HBAR has experienced considerable volatility over the past month, struggling to recover from recent losses and break down the downtrend for a month and a half.

Despite these challenges, Altcoin is in a critical position as traders remain optimistic about their potential breakouts. However, the price could drop even further as it did not break the main resistance level.

HBAR traders are bullish

All this month, traders showed strong bullish sentiment towards HBAR. Funding rates remained consistently positive, indicating long contract control in the market.

This suggests that traders are confident in potential price recovery and position themselves to take advantage of increased value. Consistent optimism reflects the belief that HBAR can rebound from the current downtrend.

The positive funding rate also shows that despite ongoing challenges, more investors are willing to wager Altcoin’s future.

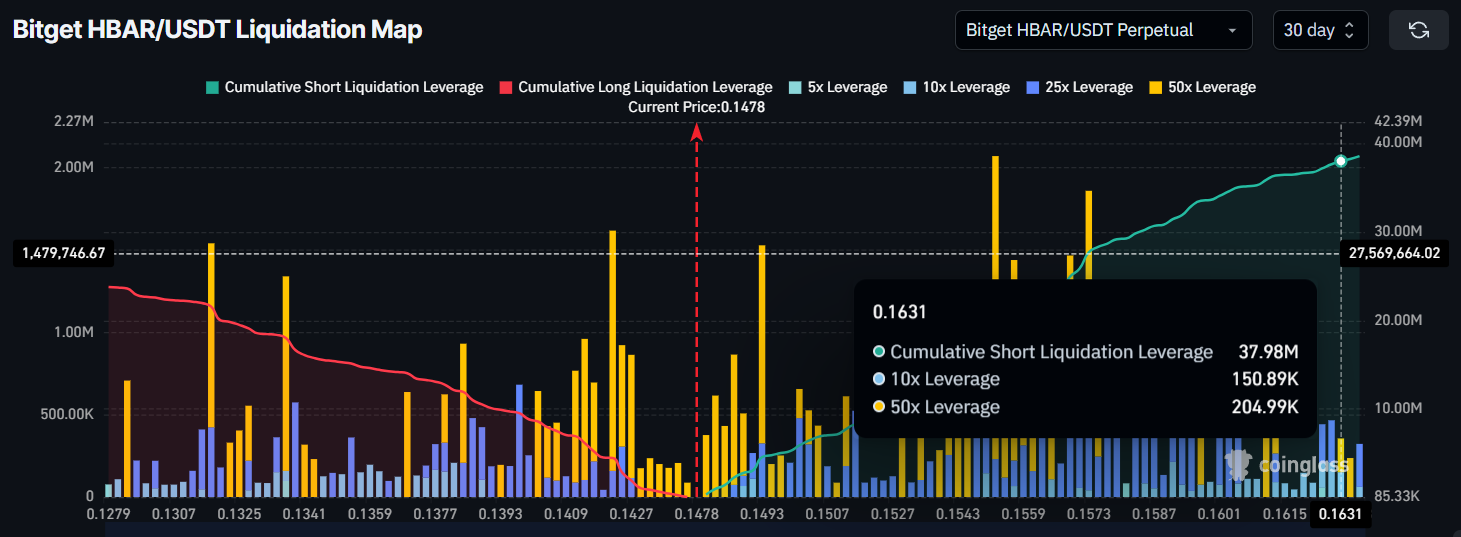

HBAR’s macro momentum reveals that short traders could face a major loss if prices rise. The liquidation map shows that if HBAR breaks the current downtrend and rises to $0.163, it could liquidate a short contract worth around $38 million.

This could have a major impact on the market and drive further purchasing momentum.

Short traders bet on a continuous decline in prices, but breakouts above major resistance levels could potentially end their position. This creates additional purchasing pressure and supports the possibility of greater upward movement.

HBAR Prices are waiting for a boost

At the time of writing, HBAR is trading at just $0.148, a critical resistance level of $0.154. Altcoin is considering breaking down the downtrend line that violates this resistance and keeps it under control.

A successful push through this level is a key milestone in HBAR recovery.

A potential breakout support factor indicates that if HBAR can support $0.154 and flip it could rise to $0.163. Once this level is reached, it will lead to liquidation of short positions, further increasing the price.

This will help HBAR gain momentum and recover from recent downward trends.

However, if the broader market becomes bearish, the HBAR price could drop to $0.139. Losing this support is a bearish signal and could potentially cut the price to another $0.133.

Such decline negates bullish papers and brings market outlook back towards the bear.

Disclaimer

In line with Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. Although Beincrypto is committed to accurate and unbiased reporting, market conditions are subject to change without notice. Always carry out your research and consult with an expert before making any financial decisions. Please note that our terms and conditions, privacy policy and disclaimer have been updated.