Ethereum could face downward pressure in August as institutional and whale support that promoted the rally at its $3,800 July peak in August appears to be receding.

With bearish sentiments quietly mounted on the broader crypto market, major altcoins are currently facing tougher climbs towards the $4,000 mark.

ETH futures sink to $6.2 billion: Will institutional trust lose steam?

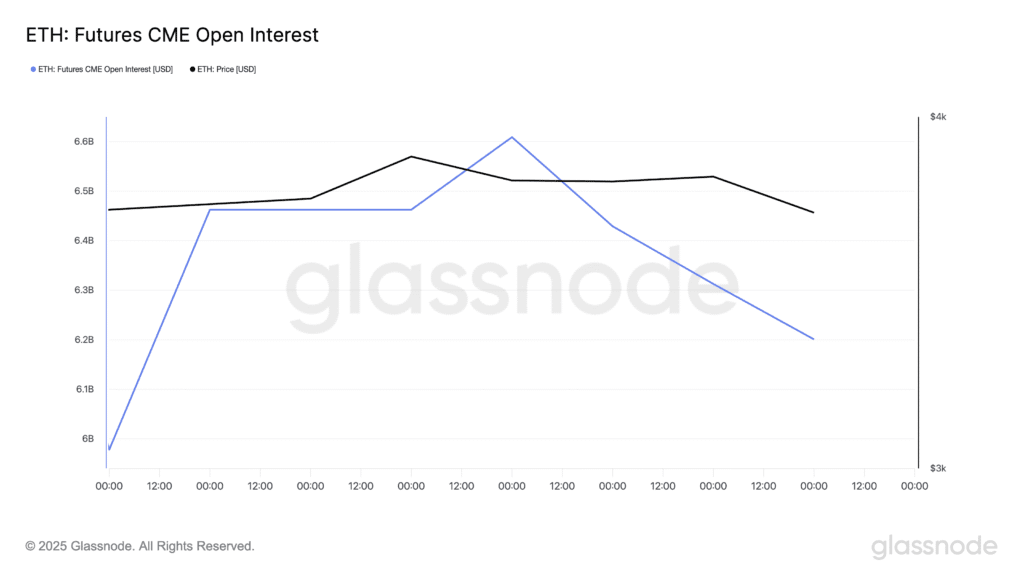

Chain and derivatives data show a recent trend in activity among the largest players in the market. For example, public interest in ETH futures contracts regarding the Chicago Mercantile Exchange (CME) has dropped sharply, closing yesterday at a five-day low of $6.2 billion.

About Token TA and Market Updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s daily crypto newsletter.

This drop is noteworthy as CME’s ETH futures market is primarily used by institutional players seeking regulated exposure to assets. Therefore, it is possible that these investors are reducing their ETH position.

Without continued institutional involvement, the upward pressure on ETH prices will weaken and the possibility of short-term corrections will increase.

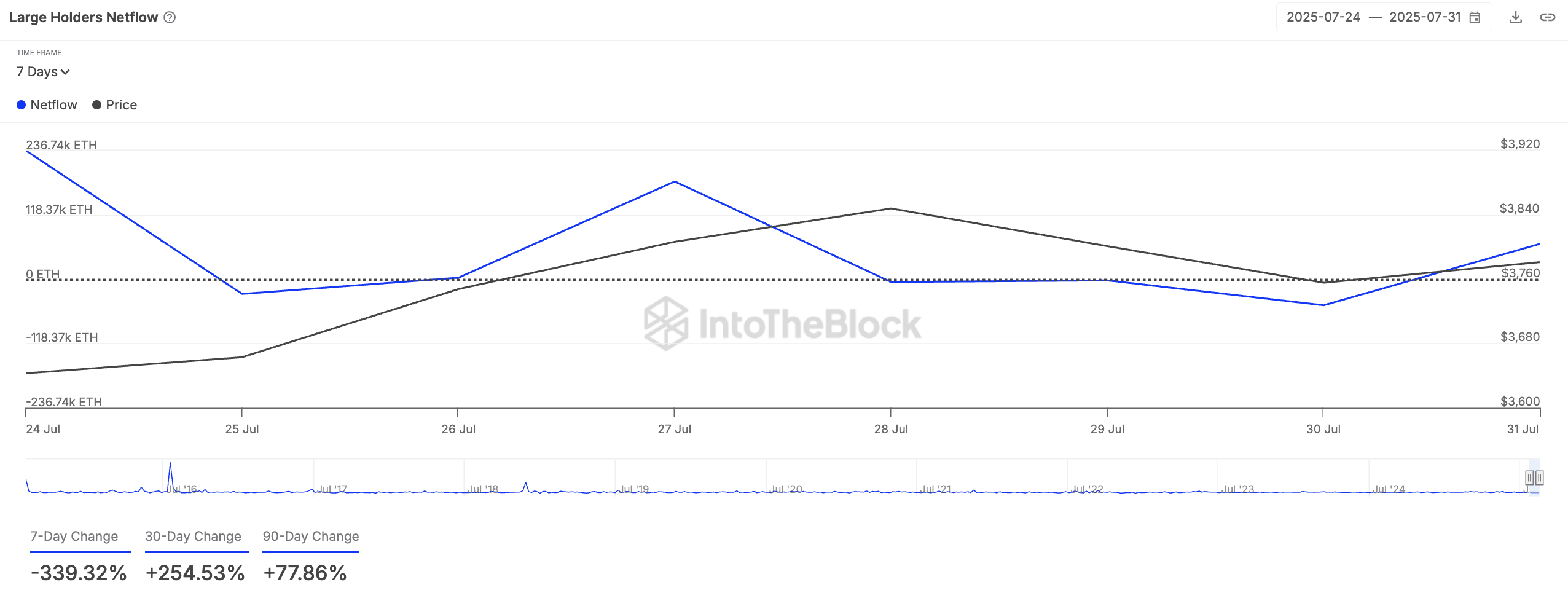

Furthermore, whales’ activities are also tapering. A review of activity on the coin chain revealed 339% DIP on large holder Netflow over the past seven days.

Large holders are the addresses of whales that hold more than 1% of the distribution supply of assets. Their Netflow tracks the difference between the coins they buy and the amounts sold over a specific period.

As the Netflow of large-scale holders of assets increases, more tokens or coins flow into the wallets of major investors than they run out. This trend indicates that these holders have accumulated assets and demonstrate confidence in future value.

Conversely, when it dips, it marks a high accumulation cooling of convictions and weakens short-term price support.

Ethereum tanks are 10% as sales pressure spike – next $3,314?

At the press conference, ETH traded at $3,620, down nearly 10% over the past day. During that period, its trading volume took 17% rockets, resulting in a negative divergence. This divergence appears when trading activity rises coincides with a fall in prices and indicates an increased sales pressure.

If this continues, the price of the ETH could drop to $3,524. Violation under this key support floor could lead to a deep decline to $3,314.

However, if demand resumes, ETH could recover and rise to $3,859.

Post-Ethereum’s move to a $4,000 stall when whales and agencies were pulled back first appeared in Beincrypto.