Bitcoin has experienced recent consolidation, with cryptocurrencies stabilizing between $117,261 and $120,000 over the past two weeks. This stagnant price action prevents Bitcoin from reaching its new all-time high (ATH).

However, signals of investor behavior suggest that next month could change drastically, potentially rewriting Bitcoin’s historic price pattern in August.

Bitcoin Investors Sent a Positive Signal

Bitcoin’s current sell-side risk ratio is 0.24 and is six months high. Nevertheless, it is well below the neutral threshold of 0.4 and close to the low value realization threshold of 0.1. This suggests that the market is experiencing consolidation, and investors’ actions indicate a moratorium on a massive sale.

Historically, periods of low risk on the seller side have indicated the bottom or accumulation stage of the market, with investors waiting for a favorable moment to boost prices. This accumulation is important as it suggests that Bitcoin prices may be prepared for shifts.

About Token TA and Market Updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s daily crypto newsletter.

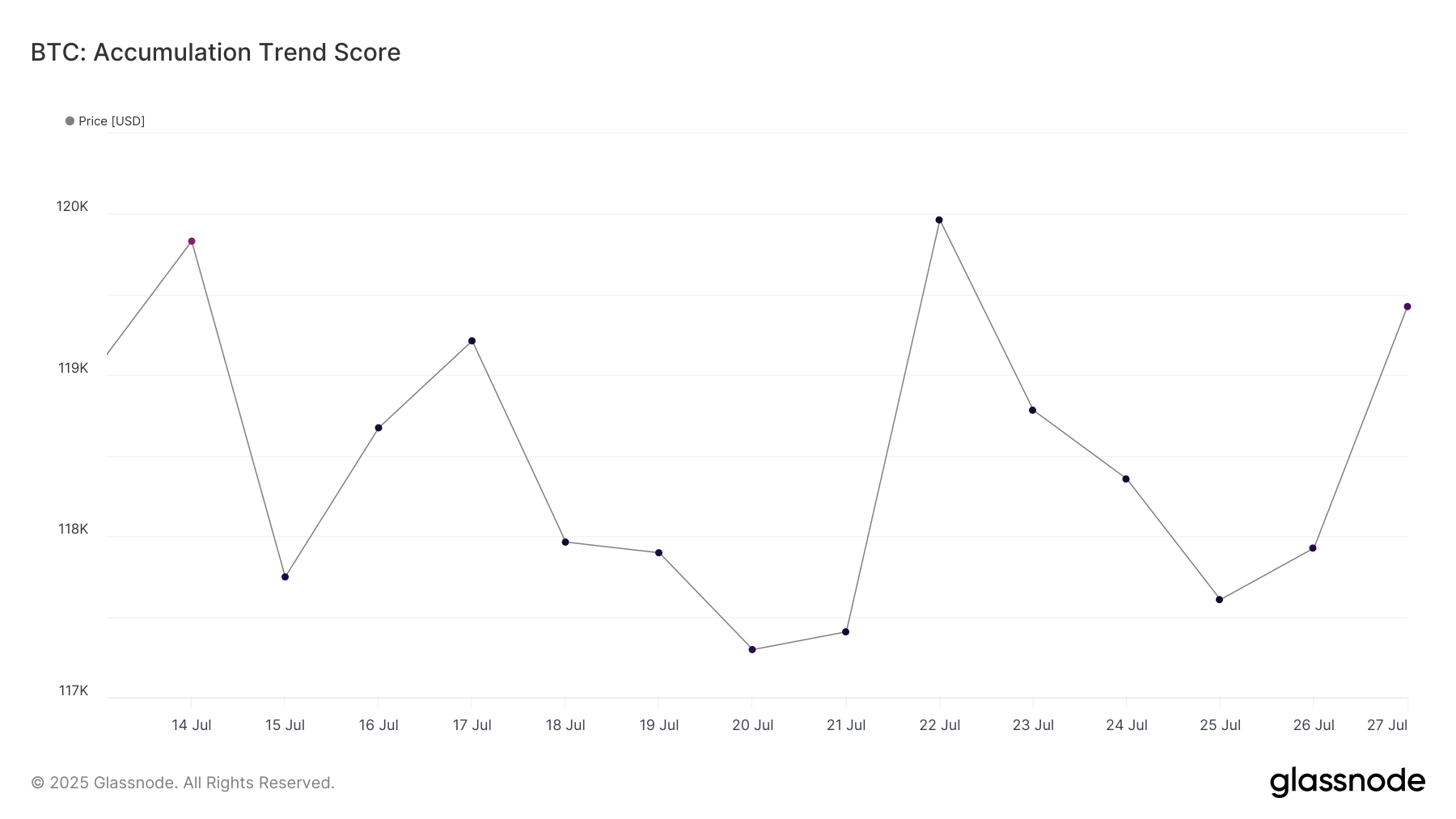

Bitcoin’s accumulation propensity score is currently close to 1.0 over the past two weeks, indicating that large holders, including whales, are actively accumulating Bitcoin. This trend is essential as these whales have a major impact on cryptocurrency prices.

Accumulation scores near 1 suggest strong bullish momentum among institutional and wealthy investors. This could provide a solid foundation for Bitcoin to break through the resistance level that has been struggling with lately.

The steady accumulation of large entities means that you are gaining confidence in the long-term value of Bitcoin. This could lead to an increase in Bitcoin prices as more capital is injected into the market by investors.

BTC prices can find a way to ATH

Bitcoin currently costs $118,938, and is within the consolidated range of $117,261 to $120,000. The range is stable, but if investors remain strong, there is a high chance that they will surpass $120,000.

Historically, August has been a bearish month for Bitcoin, with a median monthly return of -8.3%. However, given the current accumulation trend and the low risk of sell-side, Bitcoin could be against that historical trend this year. If Bitcoin can secure $120,000 in support, it could move beyond $122,000 towards the ATH.

However, there remains a risk that if investors change their stance due to unexpected market factors, the market could become bearish. In this case, Bitcoin could lose support at $117,261 and slide to $115,000, potentially turning the bullish paper back.

Disclaimer

In line with Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. Although Beincrypto is committed to accurate and unbiased reporting, market conditions are subject to change without notice. Always carry out your research and consult with an expert before making any financial decisions. Please note that our terms and conditions, privacy policy and disclaimer have been updated.