Solana has been keenly backlash following the announcement of a ceasefire between Israel and Iran, and the relief rally has sparked interest from the smart money in the market.

If momentum continues, the coin can regain the $150 mark before Q2 ends.

Smart Money Back Solana

Geopolitical relief, which began Monday after the ceasefire was announced, sparked a new risk appetite for risk, bringing smart money back into the SOL market. Measurements on the Sol/USD one-day chart show a 1% increase in Coin’s Smart-Money Index (SMI) since its announcement Monday.

SMI measures institutional investors’ activity by tracking price movements at certain times of trading days. It reflects how “smart money” trades during the final session after morning retail-driven volatility. Surges in SMIs increase in credibility from institutional investors, often showing bullish outlook.

The progressive surge in SOL’s SMI suggests a growing conviction among major investors as prices rise. This trend shows that as the coin rides on a broader market recovery, the institutional players are positioned even more upside down.

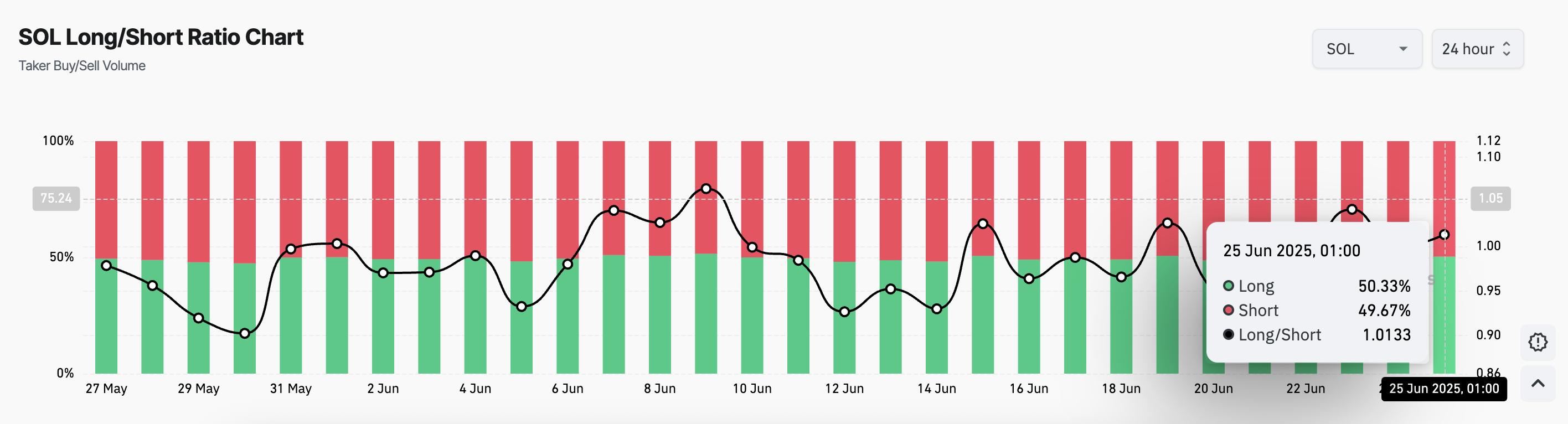

Furthermore, the long/short ratio of Sol supports this bullish outlook. With each Coinglass, this is at 1.013, reflecting the growing confidence of Sol Futures Traders.

This ratio compares the number of long and short positions in the market. If the long/short ratio of assets exceeds 1, it can be longer than the short position, indicating that salt traders are primarily betting on price increases.

Solana fights serious resistance

As key owner interest increases and overall market momentum improves, Sol is poised to expand its profits in July. If Altcoin surpasses resistance by $148.81, a push to the $150 level could be on the card.

However, for recommendations for demand stalls and SOL distribution, the value of Altcoin could plummet to $142.59. If bear pressure is increased here, the value of the coin could drop to another $134.68.

Disclaimer

In line with Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. Although Beincrypto is committed to accurate and unbiased reporting, market conditions are subject to change without notice. Always carry out your research and consult with an expert before making any financial decisions. Please note that our terms and conditions, privacy policy and disclaimer have been updated.