Story’s IP tokens are emerging as the top performance asset today. This is in the pullback of trading activities during today’s session. Altcoin rose 3%, extending the bullish streak that began on July 11th.

IP prices have grown by more than 20% in the past week, and continue to outperform despite the wider market facing downward pressure.

IP is climbing, and the $5 million spot influx says it’s just beginning

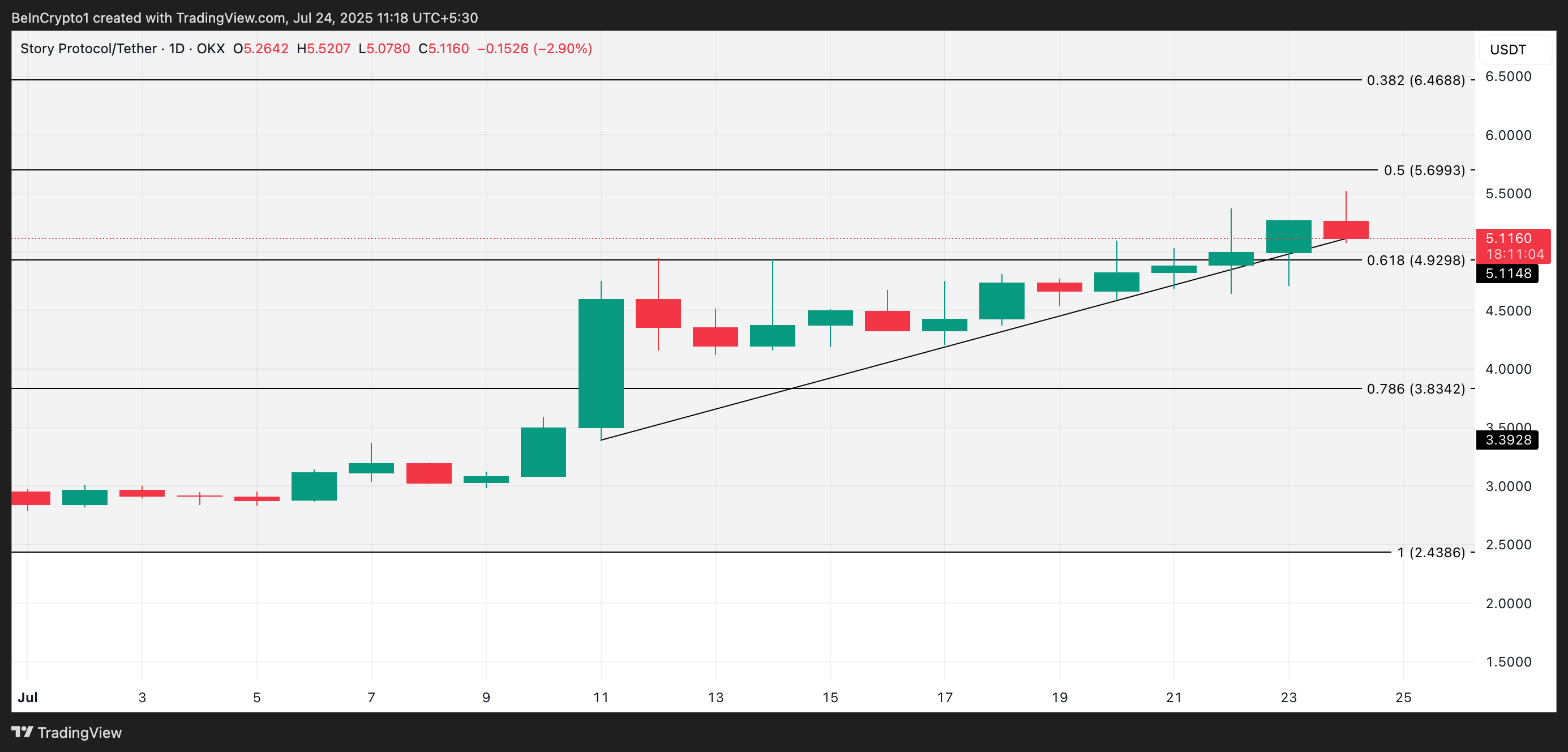

The Story’s native token, IP, is currently trading at $5.11, outperforming the key technical support that has supported the rally.

IP/USD 1-day chart reviews show that tokens have been trading consistently beyond the uptrend line since July 11th. This trend shows bullish and sustained purchase profits that appear when higher lows form over time.

About Token TA and Market Updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s daily crypto newsletter.

This trendline serves as dynamic support. Despite the small market weaknesses recorded in the past few trading sessions, it continues to drive IP price increases.

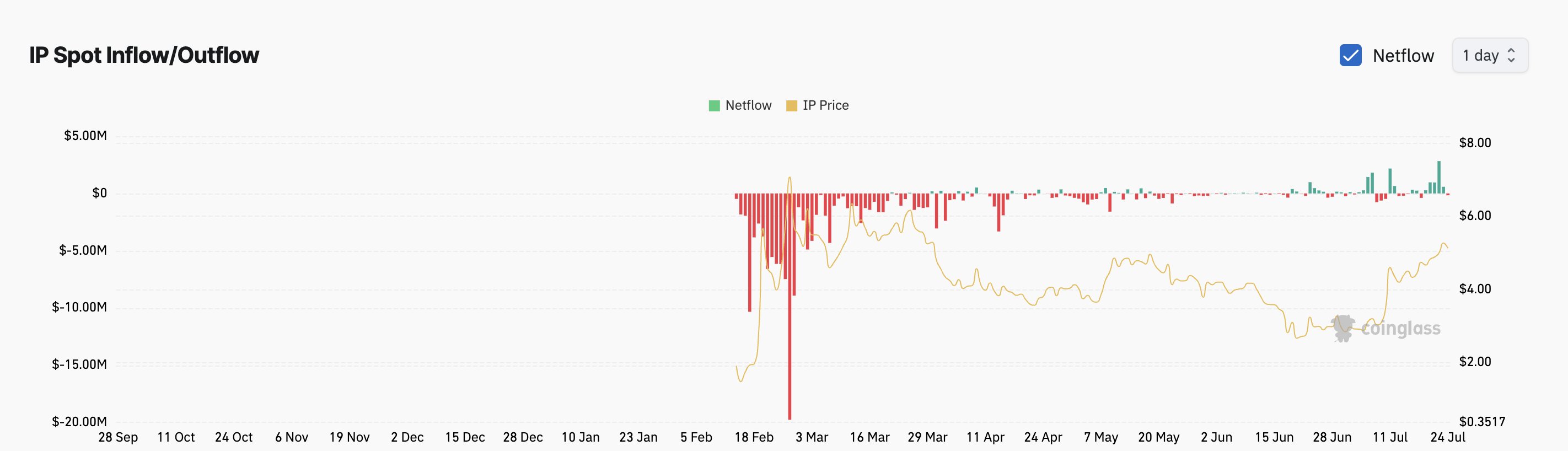

Additionally, spot influx into IP has been a sign of persistent investor interest and conviction over the past few days, and is stable. According to Coinglas, despite its market-wide profit-making trend, IP has recorded a consistent spot net inflow over the past four days, exceeding $5 million.

When assets see such spot net inflows, more capital enters the assets through purchases in the spot market than the exit. This shows the growing demand and confidence of investors in the short-term IP outlook.

Today we saw a modest net leak of $157,000 from the IP spot market as some traders locked their profits, but the overall sentiment around the token remains strong and positive.

Futures traders make big bets on IP rally

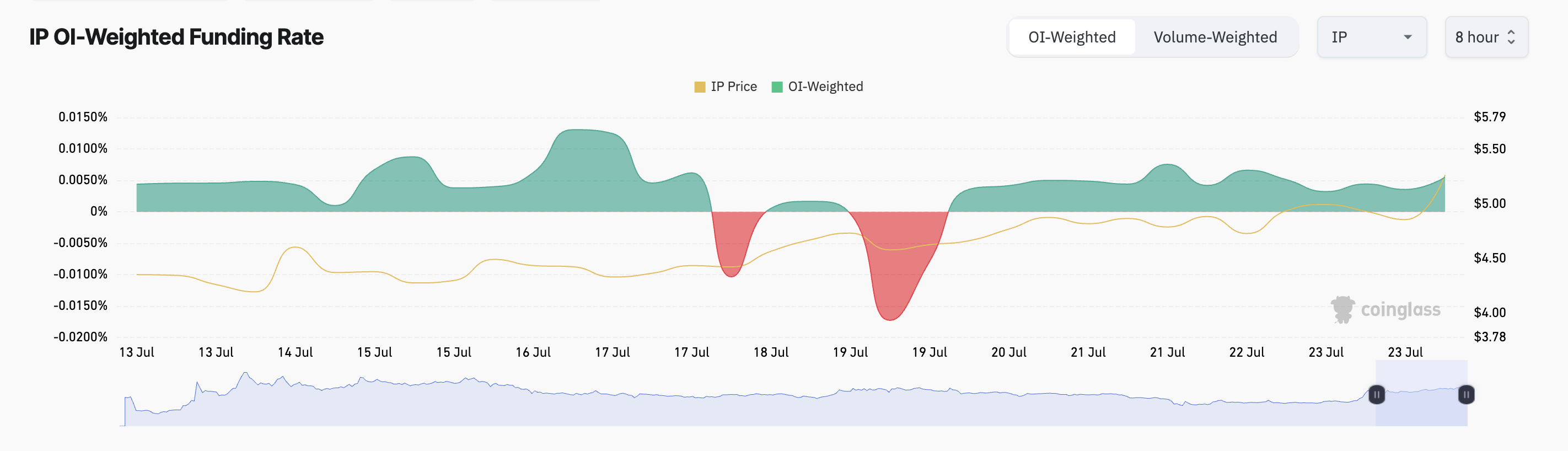

Positive on-chain activity reinforces expectations for further benefits in the short term, and this sentiment is also shared among IP futures traders. This is reflected in the IP funding rate, which has remained positive since July 20th.

At the time of writing, the metric is 0.0055%

Funding rates are regular charges exchanged between long and short traders in a permanent futures market. The contract price is on par with the spot price.

The positive funding rate means that traders are paying premiums to hold their long positions, indicating bull market sentiment.

The positive funding rate for IP indicates that futures traders are leaning heavily towards their strengths. This will strengthen Altcoin’s gatherings and provide credibility against the ongoing price surge.

IP clears the $4.92 wall. Momentum could burn fuel towards March highs

IP’s ongoing rally has outpaced long-term resistance by $4.92. If this level becomes a solid support floor, the tokens can build on recent profits and rally towards the last seen high of $5.59 in March.

However, due to lower demand, IP can follow that step. The token could potentially test the $4.92 level, and if it doesn’t hold that floor, it could open the door for a deeper fix towards $3.83.

Disclaimer

In line with Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. Although Beincrypto is committed to accurate and unbiased reporting, market conditions are subject to change without notice. Always carry out your research and consult with an expert before making any financial decisions. Please note that our terms and conditions, privacy policy and disclaimer have been updated.