The rally above Ethereum’s $4,000 mark has sparked a major wave of short liquidation, reflecting the strengthened demand for major altcoins.

On-chain data reveals a revival of interest and accumulation, suggesting that short sellers could face ongoing losses if Ethereum price momentum comes with it.

ETH is over $4,000 with updated purchase momentum

A surge in new demand for ETH has boosted prices by 18% over the past week. This powerful buying momentum and market sentiment improved culminated in a move beyond yesterday’s $4,000 price mark, causing the liquidation of short sellers.

Coinglass data has revealed that the short liquidation totaled $184 million over the last 24 hours, while the long liquidation remains relatively modest at around $24 million.

This emphasizes the strength of the short aperture as traders scramble to cover their positions in the gathering.

However, on-chain data shows that this investor cohort is poised to continue climbing and could experience more losses ahead of time.

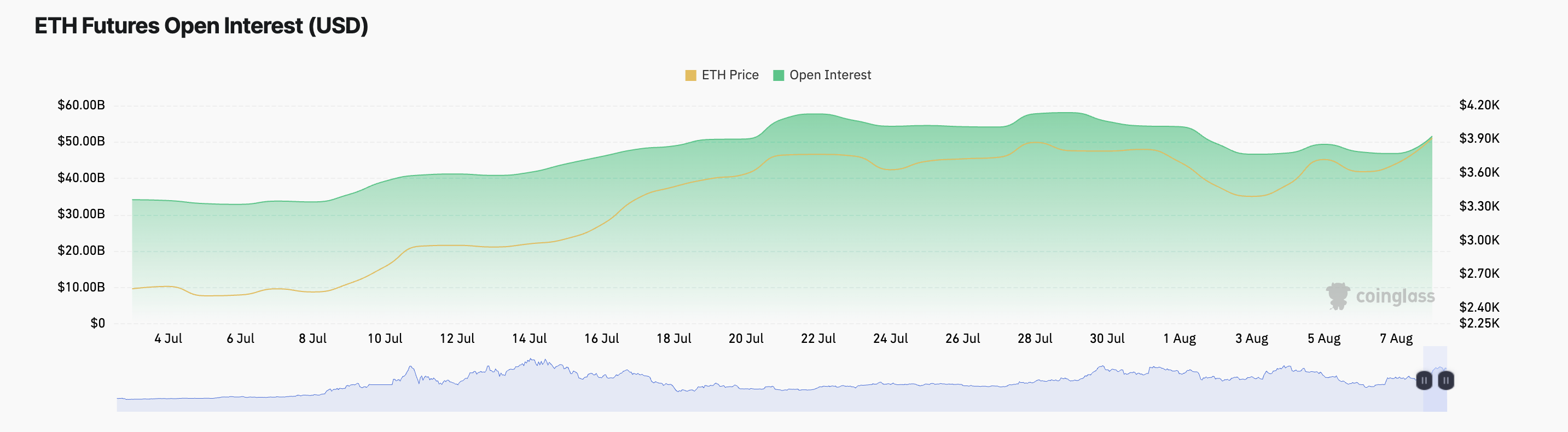

For example, open interest in ETH futures has risen with prices, indicating participation in large markets. This was $51.6 billion, an increase of 10% over the past 24 hours.

Open profits on assets measure the total number of outstanding futures or option contracts in the market. It shows a strong belief that if both the asset’s price and its open interest rise simultaneously, the current trend continues among traders.

For ETH, this suggests that more investors are actively taking new positions and are confident in their ongoing price momentum.

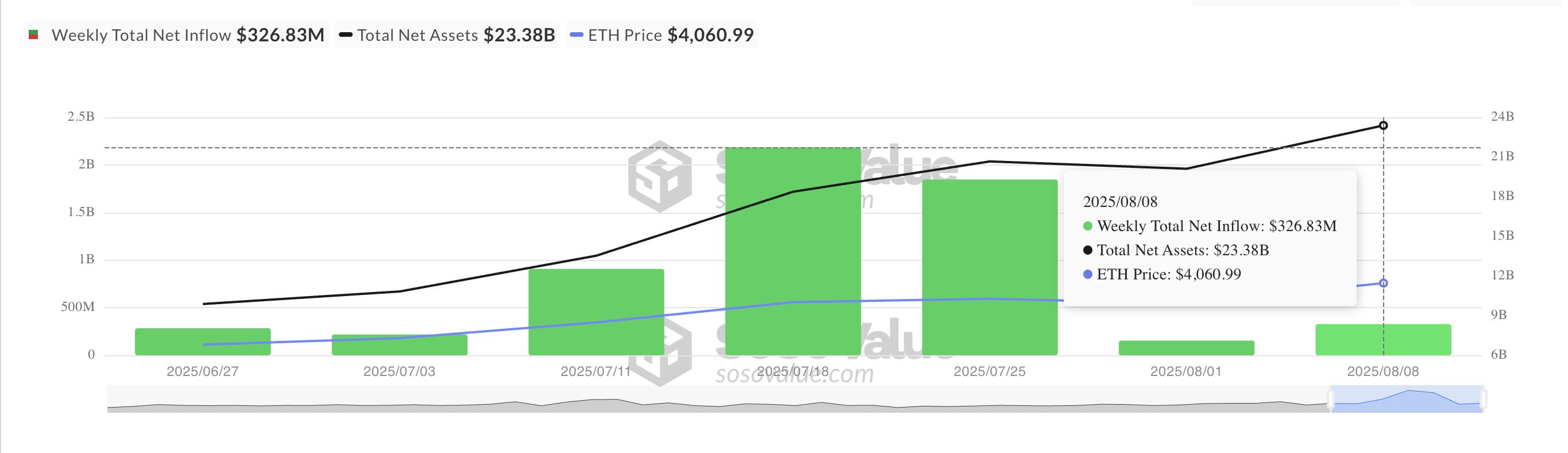

Furthermore, a revival of institutional interests adds credibility to this bullish outlook. By sosovolu, this week we have seen a new influx of Esther-backed exchange trade funds (ETFs) as market sentiment improves.

Between August 4th and 8th, these funds recorded a total of $326.83 million inflows.

The fresh waves of the institutional capital show new trust from larger investors, providing a key support layer that will allow ETH to remain on the upward trajectory in the near future.

Ethereum has $3,909 in support – next target of $4,430 or later

ETH traded at $4,160 at press time and maintains a newly established support level of nearly $3,909. With this support increased and momentum gains, the price of ETH will rise to $4,430, which could test and break through its resistance.

A successful breakout could potentially be set on the stage for ETH to revisit an all-time high of $4,827.

Meanwhile, when purchasing pressure is weakened, ETH can lose steam and reverse the current upward trend. Without holding the $3,909 support, the price could drop to $3,340.

Will this cycle bring Ethereum prices to $5,000? The technical breakdown first appeared in Beincrypto.