The PI Network (PI) has returned to the spotlight after the withdrawal of over 86 million tokens from OKX caused a price surge of 11%, causing speculation of a adjusted supply aperture. The move has intensified bullish sentiment, especially as technical indicators begin to coincide with price action.

Momentum indices like DMI and EMA suggest strength growth, while potential golden crosses suggest possible continuous breakouts. However, not all signals are fully verified. Volume-based metrics like CMF show prolonged indecisiveness and are important for checking the orientation of the PI for the next few days.

Technical indicators support pilaries in supply shock speculation

The PI Network (PI) surged 11% after more than 86 million tokens were withdrawn from OKX Exchange, reducing the platform’s PI reserves to just 21 million.

The sudden escape of tokens sparked speculation of a adjusted supply squeeze, with some investors interpreting the move as a strategic effort by large holders that could limit circular supply and increase prices.

Voices from X’s community describe the event as a “movement of power,” pointing to growing confidence in the assets’ future trajectory.

This sparked solid momentum and increased the Pi to the top of Coingecko’s trend list, but still remains questions about its long-term foundations, especially mainnet deployments, exchange lists, and broader use case development.

From a technical point of view, the PI’s Directional Motion Index (DMI) shows signs of intensity growth. ADX, a metric that measures trend strength, has risen from 12.46 to 16.6 in the past day, indicating that momentum is being built. Typically, ADX values above 20 indicate developing trends, while measurements above 25 are considered strong.

Meanwhile, the +DI line tracking bullish pressure is located at 25.98 from 20.14 yesterday, but is slightly down from its peak at 29.15 today. The -DI, representing bear pressure, fell sharply from 20.84 yesterday to 14.45.

This difference suggests that the Bulls have gained control and sellers are retreating, supporting the narrative that if this momentum continues, PI networks could enter a more critical upward trend.

Pi CMF drops after short spikes and fading of signaling is under pressure to buy

Despite the recent surge, the Pi CMF is currently at -0.03.

Chaikin Money Flol (CMF), a volume-based oscillator that measures trading pressure over a specified period of time. The CMF value ranges from -1 to +1, with measurements above 0 suggesting accumulation (purchase pressure), and below 0 indicates distribution (sales pressure).

The closer the value is, the more extreme it becomes, the stronger the pressure it reflects.

Currently, the PI’s CMF is -0.03. This is a noticeable improvement from -0.17 two days ago, but a pullback from +0.09 yesterday.

This shift indicates that while overall sales pressure has been significantly eased, the recent decline under the zero line suggests that buyers are not fully controlled. A CMF hovering around a neutral zone could mean indecisiveness in the market or a pause after a recent meeting.

For the bull to regain full momentum, the CMF should ideally be pushed back into positive territory and be held back, confirming sustained capital inflows and supporting cases for ongoing benefits.

Golden Cross Setup for Pi builds, but key resistance is still playing

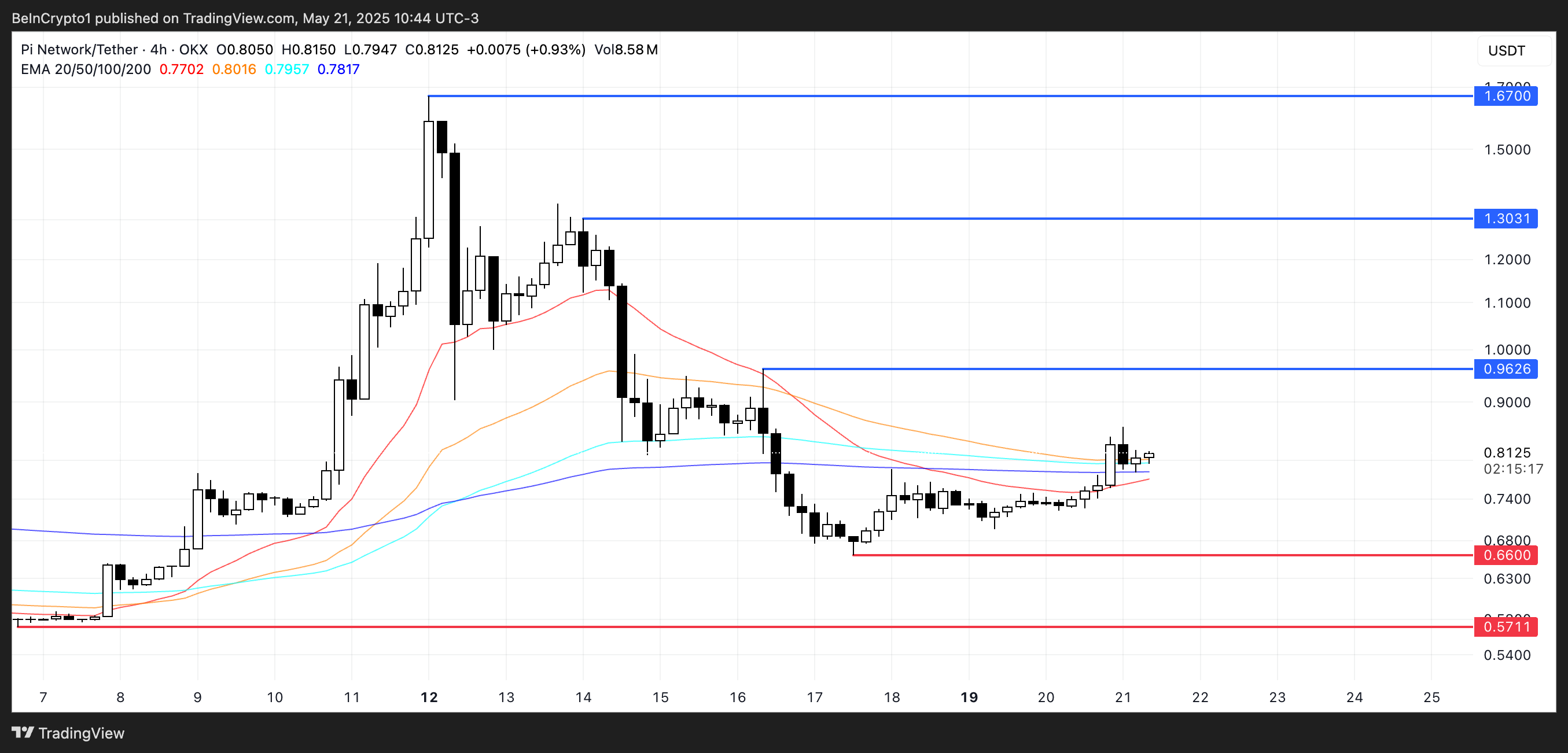

The PI network’s EMA line has a potential golden cross on the horizon, starting to fit in bullish setups. Golden crosses occur when short-term EMA crosses over long-term EMA and indicates the potential for sustained uptrends.

If this pattern is confirmed, the PI price is $0.96 and you can get enough momentum to challenge resistance.

A breakout beyond that level could open the door to earn more profits towards $1.30, and with a strong follow-through, prices can even reach levels not seen in recent trading activities.

However, bullish scenarios are not guaranteed. When the current uptrend loses steam and the purchase pressure weakens, the PI network can test support for $0.66.

A collapse below that level is likely to turn your emotions into a more bearish, exposing your token to the downside further towards $0.57.

The technical signals are optimistic for now, but traders are closely watching whether the Golden Cross is realising and whether they can convincingly clear the resistance level.

Disclaimer

In line with Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. Although Beincrypto is committed to accurate and unbiased reporting, market conditions are subject to change without notice. Always carry out your research and consult with an expert before making any financial decisions. Please note that our terms and conditions, privacy policy and disclaimer have been updated.