Pi Coin (PI) has been irritating traders for several weeks, vibrating between narrow ranges and showing little momentum in either direction. Over the past seven days, Pi Price has slipped to just 0.5% and is trading for around $0.448.

In the monthly time frame, the price of PI coins fell 15%, with a 3-month decline of 23%. Low-cost action keeps bulls and bears deadlocked. But as July approaches the end, the shift may be brewing beneath the surface.

Volume-based confirmation: It’s starting to shift!

The on-balance volume (OBV) indicator shows early signs of bullish intentions. Between July 13th and 22nd, PI coin prices showed a decent increase. The obv indicator reflects this movement at a higher height.

This sync between prices and quantities suggests that the price surge was not flukes. Actual purchase volume supported the movement.

However, its strength still needs to be verified. To see OBVs continue to trend, they need to exceed -157 billion, their previous peak. Higher highs of obv indicate sustained accumulation and strengthen the case for a wider bullish inversion.

As an accumulated volume-based indicator, obv adds volume on green day and subtracts it on red day. When it increases with prices, it confirms bullish confidence. If it flat or branches, the momentum is questionable. Currently I’m building an OBV, but it’s not broken yet.

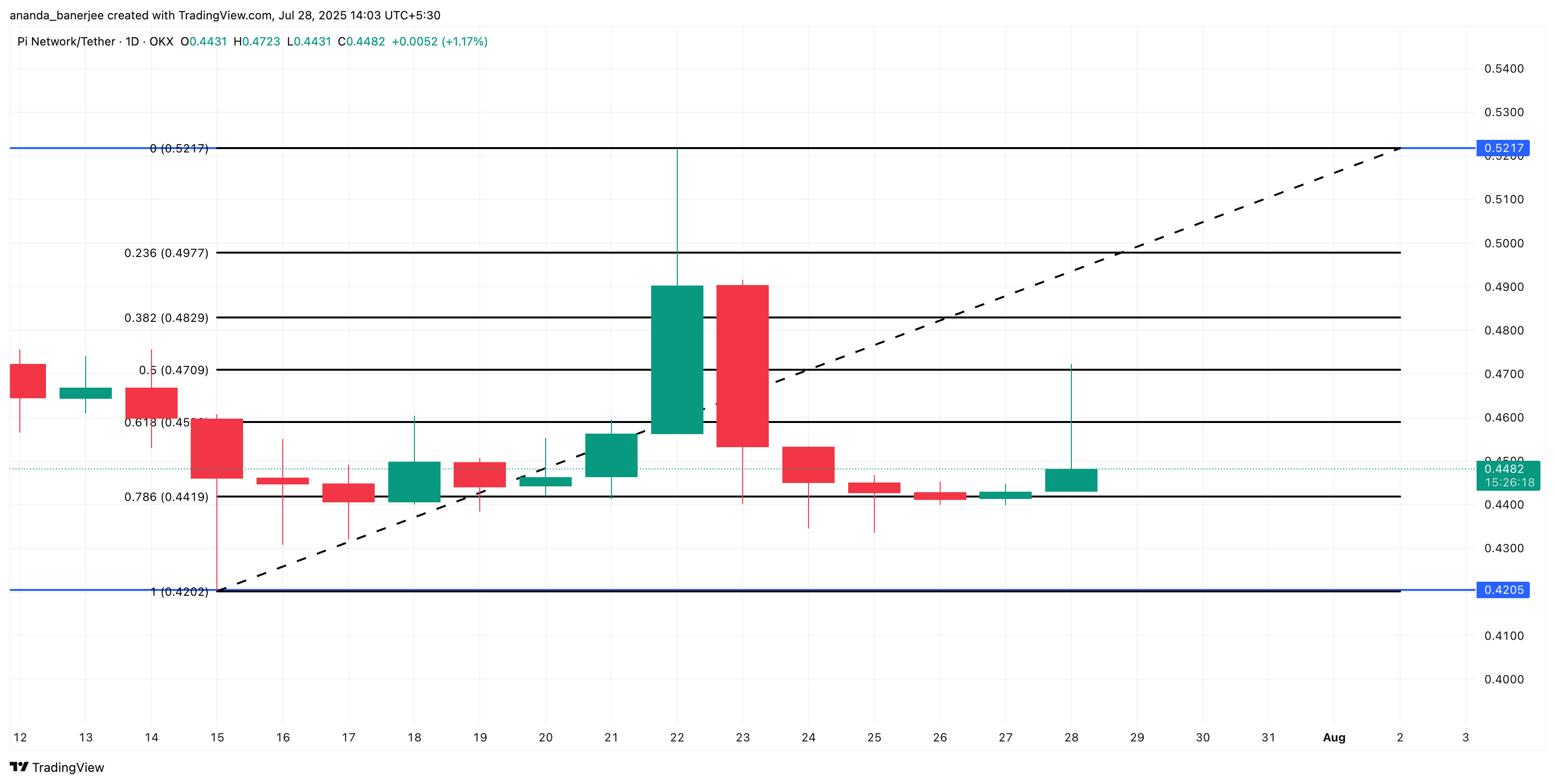

The RSI divergence of Pi Coin is consistent with the momentum of the OBV

Relative Strength Index (RSI) also shows signs of life. PI prices continue to print lower highs, but RSI is on an upward orbit. This bullish divergence suggests that bear pressure is waning. Differences between price and underlying strength.

That said, in order to solidify this signal, the RSI must move above 52 levels. Closures above 52 mean that bullish momentum is not just bubbled up. It’s breaking through. Until then, divergence remains promising, but unconfirmed. Moves above 52 mean that two highs will be formed, indicating a ferociousness like inversion.

RSI tracks momentum by comparing the magnitude of recent profits with recent losses. Disparities in RSI and price, particularly close to the main support zone, often preceded trend reversal.

About Token TA and Market Updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s daily crypto newsletter.

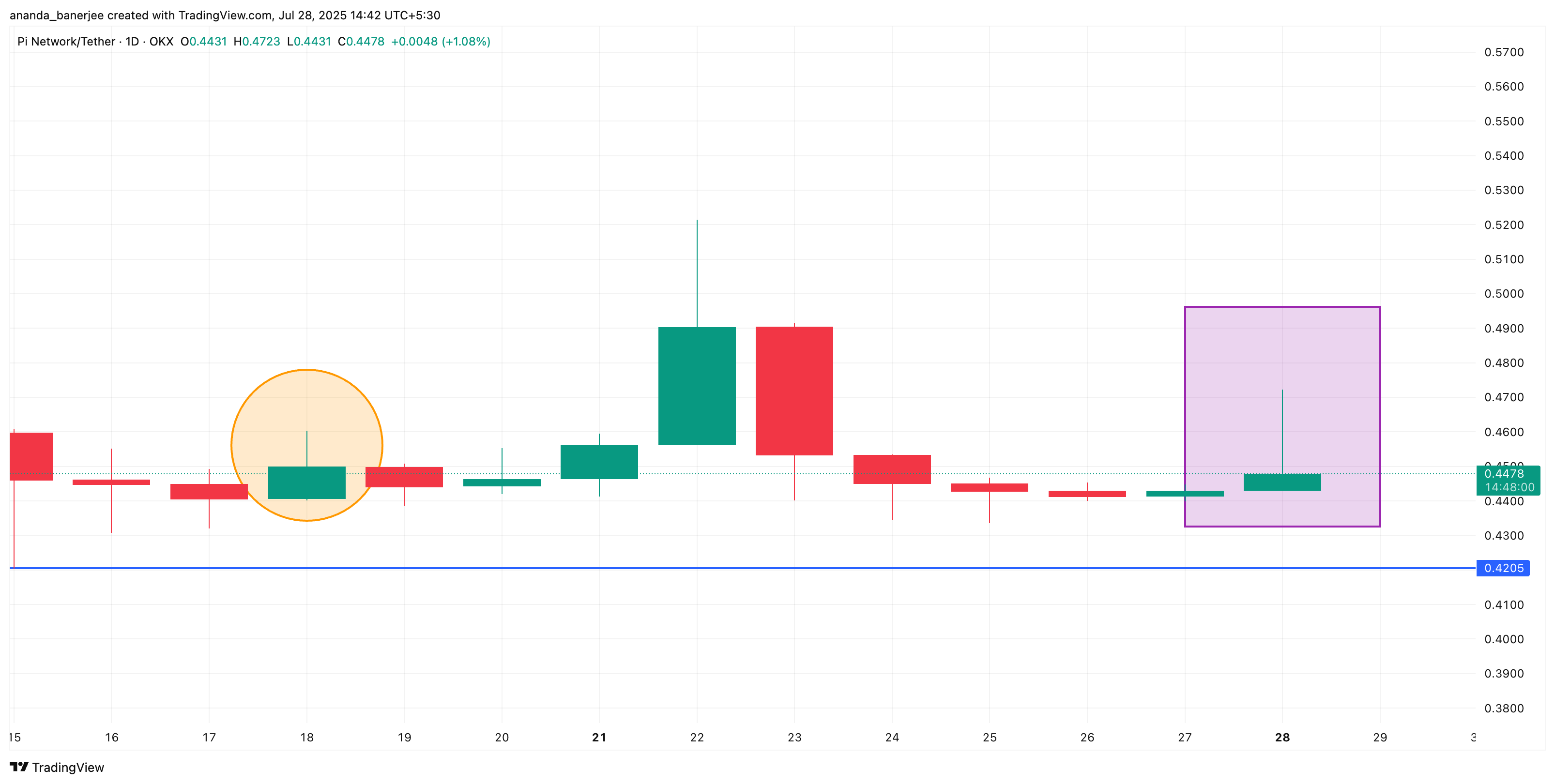

Candle Check: Inverted Hammer adds weight to the inversion of PI price!

The final bullish clue comes from the candlestick pattern. On July 28, Pi Coin printed a green reverse hammer. This prints candlestick footprints on the small body near the low authentic and long top core, suggesting a failure of resistance or a failure of the test. This pattern usually appears after a downtrend and suggests a potential bullish reversal, but only when confirmed by a powerful follow-up candle.

Buyers pushed prices up sharply during the day, but were unable to retain profits. Still, the closure above the opening (green body) indicates daytime strength. Now the important thing is to check: a hard green candle breaking over Vic High. Without it, it is a potential reversal and not guaranteed.

This is not the first time a PI has shown this behavior. A similar setup on July 18th preceded a sharp gathering from $0.439 to $0.521 in four sessions.

Where do Pi Coin prices go from here?

Bullish triple ecta, rise, OBV, RSI divergence, reverse hammer point to potential reversals. However, confirmation is still important. When the price of the PI coin exceeds the 0.47 mark (0.5 Fibonacci retracement), a retest of $0.52 appears plausible.

On the back, the extreme 0.786 FIB extension, below $0.44, disables this bullish structure. Until then, traders may want to remain vigilant for confirmation before actively positioning.

Disclaimer

In line with Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. Although Beincrypto is committed to accurate and unbiased reporting, market conditions are subject to change without notice. Always carry out your research and consult with an expert before making any financial decisions. Please note that our terms and conditions, privacy policy and disclaimer have been updated.