PI Networks (PI) shows a technical weakness that has declined nearly 15% over the past seven days and 4.4% over the past 24 hours. Currently, the market capitalization is $5.12 billion. Trading volume has skyrocketed 25% in the past day to $104.6 million, indicating increased activity amid the downtrend deepening.

Key indicators such as ADX, CMF and EMA structure all show bearish momentum, where sales pressures and price action struggle to hold support. As long as momentum does not change, PI appears to be vulnerable to further downsides in the short term.

The bearish trend in PI networks is strengthened

The Directional Motion Index (DMI) chart for the PI Network (PI) shows a significant increase in the mean directional index (ADX). This rose from 11.46 to 21 just a day ago.

ADX measures the strength of a trend regardless of direction. Generally, ADX below 20 suggests a weak or non-trend market, while measurements above 20 indicate that the trend is beginning to acquire strength.

As the Pi’s ADX is broken above this threshold, the data suggests that a more critical movement (bulwark or bearish) is developing.

Looking deeper, +DI (positive directional indicator) fell from 20.93 to 13.21 two days ago, while -DI (negative directional indicator) spiked from 23.48 to 31.92.

-DI is clearly dominant, and this widening gap increases the downward pressure of the PI. -When DI rises above +DI with ADX enhancements, it usually confirms that the bearish trend is gaining momentum.

In short, the indicators are adjusted to suggest that PIs may enter a stronger downtrend, and traders should closely monitor their follow-throughs of price action.

Indicators show strong sales pressure

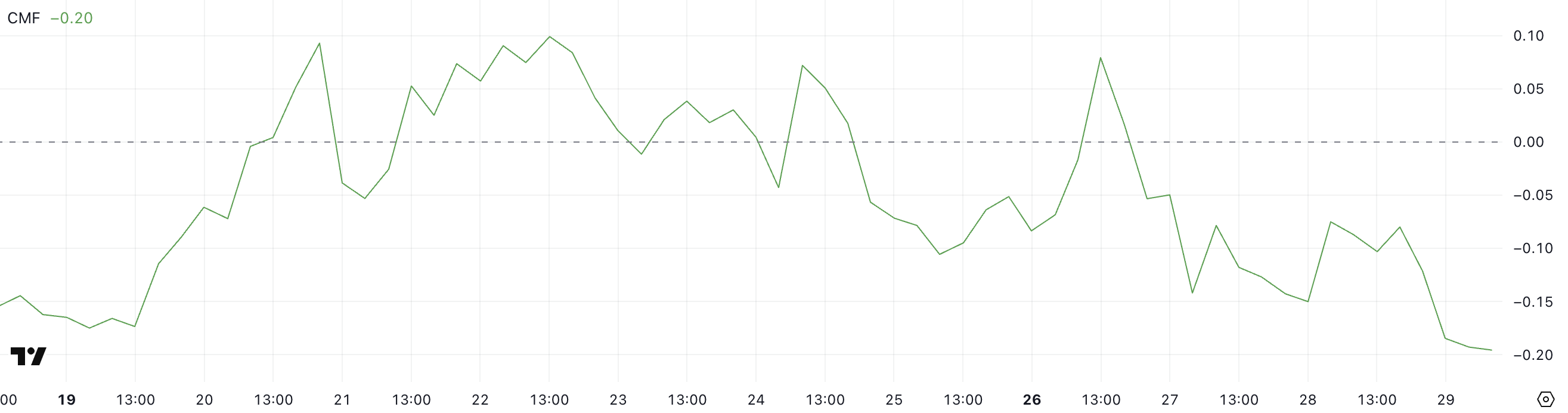

The Chaikin Money Flow (CMF) of PI Networks (PI) fell sharply just one day ago, from 0.08 and -0.08 three days ago.

A CMF is a volume-weighted indicator that measures the flow of money inside and outside an asset over a set period, typically 20 or 21 days.

Values above 0 generally indicate purchase pressure and accumulation, while values below 0 suggest sales pressure and distribution. CMF readings above ±0.10 are usually considered significant, with deeper negative values referring to persistent outflow.

The Pi’s CMF is currently -0.20, which means it’s the lowest reading since May 17th, so there’s a strong signal that it’s being controlled by the seller.

This sudden drop reflects an increase in capital leaving assets, and when combined with recent price weaknesses, it strengthens the bearish outlook.

If the CMF continues to decline or holds deep negative levels, it may suggest that a bullish lack of volume support could lead to bounce attempts facing intense resistance.

Pi Price Eyes lowers support

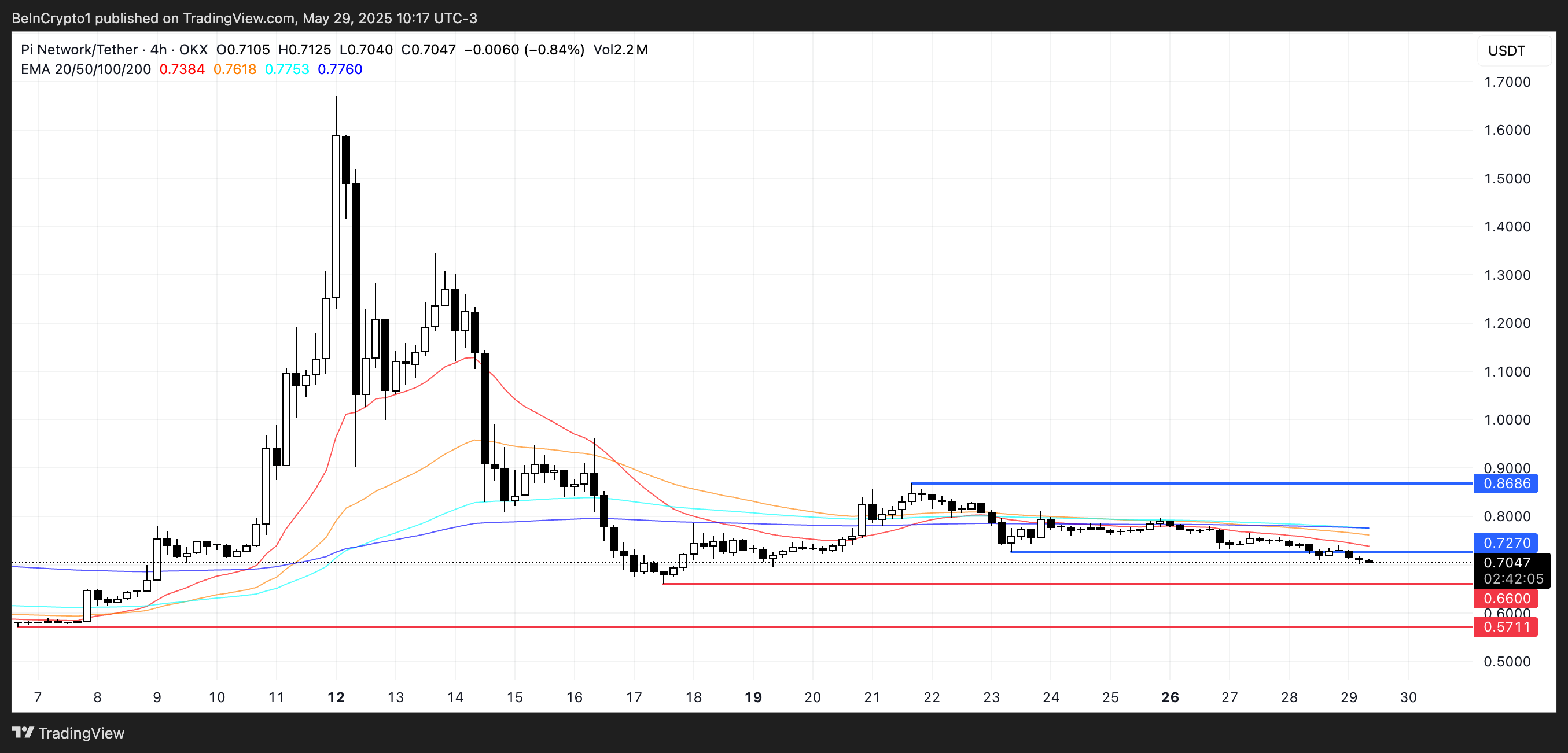

PI’s exponential moving average (EMA) indicator remains bearish, with short-term EMA being placed below the long-term.

The growth distance between these EMA lines reinforces the strength of the current downtrend. If the PI continues to slide, the next level of support is $0.66, and if you lose it, you may open the door to another reduced to $0.57.

Conversely, if the PI is able to reverse the current trajectory, the first important resistance to monitor is $0.727. A breakout above that level could indicate a short-term recovery and could potentially send the price towards $0.86.

But until short-term Emma flattens or crosses the long-term, bullish attempts could remain vulnerable to sales pressure.

Disclaimer

In line with Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. Although Beincrypto is committed to accurate and unbiased reporting, market conditions are subject to change without notice. Always carry out your research and consult with an expert before making any financial decisions. Please note that our terms and conditions, privacy policy and disclaimer have been updated.