Dexe is the native token of the Dexe protocol, an open source platform for creating and managing distributed autonomous organizations (DAOs), and is today’s top-performing crypto assets, which has skyrocketed nearly 10% over the past 24 hours.

This performance is because the broader crypto market shows signs of recovery and lifts the overall sentiment. If current momentum applies, it could strengthen bullish bias against Dexe and pave the way for even short-term benefits.

Traders make big bets on Dexe

Deexe/USD’s daily chart readings show that Altcoin has been moving consistently high since August 3rd. Its value rose 15% as it trades at $8.31 at press time, and key momentum indicators suggest an enhanced buy-side pressure.

For example, Dexe’s double-digit gathering outweighs its prices over the top-class cloud’s main span A (green) and span B (yellow).

About Token TA and Market Updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s daily crypto newsletter.

At the time of this writing, major spans A and B reversed to dynamic support levels at $7.64 and $7.21, respectively. This could serve as an important floor for Dexe’s price in future sessions.

When assets trade above the river clouds for a year, they exhibit strong bullish trends and upward momentum. It shows Positive market sentimentand if it is held beyond that support zone, your assets may continue to rise.

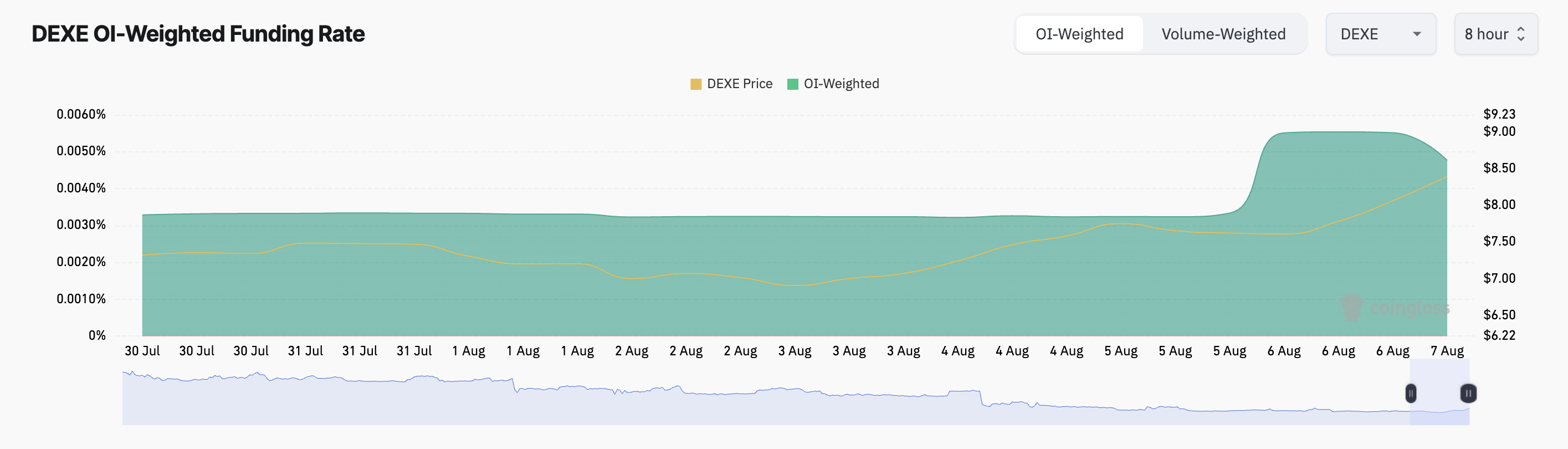

Furthermore, in the derivatives market, Dexe’s funding rate has remained positive since July 20th, highlighting the growing confidence among futures traders. At press, this is 0.0048%.

Funding rates are recurring fees exchanged between long-term and short-term traders in perpetual futures contracts. It is designed to maintain contract prices along the spot market.

If it is positive, long traders are dominating the market and paying people who hold short positions, indicating bullish market sentiment.

Deexe’s consistently positive funding rate shows that traders remain strong against tokens, maintaining their beliefs even amid the wider market volatility.

Will $9.04 fall below, or will $6.73 come first?

Deexe is currently below resistance at $9.04. This level of violation is possible in the short term if demand rises sharply and bullish bias increases. If this occurs, the token price could rise to $9.45.

Convergently, if the Bears regain control, it could cause a drop in Dexe’s price to $6.73.

Once every eye is transformed into a key breakout zone, the Postdex controls daily profits.