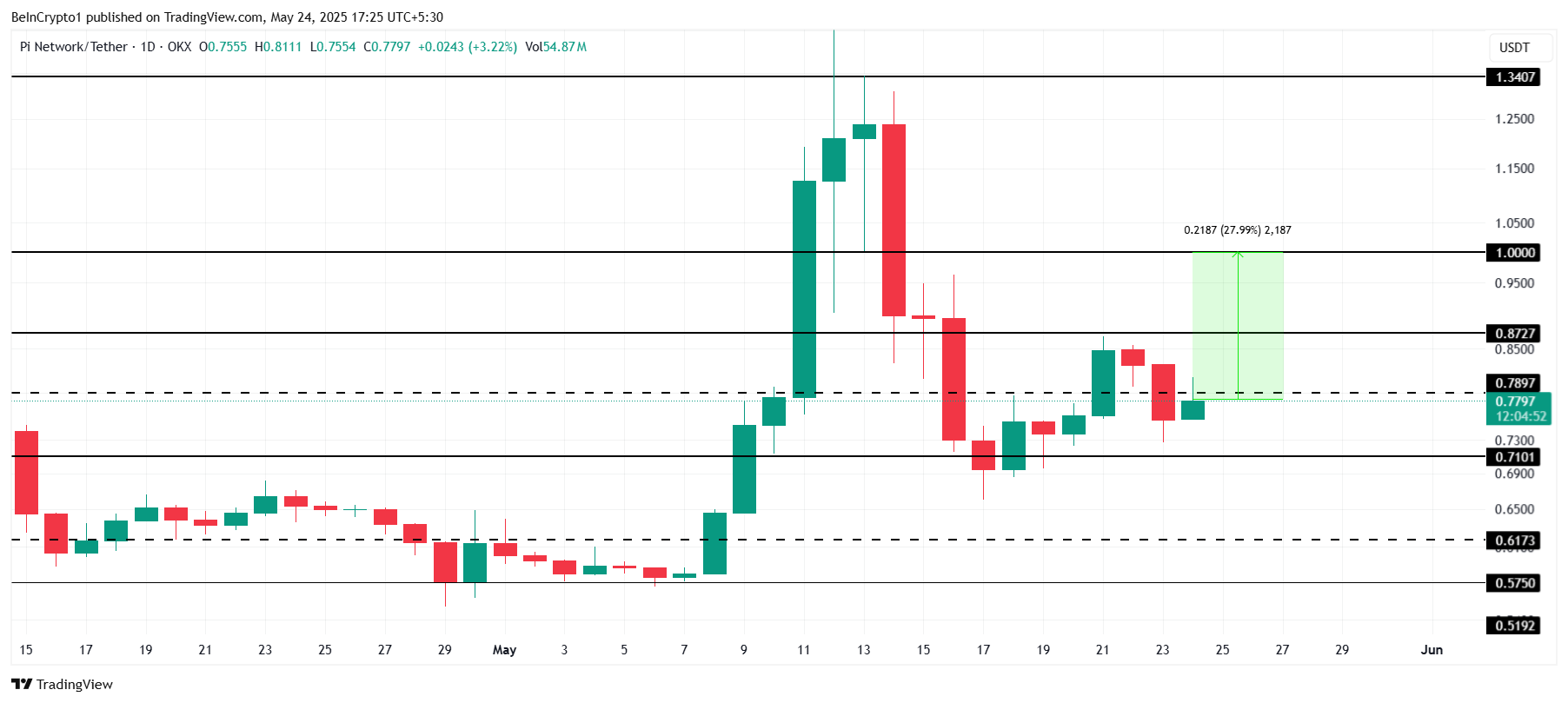

PI Networks (PIs) have recently faced a difficult period with price action. After falling below the $1 mark, Altcoin’s recovery appears to have lost momentum.

Unlike previous rebounds, current market conditions suggest that PI networks may find it more difficult to regain a price level of $1.00.

PI networks are losing traction

Currently, the mean directional index (ADX) is at 32, particularly above the 25 threshold. This reading shows that general trends acquire strength. In this case, the trend in the PI network is downward, reinforcing bearish sentiment among traders and investors.

Further evidence of this subtrend reinforcement is displayed through parabolic SAR indicators. The dots are placed above the candlestick, a classic signal that prices are likely to continue to fall. Such technical indicators often encourage careful trading behavior and can increase sales pressure.

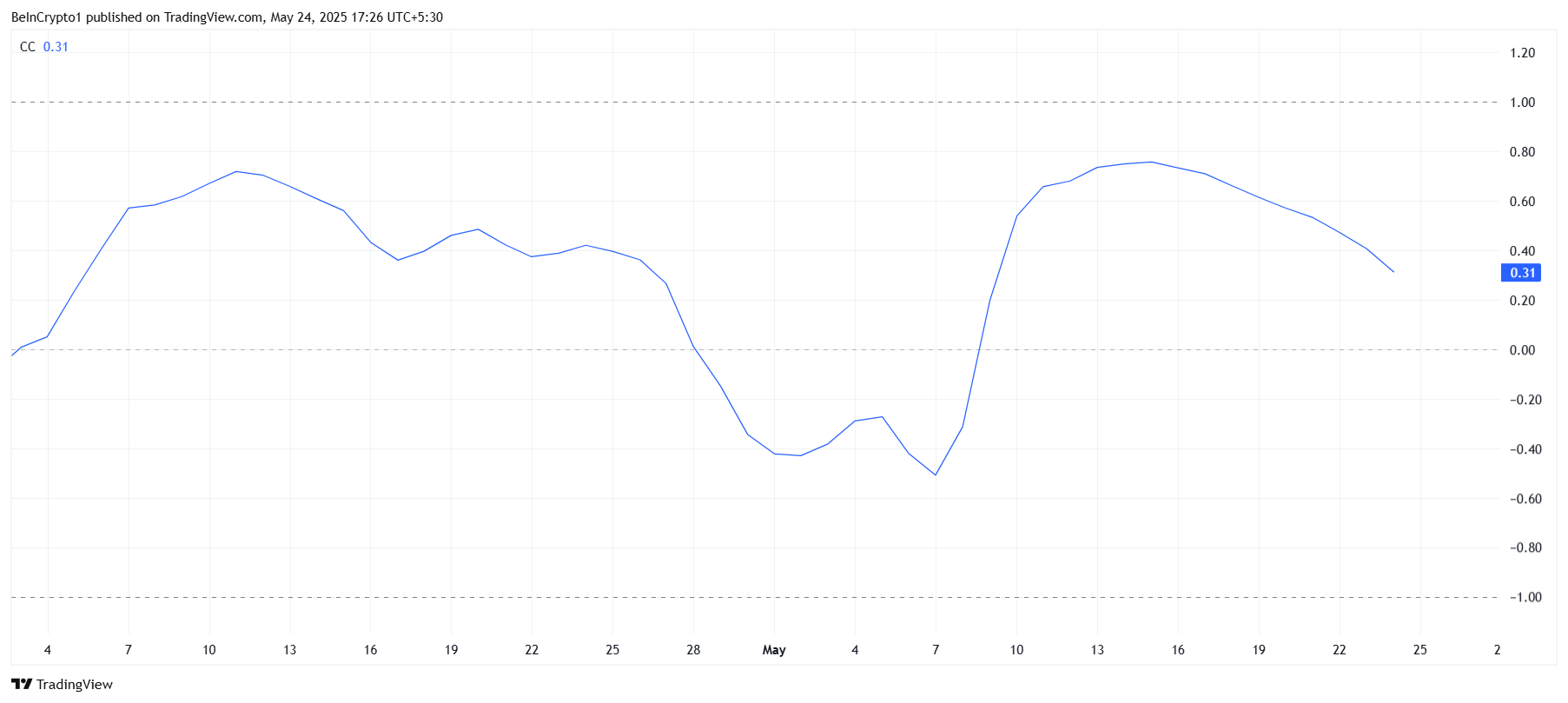

The price of the PI network is currently measured at 0.25, with a weak correlation with the steadily declining Bitcoin. This correlation of decline suggests that PIs are beginning to behave more independently rather than reflecting Bitcoin movement.

This separation is important as Bitcoin has recently set a new all-time high (ATH) and could continue to rise. However, PI networks are less likely to capitalize on Bitcoin’s bullish momentum given their divergent price dynamics.

Fall correlation means that PIs can have trouble following the upward trajectory of Bitcoin.

PI Prices aim to meet

The current price is $0.77 and the PI network needs to rise by about 28% to reach $1.00 again. Given the indicators pointing to strengthening the lower trend and weakening the correlation with Bitcoin, this price target appears to be ambitious in the short term.

A growing bearishness could erode investors’ trust and lead to increased sales. If the price falls below the key support level of $0.71, the PI could drop even further, potentially sliding to $0.61. Such drops deepen the bearish outlook.

Meanwhile, as broader market conditions improve, PI networks could break through resistance levels at $0.78 and $0.87. Overcoming these points could potentially invalidate the current bearish paper and pave the way for a new push to the $1.00 price target.

Disclaimer

In line with Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. Although Beincrypto is committed to accurate and unbiased reporting, market conditions are subject to change without notice. Always carry out your research and consult with an expert before making financial decisions. Please note that our terms and conditions, privacy policy and disclaimer have been updated.