, there is a possibility of further losses.

Trump prices are waiting for recovery

At $12.65, Trump is currently working on a lack of bullish momentum. Despite the hype surrounding Trump’s dinner, the tokens have fallen nearly 15% since the event, indicating that the market has failed to maintain its previous enthusiasm.

This decline reflects broader skepticism about the future performance of tokens.

Trump will need to watch a critical rally to recover, and will need an almost 15% increase to reach $14.53. However, given the current market situation and broader sentiment, this level seems difficult to achieve.

Instead, it is likely that Trump will break through current support at $12.18, further down to $10.97.

That said, Trump could see a surge in the sudden shift to demand driven by new investors. A strong push above $13.36 set the stage to rise to $14.53, triggering the liquidation of a short position worth $31 million.

Such a move could cause significant volatility in the market and provide a rapid rebound to Altcoin.

Disclaimer

In line with Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. Although Beincrypto is committed to accurate and unbiased reporting, market conditions are subject to change without notice. Always carry out your research and consult with an expert before making any financial decisions. Please note that our terms and conditions, privacy policy and disclaimer have been updated.