The Crypto market closed its first red weekly candle after five consecutive green candles. Following recent rallies, as seen in the liquidation maps of several altcoins, it has spurred short-term pessimism following recent rallies.

In this context, some altcoins show a high risk of causing liquidation of derivative traders in early August. Which altcoins are these?

1. XRP

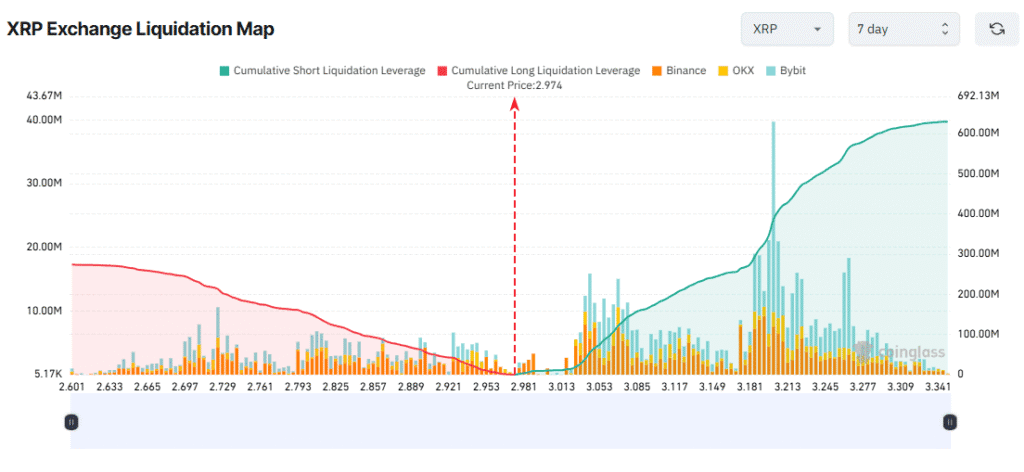

XRP’s seven-day liquidation map reveals a major imbalance between strengths and short positions. According to the data, the short volume accumulated (green bar on the right) is significantly greater than the long volume (red bar on the left).

This reflects the general sentiment that XRP prices continue to fall in the first week of August.

This bearish expectations are likely due to XRP recording losses for the second week in a row, with over 18% dropping from $3.65 to $2.97 at the time of writing. As a result, many short-term traders believe the downtrend will last.

However, if XRP recovers this week, short traders could face a surprising liquidation. If XRP rises to $3.20, it will be possible to settle short positions of over $400 million.

XRP fell 25% from peaks in July to early August. Historically, such a sudden decline has been followed by a pronounced rebound. Therefore, some analysts have warned of potential liquidation driven by this recovery.

“XRP is liquidating short positions following the liquidation of highly leveraged long positions. When XRP rises to $3.06, a large number of short positions will be cleared,” said analyst CW.

2. Trump

The Trump Memecoin liquidation map also shows a major imbalance, with most potential liquidation concentrated on the short side.

However, many analysts believe Trump is integrating around the $8.50 range. This is the main level of support for several months. If Trump rises to $9.80 this week, he could wipe out his accumulated short positions worth around $50 million.

At the end of July, Sunpump, the Tron memecoin launch and trading platform, released a list of Trumps, increasing the liquidity of the tokens. The announcement follows Justin San’s pledge to invest $100 million in Trump tokens.

These developments could boost Trump’s potential recovery momentum and hurt traders by betting on price drops.

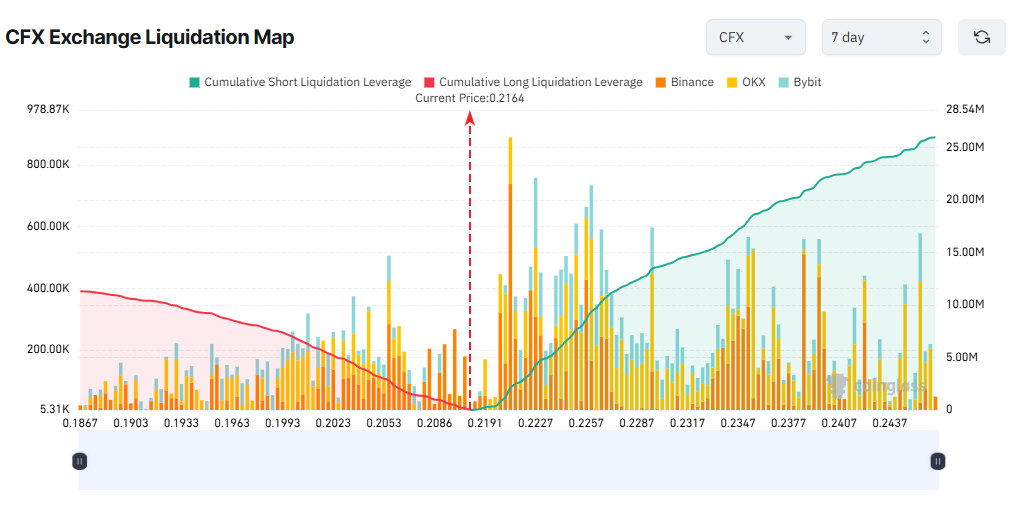

3. CFX

Conflux (CFX) surprised many investors last month by nearly quadrupleting its prices and exceeding $1 billion in market capitalization.

The liquidation map shows that most traders expect CFX to fix it in early August. This is evident in a large number of potential short liquidations.

If CFX continues the rally and reaches $0.243, a short position of about $25 million could be liquidated.

Recent project updates may help to maintain positive feelings about this Altcoin. On August 1st, Conflux announced an upgrade to Conflux v3.0.0.

“This major upgrade introduces eight new CIPS focusing on improving EVM compatibility, fixing bugs and optimizing network specifications!” The Conflux network has been declared.

Furthermore, Google Trends data shows a surge in searches for “Conflux Network” over the past month. This new investor interest in the project could disappoint leveraged traders by betting on price declines.

The Post-3 altcoin, which has the risk of a major liquidation in the first week of August, first appeared on Beincrypto.